Infrastructure | NGI All News Access

New INGAA-Backed Study Finds No Impact on Property Values From Pipelines

A new study published Monday by the Interstate Natural Gas Association of America (INGAA) found “no measurable impact” on property values resulting from nearby underground natural gas transmission lines.

The study, commissioned by INGAA and conducted by Integra Realty Resources (IRR), looked at properties near interstate natural gas pipelines in Ohio, Virginia, New Jersey, Pennsylvania and Mississippi. The pipelines identified in the report include Texas Gas Transmission Pipeline, Rockies Express Pipeline, Transcontinental Gas Pipeline and Gulf South Transmission Pipeline.

The locations, which vary in geography and population density, were selected in an effort to represent regions “experiencing an increase in pipeline construction because of either growing natural gas supply or growing consumer demand” and “where there was concern over pipeline projects and their impact on property values.”

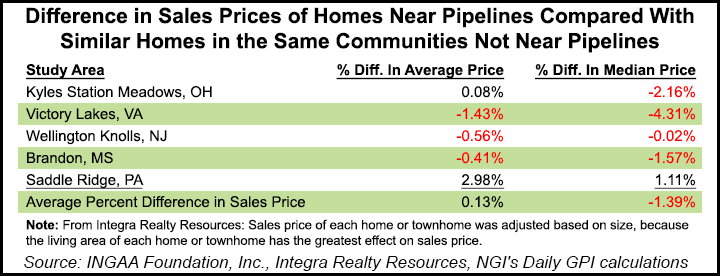

After adjusting for size, researchers compared the sales prices of single-family residential homes and townhomes near pipelines to those not located near pipelines.

The results, according to the authors, showed that properties studied in Virginia, Mississippi and Ohio “all showed increases in average and median per square foot sales prices for properties on, adjacent to or abutting a pipeline easement.” Meanwhile, properties studied in New Jersey “showed a slight decrease in average and median per square foot sales prices.

“Since the results did not show a systematic impact, there appears to be no measurable impact on sale price” as a result of proximity to the pipelines.

The researchers further concluded that the size and age of the pipelines didn’t affect sales prices and that the pipelines had no measurable impact on demand for property, sales frequency, loan applications or insurance.

“Based upon the geographically disparate areas studied, IRR concluded that it was highly likely that the results and conclusions of this report would apply to other markets across the country in which natural gas pipelines were located,” the report said.

“This report backs the findings of the INGAA Foundation’s previous 2001 study of property values along pipeline routes — that underground natural gas transmission pipelines do not affect home values,” INGAA CEO Don Santa said. “These findings might help property owners feel more confident about natural gas pipelines proposed in their communities.”

Rebecca Craven, program director for the Bellingham, WA-based nonprofit Pipeline Safety Trust, said the question of whether pipelines impact property values is largely site-specific and can be influenced by other factors, such as a high-profile accident or a public controversy.

“There are an increasing number of studies out there relating to the effect, or lack thereof, on the sales price of real property depending on its proximity to a fuel pipeline,” Craven told NGI Monday. “Unfortunately, I don’t think we can say there is a definitive weight of evidence to establish with certainty a generalized, overarching rule in either direction. It would be nice to have a set of independent academic studies done that not only check for sales that are nearly simultaneous of comparable properties near to and distant from a pipeline, but also account for recent controversies over construction, recent incidents, and perhaps most importantly, interviews with the purchasers to identify whether or not they were aware of the existence and proximity of the pipeline and whether its presence affected their purchasing decisions.

“Unless comparative sales studies are comparing knowing buyers, the studies are not very helpful in identifying whether there is a value differential for a buyer who has knowledge of the pipeline,” she added. “The INGAA-commissioned study’s methodology appears to be a paired-sales study, albeit a widespread one, but the methodology described does not give any indication that the sales involved knowing buyers. If one wants to identify what the market effect is of pipeline proximity on buyers who are aware of a pipeline and its potential safety risks, it would seem that a study would be more helpful if it identified whether or not the buyers in either half of a paired sale knew about the existence of the pipeline, and perhaps whether they knew anything about pipeline safety/risks.”

It would be hard not to know if a major pipeline was near a prospective property in, for instance, the Washington, DC, suburbs of Virginia, since the pipeline paths are marked by a wide swath (possibly 20-30 feet wide) of mowed grass all along the pipeline right-of-way and periodic Orange markers that identify the buried natural gas pipeline as “Transco” or “Columbia.”

The INGAA-backed study comes during an uptick in proposed interstate pipeline projects designed to transport new domestic shale gas production, particularly in the Northeast (see Daily GPI, Dec. 1, 2015; Nov. 2, 2015).

Lewis Freeman, chairman and executive director of the Allegheny-Blue Ridge Alliance, a coalition opposed to the proposed Atlantic Coast Pipeline (ACP), said the INGAA study is unlikely to reassure property owners along that project’s proposed route, particularly those in rural Virginia and West Virginia.

Freeman told NGI that he had not seen INGAA’s study and could not comment on it specifically. But he said “the beauty of the area, the natural resources that surround the area” are a particularly important component to property values across many of the rural counties impacted by ACP’s route.

Freeman, a resident of Highland County, said anecdotal evidence suggests that “interest in buying property” in the county “didn’t stop, but it significantly dampened and dried up in some parts because of the pipeline.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |