Markets | NGI All News Access | NGI Data

Cash NatGas, Futures Part Ways; March Expires Down 7 Cents

Most physical natural gas traders Thursday made sure they got their deals done for Friday delivery before the release of storage figures by the Energy Information Administration (EIA) at 10:30 EST.

As a result, the overall average price moved little, but hefty gains in the East were able to overwhelm modest losses in the Midwest, Midcontinent, Gulf, Rockies and California. The NGI National Spot Gas Average rose by 2 cents to $1.67, and the Northeast rose by close to 30 cents.

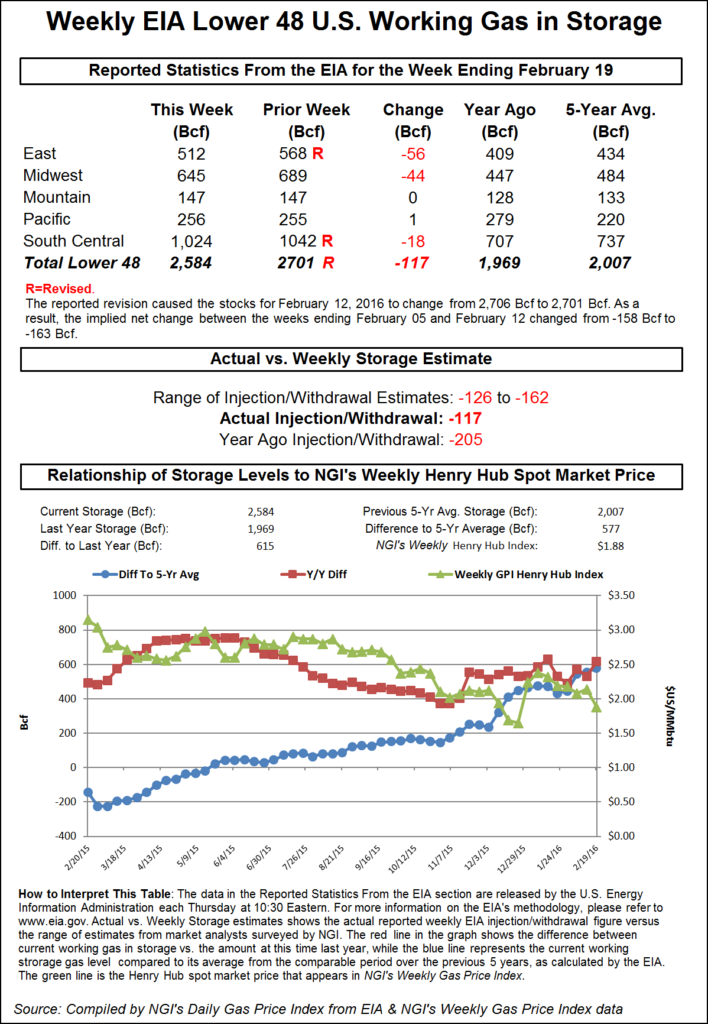

The EIA reported a withdrawal that no one saw coming. It was just 117 Bcf, well shy of expectations that were close to 140 Bcf and less than the lowest estimate of traders surveyed by a major news service. The EIA even increased the previous week’s withdrawal by 5 Bcf to -163 Bcf but even that couldn’t prevent March futures rolling lower to test the recent lows of December. At settlement, March had fallen 6.7 cents to $1.711 after trading as low as $1.682 and April was down 4.9 cents to $1.785. April crude oil gained 92 cents to $33.07/bbl.

Reaction to the thin storage pull was immediate. The expiring March futures fell to a low of $1.682 following the release of the storage data, and by 10:45 a.m. EST March was trading at $1.686, down 9.2 cents from Wednesday’s settlement.

Going into the report the best minds in the business were calculating a significantly higher withdrawal. Industry consultant Bentek Energy, utilizing its flow model, was counting on a 131 Bcf reduction, and ICAP Energy was looking for a withdrawal of 134 Bcf. A Reuters poll of 22 traders and analysts showed an average -139 Bcf with a range of -126 to -162 Bcf.

John Sodergreen, publisher of Energy Metro Desk, said his survey was around -139 Bcf, but “we think a low-side report will be published by EIA this week, more like low-to-mid 130s. Oddly enough, the editor and the GWDD Model forecast are both around -140.”

“I think a little bit of money was taken off the table on the dip, but otherwise the shorts are very comfortable right now,” a New York floor trader told NGI. “The drop put prices below the previous support in the low $1.70s and is exactly what the shorts were looking for. We may test $1.61 to $1.63,” he said.

“[T]he small revision wasn’t enough to make up for a much smaller than expected 117 Bcf net withdrawal for the week ended Feb 19,” said Tim Evans of Citi Futures Perspective. “In place of the expected, relatively neutral, near-average withdrawal, we have a small decline that implies a significantly weaker supply-demand balance.”

Inventories now stand at 2,584 Bcf and are a stout 615 Bcf greater than last year and 577 Bcf more than the five-year average. In the East Region 56 Bcf was pulled, and the Midwest Region saw inventories fall by 44 Bcf. Stocks in the Mountain Region unchanged, and the Pacific Region was higher by 1 Bcf. The South Central Region shed 18 Bcf.

If the undersized storage withdrawal were not enough overnight weather forecasts turned moderately warmer. MDA Weather Services in its Thursday morning six- to 10-day outlook said it “sees a mix of changes in this period; although the East turns warmer in the early half as models come into better agreement with the track of a developing storm system from the South-Central to the East. Despite temperatures turning colder in the latter stages, the period on the whole features slightly above normal readings for the major East Coast cities from Washington, DC, to Boston.

“The Midwest remains the region of lowest confidence as models struggle to determine how much cold air can intrude into the region in the wake of disturbances undercutting the western ridge.”

MDA said risks to the forecast include the American model showing below normal coverage in the Midwest, “but this has been a bias in the model. The East could be warmer at mid-period as low pressure tracks toward the region.”

Noon weather model runs did little to change the course of prices. “The data is quite mild this weekend into next week with only the extreme north getting into the Polar air,” said Natgasweather.com in a mid-day report. “A strong winter storm spins up mid-next week with a cold blast following in its wake for a couple days for a brief surge in demand but then warming nicely after. A bearish run overall and milder days 11-15 vs its 00z overnight solution.”

In physical market trading a few points managed a triple-digit gain as a stout rise in next-day power prices made additional gas purchases for power generation more viable. Intercontinental Exchange reported on-peak Friday power at the ISO New England’s Massachusetts Hub rose $7.39 to $28.02/MWh, and on-peak power at the PJM West market center gained $6.16 to $32.28/MWh.

Deliveries to the Algonquin Citygate rose $1.21 to $2.91, and parcels at Iroquois, Waddington gained 14 cents to $2.00. Gas on Tenn Zone 6 200L traded $1.18 higher at $2.97 on light volume.

Gas on Texas Eastern M-3, Delivery managed to rise 17 cents to $1.31, and packages bound for New York City on Transco Zone 6 added 12 cents to $1.90.

The unrelenting convergence of Marcellus points with those farther downstream offering access to Midwest markets continued in Thursday’s trading. Marcellus points rose while those on the REX Zone 3 Expansion weakened.

Deliveries to NGPL on REX Zone 3 at Moultrie County, IL, fell 3 cents to $1.69, and gas on Panhandle Eastern at Putnam County, IN, changed hands 3 cents lower as well to $1.69.

Gas on Dominion South rose 11 cents to $1.16, and packages on Tennessee Zn 4 Marcellus added 8 cents to $1.13. Gas on Transco-Leidy Line gained 7 cents to $1.11.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |