Infrastructure | NGI All News Access

Maine Governor Urges Prompt FERC Action On TGP’s Northeast Energy Direct

FERC should “move forward expeditiously” in its review of Tennessee Gas Pipeline Co. LLC’s (TGP) Northeast Energy Direct (NED) Project “to relieve New England’s natural gas capacity challenges,” Maine Gov. Paul LePage said in a letter posted on the Commission website last week.

“The NED project is particularly critical for Maine’s economic strategy because of its up to 1.3 Bcf/d size, direct reach into the Marcellus Shale region, subscription from various New England gas utilities in need of supply, and potential to satisfy the particular demands of New England’s large, flexible, and efficient fleet of natural gas-fired generators,” LePage wrote.

Kinder Morgan Inc.’s TGP filed its Federal Energy Regulatory Commission certificate application for NED in November [CP16-21] (see Daily GPI, Nov. 20, 2015). TGP said NED would bring New Englanders relief from natural gas and power price spikes, but the proposal has been the target of criticism by the Massachusetts attorney general and others (see Daily GPI, Dec. 31, 2015).

In addition to NED, LePage has called for quick action on Spectra Energy’s Algonquin Incremental Market project, Atlantic Bridge project and Access Northeast project (see Daily GPI, Oct. 28, 2015).

“We cannot afford inaction or delay on New England pipeline proposals and it is crucial that these projects move forward as quickly as possible,” LePage wrote. “I urge you to review the applications before you in a timely manner, paying sufficient attention to locals concerns while fully understanding of the nature of public goods like infrastructure projects that provide enormous but dispersed benefits to society at large but often struggle to aggregate support in the face of ‘not-in-my-backyard’ sentiment.”

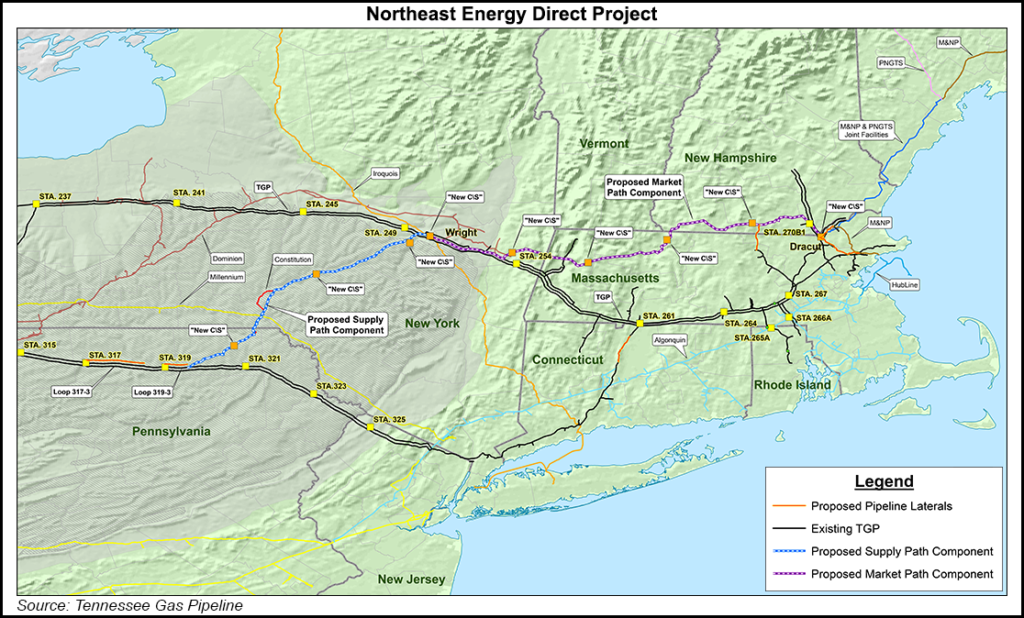

Costing $5 billion, NED would expand the TGP system in Pennsylvania, New York and New England, connecting Marcellus Shale gas from northern Pennsylvania to consumers in New York and New England. Last July, the KMI board gave the go-ahead for the project’s market path segment (see Daily GPI, July 16, 2015). The board has yet to approve the supply path portion of NED. The 20,000-page filing pending at FERC is for the entire project.

The project’s supply path component would have a maximum design capacity of 1.2 Bcf/d and consist of 133 miles of 30-inch diameter pipeline extending from TGP’s existing 300 Line system in northern Pennsylvania to an interconnection with TGP’s 200 Line system and Iroquois Gas Transmission System LP at Wright, NY; and 41 miles of 36-inch diameter looping pipeline along TGP’s 300 Line in Bradford and Susquehanna counties in Pennsylvania.

The market path component would have a maximum design capacity of 1.3 Bcf/d and consist of 188 miles of 30-inch diameter pipeline extending from Wright to Dracut, MA, five delivery laterals in Massachusetts and New Hampshire, and one pipeline loop in Connecticut. The market path facilities would be owned by Northeast Expansion LLC, which is a joint venture of Kinder Morgan Operating Limited Partnership A, Liberty Utilities (Pipeline & Transmission) Corp., and UIL Holdings Corp. TGP would construct the facilities on behalf of Northeast Expansion LLC.

TGP has executed precedent agreements with seven New England LDCs and other market participants for firm transportation service on the market path for 552,262 Dth/d (see Daily GPI, July 30, 2014). The Massachusetts Department of Public Utilities and New Hampshire Public Utilities Commission previously approved TGP’s agreements with the LDCs in these states.

National Grid’s Massachusetts Electric Co. and Nantucket Electric Co. recently asked Massachusetts regulators to approve contracts for natural gas pipeline capacity on NED and the Access Northeast project (see Daily GPI, Jan. 26).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |