NGI Data | NGI All News Access

How Low Can NatGas Go? March National Bidweek Average at $1.60

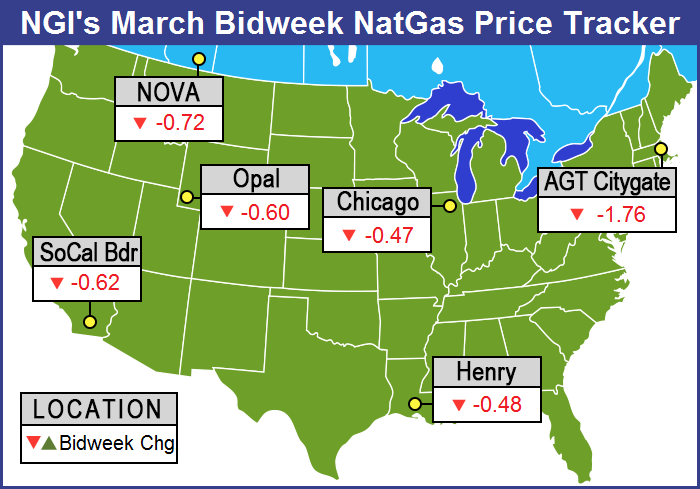

If February bidweek was disappointing, March bidweek was a disaster. February bidweek saw the NGI National Bidweek Average fall 23 cents to $2.23 and some points traded positive. No such luck for March. No points followed by NGI came anywhere close to being in the black and most points lost about a half-dollar, or more. The NGI March National Bidweek Average fell a gut-wrenching 63 cents from February 2016 to $1.60, which is also $1.50 below the March 2015 bidweek average.

Of the actively traded points the Marcellus lost the least on an absolute dollar basis with Transco Leidy dropping 32 cents to 90 cents and Transco Zone 6 New York proved to be bidweek’s biggest loser giving up $2.07 to $1.68.

Regionally the Northeast suffered the worst falling 96 cents to $1.44, and California dropped 61 cents to $1.70.

The Rocky Mountains and Midcontinent both lost 57 cents to $1.49 and $1.56, respectively, and East Texas fell 51 cents to $1.64.

South Louisiana was down by 49 cents to $1.66 and South Texas and the Midwest both shed 48 cents to $1.66 and $1.82, respectively.

March futures settled at $1.711 down a whopping 47.8 cents from the February futures settlement.

Buyers and marketers enjoyed not only low prices but also contracted basis differentials, giving those on the “buy” side of the market an additional discount. “Basis was really low,” said a Great Lakes marketer. “On Consumers we saw 6.5 cents and on Michcon we got 7 cents and 5.5 cents.”

If the marketer is correct, lower prices may be in the cards for a while. “We think there may be opportunities for still lower prices. None of our customers are in danger of losing supply,” he said.

The NGI Bidweek average for Dominion South came in at $1, and according to economic theory prices should not fall below marginal cost.

In attempting to project the Dominion $1 price as marginal cost and adding a transportation factor to equate to the Henry Hub, say 50 cents, could $1.50 represent an economic floor for April prices?

“A one-dimensional view of marginal cost may be OK, but when you are looking at an integrated system [US pipelines] then you are looking at imbalances somewhere,” observed Tom Saal, vice president at FC Stone Latin America in Miami.

“If you look at the extreme imbalance [Dominion] and work from there, that may not be the way to do it. You can only put so much gas in there and it’s not as if there is a gigantic, unlimited supply of transportation out of there.

“I’m not saying it’s not influencing it [Henry Hub], but that price is $1 because there is not enough pipeline transportation. Based on the economics of pipelines, that probably isn’t going to change much,” he said.

“There’s no question Dominion South is not a price signal. Having that much gas priced at $1, but I don’t know if I would call that a marginal cost.”

An economic floor is one thing, but a trading floor might be quite another. Fundamental analysts see continued robust production as the albatross around the market’s neck. “This remains a market much in need of some production restraint but one that is seeing negligible signs of such a development,” said Jim Ritterbusch of Ritterbusch and Associates in a morning note to clients. “[Monday’s] official EIA monthly indications for December posted only a miniscule decline of 0.3% from November. More importantly, output at the end of last year was still being indicated some 2% above a year ago.

“As a result, the output factor is providing no match for increasingly mild near record temperature outlooks that have shown up in the updated 1-2 week temperature expectations during the past weekend and within yesterday’s noon models. As a consequence, the market is being forced to discount a major acceleration in the supply surplus against average levels amidst mounting concerns that storage capacity could be challenged next fall unless prices are downsized sufficiently to deter output during the upcoming spring/summer period.”

The NGI National Spot Gas Average fell 4 cents to $1.47 on Monday for Tuesday delivery, but eastern points on average managed gains of more than a dime. Futures opened trading Sunday night sharply lower and prices never really had a chance once the day-session began. At the close, April had dropped 8.0 cents to $1.711 and May was down by 6.5 cents to $1.808.

Eastern prices scooted higher as temperature forecasts Tuesday across major metropolitan areas expected a steep decline. Forecaster Wunderground.com predicted Monday’s high of 60 degrees in Boston would drop to 43 by Tuesday before rising to 51 Wednesday. New York City’s Monday peak of 58 was expected to drop 10 degrees Tuesday then reach 50 on Wednesday. Chicago’s high Monday of 54 was anticipated to plunge to 33 Tuesday and climb only 34 Wednesday, 3 degrees below normal.

Gas for delivery at the Algonquin Citygate rose 37 cents to $1.96, and packages on Iroquois, Waddingtongained 2 cents to $1.78. Gas on Tenn Zone 6 200L rose 18 cents to $1.93.

Marcellus points were mostly steady, but couldn’t breach the $1 threshold. Deliveries on Dominion South changed hands 2 cents lower at 95 cents, gas on Tennessee Zn 4 Marcellus added 2 cents to 95 cents, and gas on Transco-Leidy Line was quoted at 94 cents, down a penny.

Major market hubs eased. Gas at the Chicago Citygate shed 3 cents to $1.68, and deliveries to Henry Hub were seen 4 cents lower at $1.62. Gas on El Paso Permian was quoted 3 cents lower at $1.42, and gas at the PG&E Citygate fell 6 cents to $1.80.

The market may get a reprieve from ever-falling prices if near-term weather forecasts are correct. Industry consultant Genscape Inc. said in a report that its “weather forecasts are showing national population weighted HDDs [heating degree days] increasing back to seasonal norms by Wednesday and Thursday, then once again retreating to this winter’s standard of substantially warmer-than-normal conditions.

“Seasonal temperatures will persist through the week in the Midwest and Midcon regions. Midwest demand is expected to inch toward a peak of 11.76 Bcf/d by Wednesday. The Northeast, New England, and Southeast/Mid-Atlantic will trend cooler, causing demand to peak Thursday in Appalachia at 17.9 Bcf/d, in New England at 3.5 Bcf/d, and in SEMA 17.5 Bcf/d.”

In the West, temperatures “will remain substantially warmer than normal, including strong cooling-degree day readings in the Desert Southwest. California/Nevada demand will remain below 7.3 Bcf/d through the week,” Genscape said.

Critical to any price recovery is a decline in production and the number of drilled but uncompleted (DUC) wells, particularly in the Northeast. Wood Mackenzie Ltd. reportedly said the number of DUCs has fallen sharply from initial estimates of 1,200 at its peak to just above 650 wells.

“Producers have obviously been choosing, not surprisingly, to complete wells as opposed to drilling new ones,” said Societe Generale analyst Breanne Dougherty. “This has added volumes into the supply stack even as rig counts have continued to drop; news out of producers is pretty consistent that capex will remain very light until there is a material improvement in the price environment.

“A combination of all of these supply factors continues to support our view that, at best, production should hold flat this year. The longer gas and oil prices stay low, the larger the risk of production sliding into structural decline by the end of the year,” she said.

Societe Generale’s team is expecting prices to move above $2/MMBtu “as summer weather begins to make its appearance (normally around mid to late May) and for the price to ascend gradually through core summer, reflecting the tightening of the ledger that should start being visible. Our July through December price average is $2.95/MMBtu.”

A decline in production is expected by, among others, No. 2 gas producer Chesapeake Energy Corp. and Southwestern Energy Co., the No. 4 gas producer, based on quarterly reports.

“With now two of the top five U.S. gas producers in clear distress, the implications are highly bullish for macro gas,” wrote Jefferies LLC analyst Jonathan D. Wolff. “Our bottoms-up 21-basin U.S. supply model is at 3.2% exit-2016 decline rate, but the potential for further declines is becoming more obvious.”

Longer term forecasts sent futures bulls running for cover as weather models turned sharply warmer. Monday’s “six-10 day period forecast features widespread above-average warmth, except in New England and the southwestern U.S.,” said WSI Corp. in its Monday morning report. The forecast “is sharply warmer than Friday’s forecast over the eastern two-thirds of the nation but cooler over the West.” Continental U.S. natural gas-weighted HDDs “are down 20.5 to 78.9 for the period. Forecast confidence is a little higher than average for a change as medium-range models are in good agreement with a pattern shift.

“The Northeast and southwestern U.S. have a risk to the cooler side. The central U.S. and even the East could run warmer by the end of the period.”

No one saw the EIA storage report coming Thursday. The EIA reported a withdrawal of just 117 Bcf well shy of expectations close to 140 Bcf and less than the lowest estimate of traders surveyed by a major news service. The EIA even increased the previous week’s withdrawal by 5 Bcf to -163 Bcf but even that couldn’t prevent the March futures rolling lower to test the recent lows of December. At settlement March had fallen 6.7 cents to $1.711 after trading as low as $1.682 and April was down 4.9 cents to $1.785.

“[T]he small revision wasn’t enough to make up for a much smaller than expected 117 Bcf net withdrawal for the week ended Feb 19,” said Tim Evans of Citi Futures Perspective. “In place of the expected, relatively neutral, near-average withdrawal, we have a small decline that implies a significantly weaker supply/demand balance.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |