NGI Archives | NGI All News Access

Weekly NatGas Prices Grind Lower; Declining Production Seen For 2016

How soon the oversupplied natural gas market can right itself and enjoy a pricing landscape sufficient to generate the capital necessary to maintain a balance between supply, demand, and reserve replacement remains to be seen. However judging by the behavior of weekly prices for the week ended Feb. 26, the industry is not there yet.

TheNGI Weekly Spot Gas Average dropped 12 cents to $1.65 and only one thinly traded point followed by NGI made it to positive territory. The week’s sole gainer was CIG DJ Basin with a rise of 3 cents to average $1.60. The week’s biggest losers were Algonquin Citygate with a drop of 99 cents to $2.14 closely followed by Tennessee Zone 6 200 L with a decline of 98 cents to $2.22.

Regionally the Northeast took the week’s greatest hits with a drop of 32 cents to average $1.50, and the Rocky Mountains proved the most resilient losing 4 cents to $1.54.

The Midwest and South Louisiana both shed 10 cents to $1.78 and $1.72 respectively, and East Texas rode to a 9 cent decline to average $1.69.

South Texas dropped 8 cents to $1.71 and the Midcontinent fell 6 cents to $1.63. California dropped 5 cents to average $1.73.

Trading terminated in the March contract Thursday with March settling at $1.711, down a gaping 47.8 cents from the expiration of the February contract.

The spot April contract on the week fell 7.6 cents to $1.791, unable to match the plump declines in the cash market.

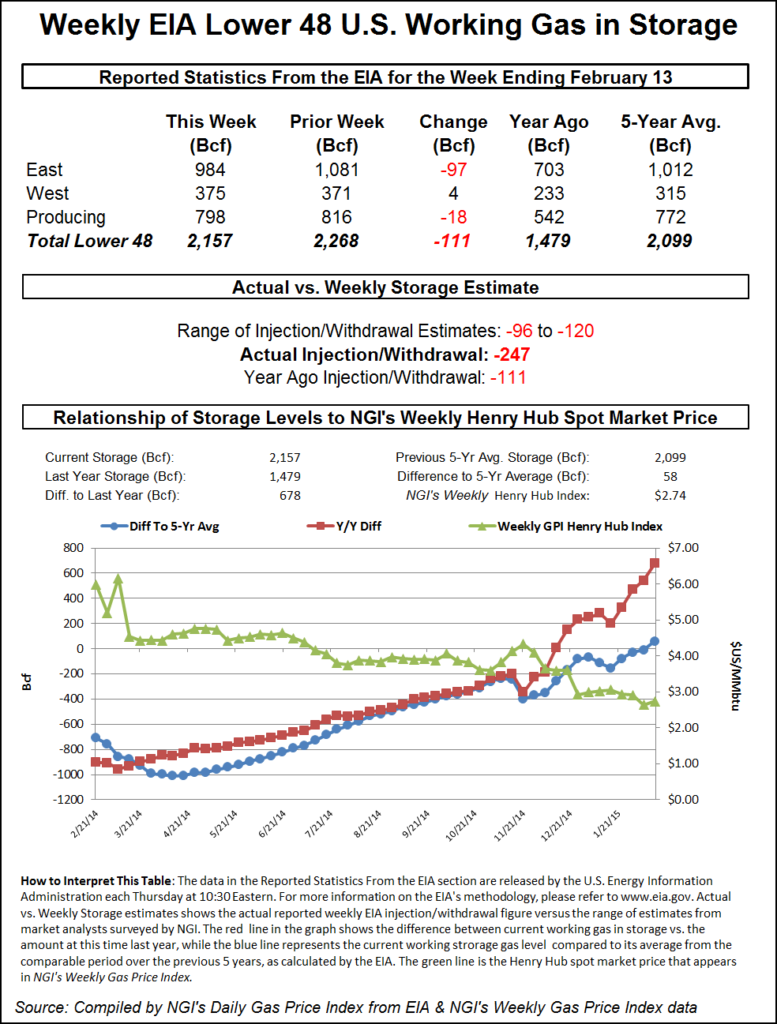

Much of the market’s weakness was prompted by a storage report that no one saw coming. The EIA reported a withdrawal of just 117 Bcf for the week ending Feb. 19, well shy of expectations close to 140 Bcf and less than the lowest estimate of traders surveyed by a major news service. The EIA increased the previous week’s withdrawal by 5 Bcf to -163 Bcf but even that couldn’t prevent the expiring March futures rolling lower to test the recent lows of December. At settlement on Thursday March had fallen 6.7 cents to $1.711 after trading as low as $1.682 and April was down 4.9 cents to $1.785.

Reaction to the thin storage pull was immediate. March futures fell to a low of $1.682 following the release of the storage data, and by 10:45 a.m. March was trading at $1.686, down 9.2 cents from Wednesday’s settlement.

Going into the report the best minds in the business were calculating a significantly higher withdrawal. Industry consultant Bentek Energy, utilizing its flow model, was counting on a 131 Bcf reduction, and ICAP Energy was looking for a withdrawal of 134 Bcf. A Reuters poll of 22 traders and analysts showed an average -139 Bcf with a range of -126 to -162 Bcf.

John Sodergreen, publisher of Energy Metro Desk said his survey was around -139 Bcf, but “we think a low-side report will be published by EIA this week, more like low-to-mid 130s. Oddly enough, the editor and the GWDD Model forecast are both around -140.”

“I think a little bit of money was taken off the table on the dip, but otherwise the shorts are very comfortable right now,” a New York floor trader told NGI just after the number was released. “The drop put prices below the previous support in the low $1.70s and is exactly what the shorts were looking for. We may test $1.61 to $1.63,” he said.

“[T]he small revision wasn’t enough to make up for a much smaller than expected 117 Bcf net withdrawal for the week ended Feb 19,” said Tim Evans of Citi Futures Perspective. “In place of the expected, relatively neutral, near-average withdrawal, we have a small decline that implies a significantly weaker supply/demand balance.”

Inventories now stand at 2,584 Bcf and are a stout 615 Bcf greater than last year and 577 Bcf more than the five-year average. In the East Region 56 Bcf was pulled, and the Midwest Region saw inventories fall by 44 Bcf. Stocks in the Mountain Region unchanged, and the Pacific Region was higher by 1 Bcf. The South Central Region shed 18 Bcf.

In Friday’s trading natural gas for weekend and Monday delivery slumped as all traders had to do was look at near-term weather forecasts and remember that incremental weekend purchases could be made via electronic media. Three-day deals did not seem necessary.

Several points followed by NGI traded flat, but all other market points fell at least a dime. The NGI National Spot Gas Average fell 16 cents to $1.51, and the East on average was down more than 30 cents. Futures continued to slip lower after Thursday’s weak EIA storage report, and at the close April had lost six-tenths of a cent to $1.791 and May was down six-tenths as well to $1.873.

Forecasts for weekend and Monday temperatures gave gas buyers no cause for alarm. Wunderground.com predicted that Chicago’s Friday high of 38 degrees would rise to 53 Saturday and ease only slightly to 50 on Monday, 10 degrees above normal. New York City was anticipated to see its high Friday of 38 rise to 44 Saturday but jump to 57 on Monday. The normal high in New York City for late February is 44.

Gas at major market centers tumbled, with the East taking the lead. Deliveries to the Chicago Citygate fell 6 cents to $1.71, and gas at Henry Hub was quoted 11 cents lower at $1.66. Deliveries to New York City via Transco Zone 6 skidded 77 cents to $1.13, and gas at the PG&E Citygate changed hands 4 cents lower at $1.86.

Double-digit declines were common. Gas on Dominion South fell 19 cents to 97 cents, and gas on Transco Zone 4 gave up 11 cents to $1.66. Deliveries to El Paso Permian shed 12 cents to $1.45, and gas at Opal retreated 11 cents to $1.44.

Big moves were seen at the Algonquin Citygate for weekend and Monday gas, down $1.32 to $1.59, and gas on Tenn Zone 6 200L fell $1.22 to $1.75. Deliveries to Tenn Zone 5 200L were quoted 68 cents lower at $1.68.

Thursday’s lean storage withdrawal was met with a healthy degree of skepticism. “The EIA reported a -117 draw yesterday, which was 19 Bcf below our expectation (-136), 22 Bcf below the survey average (-139), and 12 Bcf below the lowest number on the street (-128),” said industry consultant Genscape.

“Last week’s stat was revised by 5 Bcf from a -158 to a -163 pull [and] one could argue that the 5 Bcf revision in last week’s stat was “borrowed” from this week, which could have made this week’s draw a -122. But even a -122 would be well below the lowest number on the street and well below our S&D [supply and demand] and pipe scrape models. This week’s stat appears erroneous and it would not be a surprise to see it revised in the near future.”

“The bears have had a good run lately. In addition to this week’s bear stat, the weather forecast remains very mild (we are on track to end the winter more than 450 degree days below normal – around 750 Bcf below normal demand for the winter); production recently hit a new all-time high; and storage is likely to end the winter more than 600 Bcf above average as a result of the previous two points.

“Beleaguered bulls can point to production declines over the last several days, and the fact that Sabine Pass just exported its first LNG export cargo this week. Per Cheniere’s most recent presentation, they expect Train 1 to be fully operational by late April or early May, and train 2 to be fully operational by August. Trains 1 and 2 will consume around 1.3 Bcf/d when they are running at 100%.”

Others point to production declines as also aiding the case for the bulls. “The declines in production are a bullish sign for gas prices, said Jefferies LLC in a report.

“With now two of the top five U.S. gas producers in clear distress, the implications are highly bullish for macro gas,” wrote Jefferies analyst Jonathan D. Wolff. “Our bottoms-up 21-basin U.S. supply model is at 3.2% exit-2016 decline rate, but the potential for further declines is becoming more obvious.”

Tim Evans of Citi Futures Perspective said the 117 Bcf pull reported Thursday “was much smaller than our simple weather-based model’s 145 Bcf forecast, implying some weakening of the underlying supply-demand balance and a bearish shift in the baseline for the weeks ahead.”

Evans forecasts next week’s storage withdrawal report at a mere 35 Bcf, much less than last year’s 204 Bcf and a five-year average of 144 Bcf. By March 11 he anticipates the year-on-five-year surplus at a titanic 765 Bcf.

“The uptrend in the surplus confirms the market is becoming increasingly overstocked on a seasonally adjusted basis, with a corresponding increase in the downward pressure on prices.”

Gas buyers across the PJM footprint should have ample renewable generation to offset weekend gas purchases for power generation. WSI Corp. in its Friday morning report said, “High pressure will promote fair, yet cooler temperatures [Friday] into tomorrow. A clipper type low-pressure system is expected to sweep across the Canadian border Sunday into Monday, producing a period of rain showers and clouds. Total precipitation will range between 0.1-0.25 inches. After a cool start to the period (highs in the 30s-40s), a warming trend this weekend will promote above average temperatures to begin next week (highs in the 50s-60s).

“A southwesterly breeze will promote modest wind gen prospects over the next couple of days as output will slowly rise from 3 GW to 6 GW through Sunday. Flow is expected to become more variable next week, reducing prospects.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |