Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Apache Slices Budget, Reports North America D&C Costs Down 35%

Super independent Apache Corp. plans to remain cash flow neutral this year — even at a $35/bbl oil price — by relying on a pullback in development, lower well costs and a sharp reduction in capital spend.

The Houston-based producer, which reported fourth quarter results on Thursday, expects production volumes to fall by 7-11% in 2016. Forty-five percent of capital is being directed to North America, where the Permian Basin continues to provide solid results and, in a bit of a surprise, produced higher natural gas than oil volumes than a year ago.

The global operator couldn’t overcome a $5.9 billion one-time impairment to the value of its reserves during 4Q2015, and net losses amounted to $7.4 billion (minus $19.57/share), versus a year-ago loss of $3.7 billion (minus $9.93). However, adjusted for the one-time writedowns, losses totaled $24 million (minus 6 cents/share), compared to a Wall Street consensus that Apache would lose 48 cents/share. For 2015, the loss was $22.35 billion (minus $59.16/share) from 2014 losses of $3.82 billion (minus $9.93).

“In 2016, we plan to be cash flow neutral after dividends and believe this can be achieved at $35 oil with minimal noncore, non-producing asset sales,” CEO John Christmann said.

Capital expenditures for 2016 are set at $1.4-1.8 billion, 56% lower year/year and 80% below 2014 levels. Plans are to achieve cash flow neutrality for the year, assuming flat West Texas Intermediate and Brent oil prices of $35/bbl, Christmann said.

“With current 2016 strip prices 30-35% below year-ago levels, we believe a conservative plan and a flexible capital spending program are paramount to protecting the financial position we have worked hard to establish over the last 18 months,” he said. The capital spend could be adjusted “up or down to align with actual commodity prices and resulting cash flow.” Discretionary capital is “prioritized to higher rate-of-return opportunities” including “key strategic testing” in North America’s onshore.

“Apache has a large inventory of low-cost drilling opportunities in North America, but with the majority of its net acreage held-by-production, it does not view spending on development wells as a necessary or prudent use of limited dollars at current oil prices,” Christmann said.

“The company will maintain capital allocation and operational flexibility to respond quickly to changing oil price scenarios and has developed specific plans for adding rigs back in the event prices and costs come back into better alignment.”

Full-year production rose across the globe in 2015 to 535,000 boe/d, 3% higher in North America’s onshore and up 13% in international and offshore units. This year, volumes pro forma are forecast to be 433,000-454,000 boe/d, down 7-11%. In North America’s onshore, production is projected to decline by 12-15% to 263,000-273,000 boe/d.

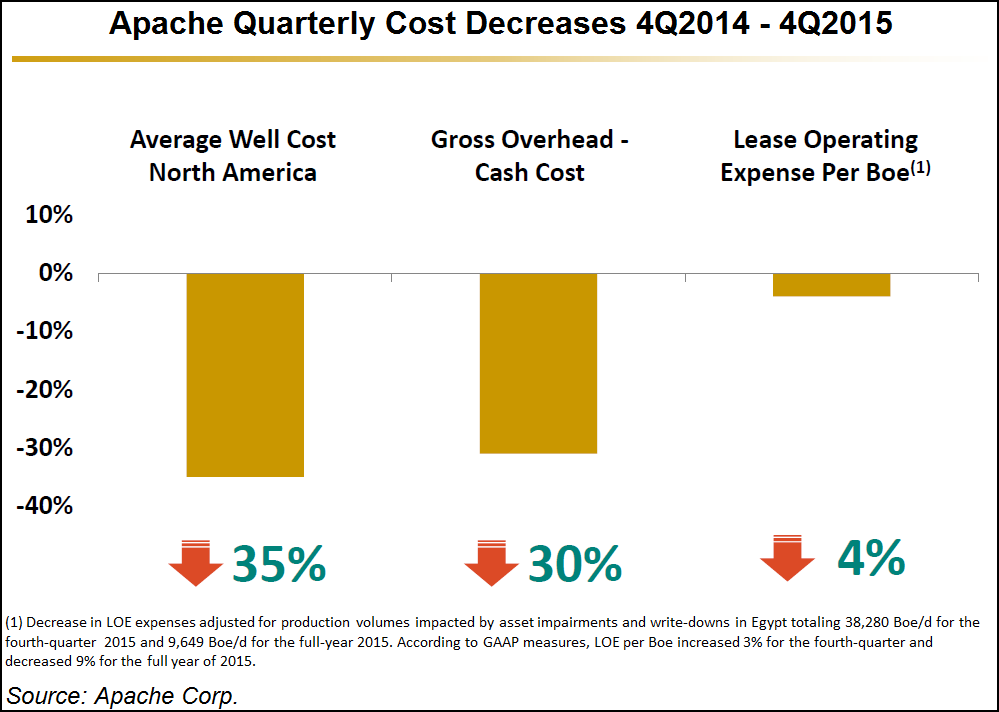

Volumes may be on the decline, but Apache is getting a bigger return on its spend after realizing a 35% reduction year/year in North American onshore drilled and completed (D&C) well costs. Apache drilled and completed 79 wells in the onshore during the final three months of 2015, increasing production sequentially to an average of 308,000 boe/d from 306,000 boe/d.

In the Permian, Apache operated 11 rigs and completed 57 wells, with production averaging 174,000 boe/d, 2% higher sequentially.

Fifteen wells were completed in the Delaware sub-basin, where the Bone Spring is the target. Another 42 wells were completed in the Midland sub-basin, Northwest Shelf and Central Basin Platform. Permian natural gas output rose by 11% year/year to 248,071 Mcf/d, while oil volumes were down 4%. Liquids production was 1% higher.

Apache’s gas volumes elsewhere in North America declined, with the Midcontinent down 53% and Canada volumes off 23%. Gulf of Mexico (GOM) gas production was 12% lower.

North American onshore oil volumes declined not only in the Permian but across the board. Midcontinent/Gulf Coast region volumes fell by 43%, Canadian volumes were down 9% and GOM volumes fell by 28%. On the liquids side, onshore volumes slumped overall by 12%, with Midcontinent/Gulf Coast output down 39%, Canada off 4%, and GOM volumes declining 28%.

Worldwide estimated proved reserves totaled 1.6 billion boe at the end of 2015 from 2.4 billion boe at year-end 2014, primarily because of divestitures in Australia and Canada, the significant decline in prices used to calculate reserves volumes, and the reduction in spend. The decrease in reserves consisted of divesting 385 million boe, production of 204 million boe and revisions of previous estimates of 368 million boe. These decreases were offset in part by 117 million boe of proved reserves added through net extensions and discoveries.

Apache had access to available liquidity of $5 billion at the end of 2015, including $1.5 billion in cash and $3.5 billion in available borrowing capacity. The credit facility matures in June 2020. There are no debt maturities before 2018 and only $700 million of debt maturing before 2021.

“Our target is for net debt at the end of 2016 to be unchanged or lower than it was at the end of 2015,” Christmann said. Apache net debt at the end of 2015 was $8.8 billion, down $2.2 billion from 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |