NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Chesapeake Focusing on Completions, Renegotiating Contracts as Rig Count Collapses, Capex Declines

Chesapeake Energy Corp., once the most active producer in the U.S. onshore, has reduced its rig count to less than 10 and cut capital spending by more than half as it shores up its balance sheet for the long haul. With a fourth quarter loss of more than $2.2 billion, the No. 2 U.S. natural gas producer also is continuing to negotiate with midstream partners to revise contracts that better fit its downgraded development plans.

The Oklahoma City-based independent, which like many of its peers has been struggling with liquidity, issued quarterly results on Wednesday. Planned capital expenditure (capex) this year is set at $1.3-1.6 billion, down 57% year/year. Adjusted for planned asset sales of $500 million to $1 billion, output should be flat or decline by up to 5%.

“In light of the challenging commodity price environment, our focus for 2016 is to improve our liquidity, further reduce our cost structure and address our near-term debt maturities to strengthen our balance sheet,” CEO Doug Lawler said. “Our tactical focus areas remain asset divestitures,” with about $500 million net of divestitures completed or under signed sales agreements. Another $700 million in divestitures is expected to close by the end of June.

Chesapeake’s share price, which has been as high as $18.55 in the past year, climbed on the earnings results by almost 23% on Wednesday to end the day at $2.69. More than 61.67 million shares traded hands for the day, compared with an average volume of almost 29 million.

Because of the “size and diversity of Chesapeake’s portfolio, we have received several inbound offers and sales inquiries for smaller, noncore, nonoperated properties from strategic buyers,” he said. “These smaller packages can range anywhere from $10 million to $500 million,” with limited earnings and production.

“The interest level in larger $1 billion-plus sized asset sales is very low in the current market. We expect to continue to make progress on several smaller asset divestitures, which when taken together can add up to meaningful amounts until we can evaluate the possibility of divesting a larger asset. The quality and diversity of our portfolio provide tremendous opportunities to further optimize our current assets and bring additional value forward.”

This week Chesapeake secured two asset sales. On Tuesday the operator agreed to sell private equity-backed Haymaker Resources LP a bundle of mineral and royalty interests in 24 states and 324 counties for $128 million (see Shale Daily, Feb. 23). On Wednesday it sold its remaining natural gas-heavy Anadarko Basin properties for $385 million to FourPoint Energy LLC (see related story).

“We are also renegotiating gathering, transportation and processing contracts to better align with our current development plans and market conditions, aggressively working to minimize the decline of our base production and making shorter-cycle investments with our 2016 capital program,” Lawler told analysts.

Transport Expenses Lowered

Earlier this month Chesapeake amended some of its firm transportation agreements in the Haynesville, Barnett and Eagle Ford shales to reduce volume commitments and fees. The main contract redo is with Energy Transfer Partners LP for its ETC Tiger Pipeline, which carries natural gas from the Haynesville/Bossier areas, Lawler said.

Chesapeake should reap a $50 million benefit in lower unused demand charges for its underutilized capacity and lower transportation fees this year, which equates to an improvement in total transport expenses for natural gas of about 6 cents/Mcf.

Pipeline renegotiations continue, to modify additional gathering, processing and transportation agreements with its midstream service providers “resulting in mutually beneficial solutions in 2016,” Lawler said.

Continued pressure, however, is expected from commodity prices.

“The current deposition and the high operational leverage associated with our midstream commitments exacerbate the challenge here at Chesapeake,” the CEO said. “However, we have multiple levers available to us to further strengthen our financial and operational stability and strength.”

The primary focus is to manage near-term debt maturities due in 2017 and 2018, said CFO Nick Dell’Oso.

“We are pursuing several avenues to reduce these obligations, including the use of additional secured debt, private negotiations with bondholders and other types of exchange and tender offers. We will continue to be active in the market to exchange or repurchase our debt and reduce these principal balances even further,” he said.

As of February Chesapeake’s collateralized hedge facility has been terminated, “which gives us more flexibility as we move into the spring redetermination season. If necessary, we can pledge our unencumbered assets and assets previously pledged to the hedge facility to be used as collateral for the credit facility lenders in April.

Increased Cash on Hand

“As a result, we feel good about our ability to maintain robust liquidity through the upcoming borrowing base, despite the significant drop in commodity price strips. We expect to end the month of February with approximately $300 million in cash on hand, which reflects having already used approximately $230 million of cash to retire bonds due March 15 at an average price below $95.”

The cash balance reflects only $135 million of the $700 million in asset sales that are closing through the end of June.

As far as the bankruptcy rumors that have surfaced in recent weeks, Lawler addressed them head on (see Shale Daily, Feb. 8) . Chesapeake hired Evercore Group LLC in December to assist with the exchange offer for debt, he told analysts.

“We also have brought in counsel that’s pretty adept at debt exchanges and other more complicated transactions around balance sheet restructurings like this, where there are restructurings. And that context to me can mean a lot of things, and debt exchanges are much more complicated than your regular way transactions…

“It makes a lot of sense to have counsel around that works on these types of things on a regular basis, and is very, very helpful in navigating all the things that need to be considered when going through this type of an effort. We have debt securities that trade at a significant discount. There is real opportunity in that, and we are going to continue to think through the various avenues the company can take to deal with the near-term maturities we have, try to capture some of that discount that’s there, and position the company for better success in years to come.”

Planned capex this year is focused on “shorter cash-cycle projects that generate positive rates of return in today’s commodity price environment and in mitigation of the company’s commitment obligations.”

More spending this year is to be directed toward “more completions and less drilling,” with 70% alone for completions. Chesapeake plans to tie in 330-370 wells to sales.

Asset sales this year, if they are completed, would reduce production by about 31,000 boe/d. Also, the planned divestiture of some Granite Wash assets in Western Oklahoma and the Texas Panhandle requires Chesapeake to repurchase for $200 million the overriding royalty interests related to three of its previous volumetric production payment transactions, resulting in a projected impact to full-year output of about 25,000 boe/d net.

Hedges in Place

In addition, to improve cash flow and provide protection against lower commodity prices, Chesapeake has hedged 590 Bcf-plus of its projected gas production in 2016 at $2.84/Mcf and more than 19 million bbl of projected oil production at $47.79/bbl.

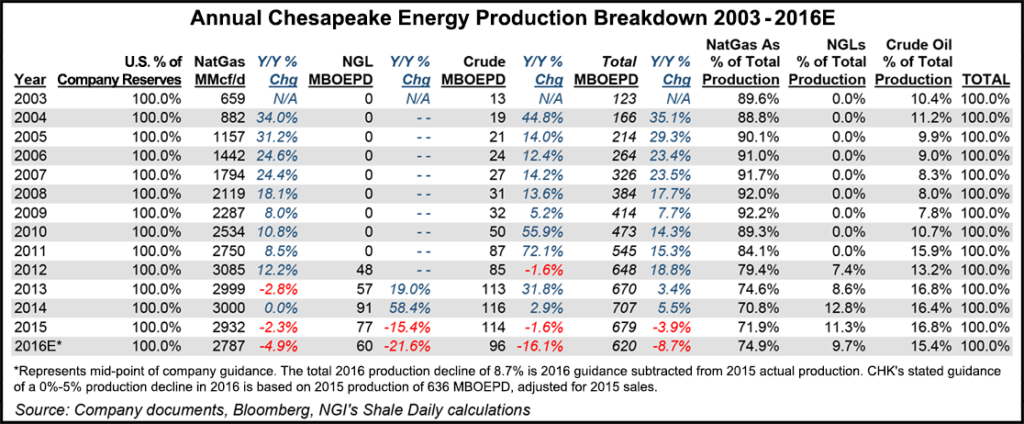

Although Chesapeake has moved toward more oil production in the last few years, total output remains solidly weighted to natural gas. In fact, gas now accounts for 74% of total output, versus 71% at the end of 2014, while oil accounts for 15%, down 1% from 2014.

Chesapeake didn’t escape having to write down the value of its reserves because of sharply lower commodity prices, which sent net losses in 4Q2015 to $2.228 billion (minus $3.36/share), versus year-ago profits of $586 million (81 cents). Adjusted for the one-time writedown, net losses year/year in 4Q2015 were $168 million (minus 16 cents/share) from profits of $34 million (11 cents). Net losses in 2015 totaled $14.856 billion (minus $22.43/share), following writedowns of $14.527 billion. Adjusted losses in 2015 totaled $329 million (minus 20 cents/share).

Production averaged 661,100 boe/d in the final three months of 2015, an increase of 1% adjusted for asset sales. Average daily production consisted of 2.9 Bcf/d of natural gas, 100,700 b/d of oil and 75,600 bbls of gas liquids. Adjusted for asset sales, average gas output increased 3%, with oil production down 7% and liquids up 4%.

Production expenses fell on average by 29% year/year to $3.62/boe, with general and administrative expenses falling 27% to $1.02/boe.

Principal debt balances were reduced to $9.7 billion at year-end 2015, compared with $11.8 billion at the end of 2014. As of Tuesday (Feb. 23), debt totaled $9.5 billion, and near-term liquidity consisted of more than$300 million in cash and a $4 billion undrawn revolving credit facility.

“The company plans to repay the remaining balance of its 3.25% senior notes due March 2016 with available liquidity and expects to continue to take advantage of the significant discounts in the prices of its debt securities in 2016,” management said.

4Q Output Down 10%

Operationally, Eagle Ford output during 4Q2015 averaged 97,000 boe/d, off 10% from the third quarter following plant downtime that impacted on average by 2,000 boe/d. Well costs through October 2015 averaged $5.4 million, with completed lateral lengths of about 6,250 feet and 23 fracture stages, versus 2014 average costs of $5.9 million, lateral lengths of 5,850 feet and 18 fractures.

Eighteen wells were placed on production in South Texas during the final three months of 2015, compared with 123 in 4Q2014. Plans are to place 170-180 wells on production this year. The operated rig count averaged three in the final three months, but all rigs are to be dropped by June.

In the natural gas-rich Haynesville and Bossier formations in northwestern Louisiana/East Texas, net production during the quarter averaged 609 MMcf/d net, down 4% sequentially. Average completed well costs through October were $7.7 million on average completed lateral lengths of 5,350 feet and 17 fracture stages, compared with 2014 completion costs of $8.4 million, laterals of 4,900 feet and 14 fractures.

Longer completed laterals continued to generate efficiencies in the Haynesville, evidenced by the company’s PE 36&25-15-15 1H ALT well, which had a completed lateral length of more than 10,000 feet and a peak rate of 25 MMcf/d using flowing tubing pressure of 7,200 pounds per square inch.

Thirteen wells were placed on production in Haynesville during 4Q2015, compared with 18 wells in 4Q2014. Plans are to place 50-60 wells on production this year. The operated rig count averaged six rigs in the final period, but only up to three are planned through the rest of the year.

In the Sooner Trend of the Anadarko (Basin) mostly in Canadian and Kingfisher counties, aka the STACK, three wells targeting the Meramec formation were completed. The Rouce 4-17-10 1H reached peak production of 1,260 boe/d, with the Wittrock 16-16-9 1H at 2,240 boe/d. The Stangl 36-16-9 1H reached 1,480 boe/d after eight days of flowback. Two Oswego wells also are being completed and likely placed on production in the second quarter.

Delineation of the STACK is to continue this year using up to three rigs, with expectations to place 35-45 wells on production.

In Northern Oklahoma, Mississippian Lime production fell 7% sequentially to average 29,000 boe/d net. Average completed well costs to date in 2015 (through October) were $2.8 million, with an average completed lateral length of 4,600 feet and 10 fracture stages, compared with full-year 2014 average completed well costs of $3 million, lateral lengths averaging 4,450 feet and nine fracture stages.

The first multilateral well in the Mississippian, the Wilber 26-27-11 1H, has dual laterals of 4,653 feet and 4,556 feet, and it reached a peak rate of 1,570 boe/d in late 2015. Eleven wells were ramped up in the play during 4Q2015, versus 42 in the year-ago period. Only one operated rig was working in the play at the end of the year.

Eastern Ohio’s Utica Shale recorded average production of 140,000 boe/net in the final period, up 33% sequentially, as curtailed volumes were brought online “with better pricing.” Those volumes will be closely watched and adjusted depending on the price environment, said Chris Doyle, who oversees Northeast operations.

Average completed well costs in Utica through October were $7.2 million using lateral lengths that averaged 7,800 feet and 40 fracture stages, versus 2014 average costs of $7.2 million, laterals of 6,200 feet and 29 fractures.

Chesapeake placed 43 wells on production in Ohio in the final quarter, versus 51 a year earlier. Plans are to place 45-55 wells on production this year. Only two rigs were working in the play at the end of the year, but both rigs have been dropped.

In Northern Pennsylvania’s Marcellus Shale, production averaged 782 MMcf/d net, down 3% from 3Q2015. Well costs averaged $7.6 million, with completed lateral lengths of 6,750 feet and 29 fractures, compared with full-year 2014 average costs of $7.5 million/completed well, average laterals of 6,000 feet and 27 fracture stages.

Three Marcellus wells tied to sales during 4Q2015, compared with 25 a year earlier, and plans are to place 20 more wells online this year. Only one rig was working at the end of the year, but it also has been dropped.

The Powder River Basin (PRB) in Wyoming saw production decrease by 4% from the third quarter to average 20,000 boe/d. Average well costs through October 2015 were $10.4 million using lateral lengths of 5,900 feet and 22 fracture stages, compared with 2014 costs of $10.6 million, laterals averaging 5,400 feet and 20 fracture stages.

Seven wells were placed on production in the PRB during the final period, versus 13 in 4Q2014, with five expected to ramp up this year. All operated rigs in the area have been released.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |