Rigs: Down Again With Still Further to Fall

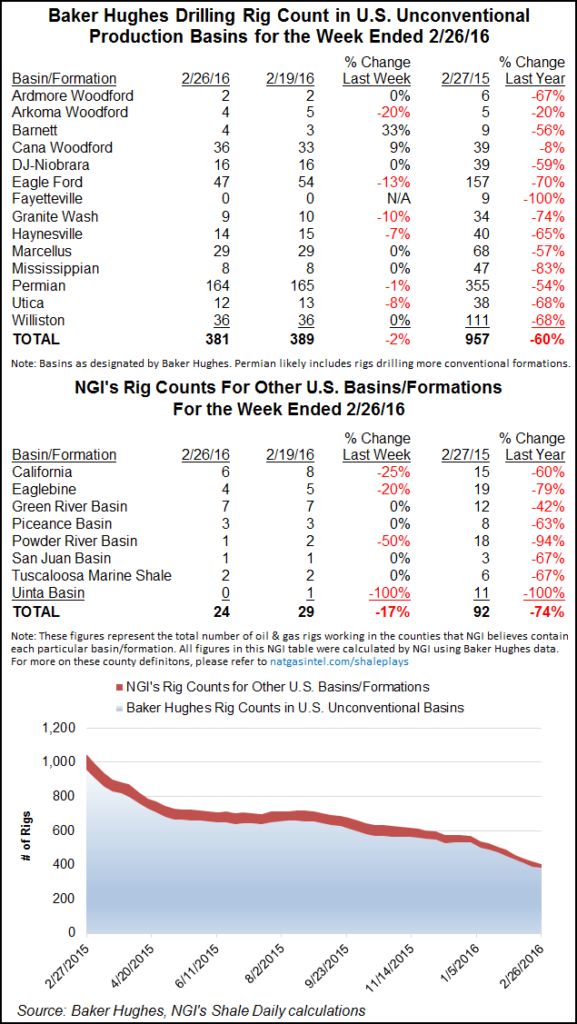

The tally of active U.S. land drilling rigs fell by 14 in the latest Baker Hughes Inc. count issued Friday, and analysts are expecting it to set a lower bottom than their previous calls.

“The U.S. land rig count remains fluid and there is increasing risk that it could bottom in the low 300s, which is well below our prior scenario analysis of 440 and the current [as of Feb. 19] count of 487,” BMO Capital Markets analysts said in a note published Thursday.

“Our analysis of 13 companies that have given specific rig count targets suggest a 50-rig, or approximately 40%, decline from early February. These companies represent just about 20% of the total rig count. This suggests that the rig count could trough as low as 300-350 if one were to extrapolate the sample. However, our E&P team thinks this sample is not representative of the industry and that overall declines may be less.”

In their own note Thursday, analysts at Cowen and Company looked at recent operator announcements for the preceding week and said they expect to see about 14 more rigs being dropped in addition to about 50 from the previous week. “This supports our thesis of a total 100-125 [U.S. land] rig drop with the trough at 375-400.”

For the week ending Feb. 26, the U.S. land rig count stood at 473. The U.S. total rig count rested at 502 after 12 net departures: the 14 from land offset by two offshore additions.

In the United States, 13 oil rigs left play, but one natural gas-directed rig rejoined the game. Nineteen horizontal rigs departed, accompanied by one directional unit; however, three vertical units were added.

The Eagle Ford Shale was the biggest loser among plays, dropping seven units and giving the Permian Basin a break from its recent hold on that distinction. And Texas, again, was the biggest loser among states, dropping five rigs. The Permian could very well reclaim the biggest loser title in coming weeks, though.

“The Permian (Midland Basin) has been the most resilient in terms of the horizontal rig count as the lowest-cost oil in the U.S. However, reality has set in for operators who now need to preserve balance sheet and inventory value rather than chase volume growth,” analysts at Jefferies said in a Feb. 23 note.

To the north, Canada gave up 31 rigs for the week to end at 175, and combined with the United States, that gave North America 677 active rigs, a decline of 43 from the previous week. Twenty-six Canadian oil rigs left the game, joined by five natural gas units.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |