EVEP to Complete Only 10 Barnett Wells, Cancel All Onshore Drilling

Houston’s EV Energy Partners LP (EVEP) has canceled all of its natural gas-heavy drilling projects in the U.S. onshore and plans to complete only 10 Barnett Shale wells this year. However, natural gas production still should be about 15% higher year/year, with oil output up 23%.

The publicly traded master limited partnership, backed by general partner EnerVest Ltd., also has slashed capital expenditures by up to 75% year/year to $10-18 million from $67.9 million. The producer works not only in the Barnett, but also in East/Central Texas, the Midcontinent, Michigan, Louisiana’s Monroe field, as well as the Permian, San Juan and Appalachian basins.

During a conference call to discuss 4Q2015 and year-end results, Executive Chairman John Walker was blunt about the prospect for rising natural gas prices this year, but he was more optimistic beyond 2016.

“This year, there is not much to be optimistic about with natural gas prices,” Walker said. “With storage of over 2 Tcf on April, it will be almost be impossible to overcome.” With added gas power burn volumes, expanded liquefied natural gas exports and more Mexico exports, “demand will grow faster than gas supply between now and 2020, in my opinion.”

Throwing politics into the mix ever so slightly, Walker said expanded gas exports could be hampered if Republican presidential candidate Donald Trump is elected. Trump has said if elected he would return to Mexico an estimated 11 million people living in the United States and build a wall to prevent lawbreakers from returning. His plans have been condemned by top Mexican officials.

“In this segment, it’s more true than false probably, that if Donald Trump is not elected President, we should be exporting 7 Bcf/d to Mexico by 2020, up from 3.4 Bcf/d today,” Walker said. He did not elaborate.

All things being equal, “there is more optimism for gas prices in 2017 and 2018,” he said. U.S. producers are “overwhelmingly” focused on surplus gas supplies, but production currently is declining by 10-15% a year as operators pull back, he said. It’s EVEP’s plan through 2016.

“Needless to say, we all should be running our companies today for survival,” Walker said. “We’re now operating 33,000 wells in 17 states with 15% fewer people. Our strategy of building major concentrations on wells in several basins is really paying off in these distressed times.”

EVEP has about 1.5 Tcfe across the United States, including 577 Bcfe in the Barnett, 137 Bcfe in Appalachia, 60 Bcfe in the Midcontinent, 53 Bcfe in the Monroe field, 52 Bcfe in San Juan, 51 Bcfe in Michigan, 43 Bcfe in East/Central Texas and 28 Bcfe in the Permian.

Most of the capital last year was spent in the Barnett and that’s the same plan this year, CEO Mike Mercer told analysts. Thirty wells were drilled and completed in the Barnett by the end of 2015. This year, only 10 previously drilled wells are expected to be completed, all online during the second quarter, he said.

“The remainder of the capital will be spread across our other assets for maintenance type activities. Currently, we’re not running any rigs and with commodity prices where they are, do not have any drilling plan for the remainder of the year at this time.”

To cope with stressed pricing, the senior management of EVEP and EnerVest, as well as the board, agreed to take a 10% reduction in base compeneffective March 1 “to preserve jobs,” said Walker.

“All of these efforts are to help ensure we will be able to survive this significant prolonged downturn and emerge on the other side” and be “viable participants in the rebound that will come. Personally I have experienced six other downturns, and I have to admit this is the worse one I’ve seen from every perspective. The downturn gets hard,” while the surge in return business will “get fast and I do believe the pendulum will swing the other way.”

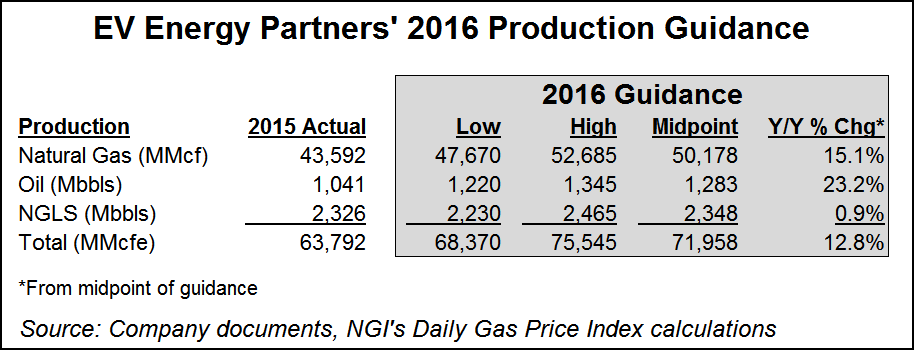

If drilling doesn’t pick up by 2017, production will begin to decline, Mercer said. But completions in place or underway should sustain higher oil and gas levels through the year, rising 12.8% overall to 63.792 MMcfe.

Natural gas production in 2015 totaled 43.592 Bcf, but output should climb about 15% year/year, with the midpoint at 50.178 Bcf. Oil production is forecast to be 23% higher at a midpoint of 1.283 billion bbl, while natural gas liquids should increase by about 0.9% to 2.348 billion bbl. Based on trailing year-end pricing, net proved reserves at the end of 2015 totaled 1.0967 Tcfe, including 747 Bcf of gas, 22 million bbl of oil and 36.3 million bbl of liquids.

Production during 4Q2015 was 23% higher year/year and 36% more than in 3Q2015, with 13.3 Bcf/d of gas, 351,000 b/d of oil and 655,000 b/d of liquids, or 209.8 MMcfe/d. The increases in output were tied primarily to acquisitions, not through the drillbit, the company said. For 2015, production was 43.6 Bcf of gas, 1,000 bbl of oil and 2,300 bbl of liquids, or 174.8 MMcfe/d, essentially flat from 2014. Estimated proved reserves were 68% weighted to gas, 20% to liquids and 12% to crude oil, with 83% proved developed.

Net losses in 4Q2015 totaled $71.3 million (minus $1.43/share), which included $14.4 million for writing down the value of oil and gas properties. In 4Q2014, EVEP’s profits were $102.4 million ($2.03/share). For 2015, EVEP earned a net $21.3 million (41 cents/share), versus earnings in 2014 of $129.7 million ($2.58).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |