Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

Chevron Using Permian Template to Improve Output, Lower Costs

Chevron Corp. is shifting more of its capital spending to “shorter cycle” investments, specifically shale and tight oil resources, with the Permian Basin to be the No. 1 benefactor, management said Tuesday.

The second-largest U.S.-based oil major, like its peers, is known for allocating most of its capital expenditures (capex) to decades-long, expensive projects. However, commodity prices are forcing a course correction, CEO John Watson said at the company’s annual analyst meeting.

Off the table until prices cooperate are U.S. onshore gas projects, primarily in Appalachia. The Permian, however, remains front and center, with around $3 billion of a global $26 billion budget earmarked for the region. The reasoning is clear: 2015 global oil and gas production rose 2% year/year, while shale/tight sands output jumped 33%.

“We will see higher spending in the Permian as we increase rigs over time,” Watson said. “As we continue to make progress in other shales, we’ll see growth as well. By the middle of the next decade, 20-25% of production could be in short-cycle shale and tight activity…”

The Permian is “first among our opportunities,” in large part because of the “royalty advantage,” upstream chief Jay Johnson told analysts. About 85% of the legacy leasehold, which runs across an estimated two million net acres, has no or low royalties associated with it. The leasehold has an estimated 9 billion boe of resources, offering a “shorter cycle, higher return.”

An estimated 1,300 drilling locations across the Permian make a 10% return at $40/bbl crude oil, Johnson said. Another 4,000 locations turn a profit at $50, while 5,500 can make money at $60. And that’s only an an assessment of about one-third of the portfolio, he added.

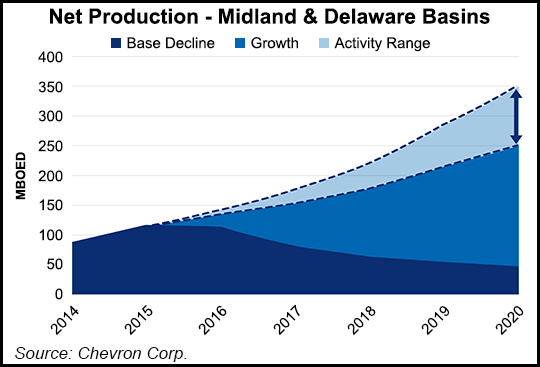

Chevron plans to drill 175 wells this year using seven operated rigs and nine other rigs. By 2020, up to 350,000 b/d could be pumped from the massive basin, versus 125,000 b/d today.

Chevron today is in “factory mode,” with multi-well pads in the Permian’s Midland and Delaware sub-basins that are being developed systematically, Johnson said. Across the entire basin, horizontal well costs have fallen by 40% since 2014, while drilling footage/day has risen 45% and fracture stages/day are up 115%.

In the Delaware, 7,000-foot laterals are being drilled, with wells completed for about $7.1 million and production averaging 960,000 boe/well. Midland laterals are about 7,500 feet currently, wells cost about $7.4 million and output is averaging 850,000 boe/well.

“Our objective is to be fully competitive with other operators in terms of operating costs,” Johnson said.

Chevron is leveraging its Permian know-how in its global shale/tight portfolio, including the Duvernay formation in British Columbia, the Vaca Muerta in Argentina and in Appalachia.

Through Chevron’s learnings to date versus 2014 in the Permian:

“Given current gas prices in Appalachia, we are taking a measured pace in the Marcellus and Utica shales,” Johnson said. “We are making good progress in lower development costs…and we have a large position…when prices recover.”

Chevron, like its peers, years ago had begun major oil and gas projects “premised on higher prices,” Watson said. “A lot of change is taking place in the business, and we are adapting to a lower price environment. We are improving efficiencies, and those types of benefits are sustainable.”

The large resource base is allowing it to scale back in the near-term, with many of the higher priced projects in the queue either nearing completion or at a point in which it can pull back on the spending throttle. Capital expenditures (capex) over the next two years have been reduced significantly.

Chevron expects to spend about $26 billion for capex this year, 25% less than in 2015. In 2017-2018, $17-22 billion is allocated.

“Industry conditions are tough right now, with low oil and natural gas prices,” Watson said. “We believe markets will improve, and we’ll be well positioned when they do.”

But the workforce will be considerably smaller, with reductions made as capital efficiencies take hold and projects are streamlined. About 10% of the global staff, 3,200 people, were laid off in 2015. Another 4,000 people will lose their jobs by the end of this year, Johnson said.

Not many long-term projects are economic at today’s oil prices, Watson said. But even with the cutbacks and project reconfigurations, Chevron isn’t turning its back on the deepwater or overseas exploration.

“As natural decline takes over, we’ll need new assets, and we need to make sure we can deliver…better than we have done over the course of this decade,” the CEO said.

Chevron is completing “major projects that have been under construction for several years,” including in the deepwater Gulf of Mexico’s Lower Tertiary and in Australia, where the expensive Gorgon gas export project is ready to begin exports to Asian markets. “This enables us to grow production and reduce spending at the same time, which should improve our net cash flow significantly.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |