NatGas Cash Inches Higher, Yet Traders Eyeing Smaller Than Normal Storage Draw

Both cash and futures markets put together modest gains on Wednesday, with physical gas for Thursday delivery adding a few pennies as traders noted no new forecasts calling for more moderate temperatures.

Only a dozen or so points followed by NGI recorded losses, and most points added a few pennies to a nickel. The NGI National Spot Gas Average rose 3 cents to $1.44. April futures managed a modest gain, and at the close April was ahead by 4.0 cents to $1.752. May gained 4.3 cents to $1.846. April crude oil rose $1.79 to $38.29/bbl.

At eastern points, next-day power markets were mostly quiet, offering little incentive to make incremental purchases for electric power generation. Intercontinental Exchange said on-peak power Thursday at the ISO New England’s Massachusetts Hub fell 2 cents to $17.65/MWh, and on-peak power at the PJM West Terminal for Thursday rose 41 cents to $2.425/MWh. Next-day power at the ISO New York’s Zone G delivery point (eastern New York) rose 7 cents to $20.75/MWh

Next-day gas at the Algonquin Citygate fell 4 cents to $1.08, and packages on Iroquois, Waddington shed 12 cents to $1.47. Gas on Tenn Zone 6 200L came in 5 cents lower at $1.18.

Although trading at less than $1.00, Marcellus points firmed. Gas on Dominion South rose 4 cents to 87 cents, and deliveries to Tennessee Zn 4 Marcellus were flat at 81 cents. Gas on Transco-Leidy Line was quoted at 85 cents, up 1 cent.

In what has to be good news for market bulls, industry reports indicated continued declining production. Industry consultant Genscape Inc. said “Spring Rock daily pipe production estimates show day-over-day production down for a fourth consecutive day, having dropped another 0.27 Bcf/d” from Tuesday and output “now running nearly 0.52 Bcf/d lower than Saturday’s 14-day peak.

“Since Saturday, increases in Gulf Coast and Texas volumes have been offset by declines in the East, Midcon, Rockies and San Juan. East volumes fell 0.24 Bcf/d day/day, with 0.1 Bcf/d of declines in Northeast Pennsylvania and another 0.1 Bcf/d in Ohio. Northeast Pennsylvania declines are being led by drops in Transco receipts at the Barto M3602 and Guinter M3632 meters. In Ohio, the bulk of the declines are being registered on Tetco and TGP.”

Weather forecasters are seeing an ongoing trend of milder temperatures.

“While powerful warming continues to dominate the one- to five- and six-10 day ranges for much of the Midwest, East and South, we are seeing building support for what looks to be a brief cooler period that impacts the middle third of the U.S., the most starting late in the six-10 day and going into the front half of the 11-15 day especially,” said Commodity Weather Group President Matt Rogers in Wednesday morning report.

“This is due to an Alaska high pressure ridge spike and a brief reduction in the Pacific, undercutting flow signal as shown on the various model guidance this morning, including the upgraded European ensemble. It seems like it really has trouble getting to the East Coast though, and we keep that area mostly warmer than normal again,” said Rogers.

Market technicians have somewhat supportive outlook, but prices have to rally considerably to change the current downtrend.

There’s “only one way for the bulls to break the back of this downtrend, clear key resistance and swing the technicals to a bullish bias,” said United ICAP market analyst Brian LaRose. “Despite the recent dip to fresh lows, the technicals continue to look constructive. However, that means nothing without action on the price front. To suggest a bottom is developing bulls would first need to push natgas up and over the $1.892-1.963 zone.”

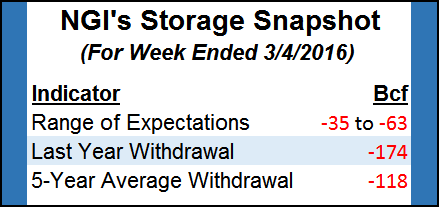

If survey estimates are correct, Thursday’s Energy Information Administration storage report for the week ending March 4 could feature the last withdrawal of the season. Last year 174 Bcf was withdrawn and the five-year average stands at a 118 Bcf pull. IAF Advisors is calculating a 62 Bcf withdrawal, and ICAP Energy is expecting a 59 Bcf decline. A Reuters survey of 20 traders and analysts revealed a sample withdrawal average 57 Bcf, with a range of 44 Bcf to 63 Bcf.

A Bloomberg survey of eight experts produced a withdrawal range from 35 Bcf to 62 Bcf, with a median draw expectation of 58 Bcf.

Looking ahead to next week’s report for the week ending March 11, Reuters early look sees anywhere from a 6 Bcf pull to a build of 21 Bcf. Last year for the week, 88 Bcf was pulled and the five-year pace is for a withdrawal of 81 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |