Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

PDC Grows Production in 2015, Focused on Balance Sheet During Downturn

Like many producers have announced in 4Q earnings calls over the last several weeks, balance sheet protection will be the name of the game for PDC Energy Inc. heading into 2016, as the Denver-based exploration and production (E&P) company continues to focus on its goal of cashflow neutrality through hedging and improved well economics.

The company has lowered its initial 2016 capital expenditures budget to $435 million, down from the $475 million midpoint of the $450-500 million range provided late last year (see Shale Daily, Dec. 9, 2015).

The $40 million decrease came purely as a result of improving well costs and left PDC’s initial 2016 drilling plan — focused primarily on its core acreage in the Wattenberg Field of the Niobrara-DJ Basin in Colorado — intact, CEO Barton Brookman told analysts during the company’s 4Q2015 earnings call Monday.

Scott Reasoner, senior vice president of operations, said PDC has reduced estimated costs per well to $2.6 million, $3.6 million and $4.6 million for 4,200-, 6,900- and 10,000-foot laterals respectively, a year/year improvement of 20-30%. These cost estimates also include the use of plug-and-perf technology, which PDC plans to implement across all 2016 wells, he said. By comparison, the 4,200- and 6,900-foot lateral wells drilled in the year-ago period averaged around $3.6 million and $4.6 million respectively, Reasoner said.

Brookman said 2016 for PDC will be characterized by “intense focus on balance sheet management, cash flow neutrality with ample liquidity.”

For 2016, PDC reported that it is roughly 52% hedged on its oil volumes at an average weighted floor price of $80.95/bbl and 62% hedged on natural gas volumes at $3.65/Mcf.

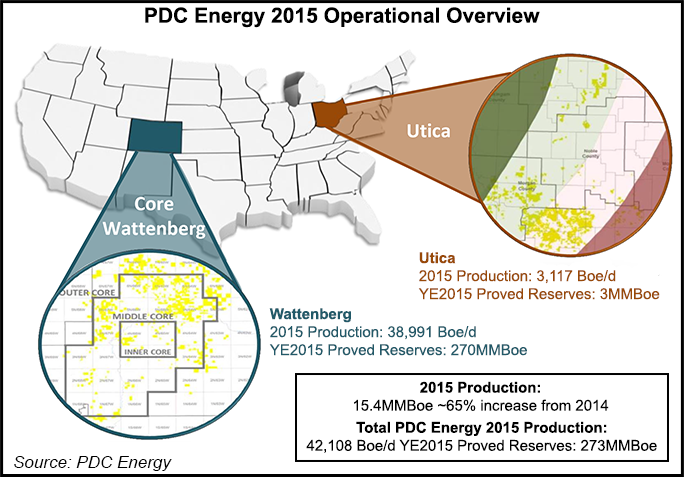

Production for PDC grew substantially in 2015 compared with 2014 levels. PDC produced 15.37 million boe for full-year 2015, compared with 9.29 million boe in 2014, a year/year increase of 65.4%. The company produced 6.98 million bbl of crude oil, 33.3 Bcf of natural gas and 2.84 million bbl of natural gas liquids in 2015. Production came primarily from PDC’s Wattenberg Field acreage, with its holdings in the Utica Shale contributing a small minority to the overall totals.

PDC will continue to monitor commodity prices and other cost variables as it evaluates its activity profile moving towards 2017, when the company is significantly less hedged, Brookman said.

“We’ve got all of these factors, and that’s why we don’t want to overreact…we still believe there is a rebound,” he said. “I can tell you this, though. If oil stays with a two-handle on it, we recognize we’re going to be heading towards the second half of this year, our hedges will be rolling off, we’ve got tremendous production growth, and we will probably give some consideration to slowing down if we feel like the pricing market is going to stay really, really, really bad into 2017.

“We will not lose focus on our commitment to manage around the balance sheet…The blessing for the company is that we have held-by-production acreage. We have short-term contracts on our rigs, and we can move pretty quick…We can move either way pretty quick.”

On the operations side, PDC plans to drill its first extended reach lateral (XRL) wells in 2016, reaching lengths of roughly 10,000 feet. These XRLs are expected to bring a production uplift for PDC beginning in 2017, management said.

Brookman said the XRLs present certain logistical challenges since they often require working with other operators to secure drilling rights. But the longer laterals also carry potential benefits in terms of minimizing surface impacts as the industry faces the prospect of increased regulation in Colorado (see Shale Daily, Jan. 26), he said.

“When we look at a two-miler, we recognize that there are other operators we’re going to have to work with, and it becomes more cumbersome for our land groups to get that done,” Brookman said. In the long-term, given trends in energy development in Colorado, “it will be a positive force” to have “operators working together to try to do more extended reach or two-miler-type projects.”

Moving forward, PDC will look to get “a handful of these under our belt” so that “technically we know we are not increasing our operational risk and then really understand the reserve performance of the well,” Brookman said. “And if all that comes to together, expect that to become more of our business plan going forward.”

In 2015, PDC spud 228 gross wells, both operated and non-operated, turning in line 198 wells. Running four rigs in the Wattenberg and one in the Utica, the E&P plans to spud 175 gross wells and turn in line 203 in 2016, including both operated and non-operated.

PDC’s 2016 plan for the Utica includes a $35 million, five-well program as the company evaluates how to proceed with a number of lease renewals coming up in 2017. Management said the E&P has about $30 million worth of leases expiring in 2017 and that some of that acreage may not be renewed depending on the results from the Utica wells.

Netting $62 million through hedging, PDC finished 4Q2015 with a net income of just over $3 million (8 cents/share), compared with a net income of $131.8 million ($2.34/share) in the year-ago period.

For full-year 2015, PDC reported a net loss of $68.3 million (minus $1.74/share), compared with a net income of $155.4 million ($3/share) in 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |