Markets | NGI All News Access | NGI The Weekly Gas Market Report

More Headwinds for NatGas Pricing as Industrial Demand Disappoints, Says Raymond James

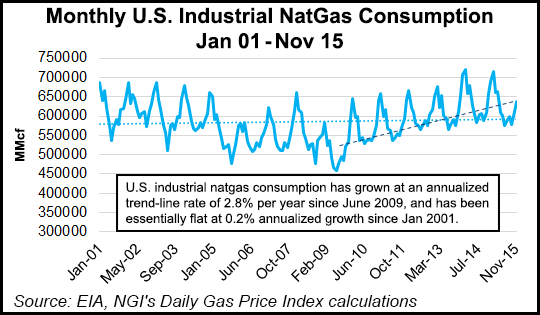

U.S. industrial demand for natural gas has failed to match expectations and lags far behind supply growth, an odious sign for natural gas prices going forward, according to Raymond James & Associates Inc.

The domestic manufacturing renaissance has for the most part disappointed investor expectations, said analyst Pavel Molchanov and his team Monday.

“One clear manifestation of that is the much slower-than-expected growth in industrial gas demand, which represents nearly 30% of overall domestic gas demand.”

Even with the meltdown in oil prices, the spread between oil and North American natural gas prices remains wide enough to support domestic industrial gas demand growth in a variety of end markets, Molchanov said. “However, as energy investors know all too well, actual demand growth has been lagging far behind supply growth for many years, as many demand-side projects have been getting pushed out or canceled altogether.”

More projects are expected to materialize through 2020, which should lead to “at least” 2.5 Bcf/d of incremental demand and in a best-case scenario, as much as 6 Bcf/d.

On industrial gas demand specifically, base demand also posted a decline in 2015, for a number of reasons. As more projects materialize from 2016 through 2020, we project at least 2.5 Bcf/d of incremental demand, and (in the best-case scenario) as much as 6 Bcf/d.

“By itself, this is certainly not enough to rebalance the oversupplied domestic gas market,” Molchanov said.

Even when more industrial demand is combined with liquefied natural gas exports, more gas-fired power generation and gas exports to Mexico, “we still envision fundamentally depressed prices for years to come. Thus, our long-term Henry Hub forecast is a below-consensus $2.50/Mcf.”

The Raymond James team has been questioned about its bullishness on an expected oil price recovery but its bearish call on natural gas. The answer is not so simple, said Molchanov.

“One obvious part of the answer is that the oil market is global, and therefore not isolated on the North American ”island.’ Another key point, though, is that the global oil market is exhibiting unmistakable signs of demand response as a result of cheap fuel.”

However, U.S. gas demand “has been a nonstop source of disappointment in recent years, no matter how low prices get.”

In part, the market can blame warm winters, but ex weather demand, the trends aren’t helpful, he said.

Raymond James has lowered its 2016 Henry Hub price forecast three times in the past six months, most recently to $2.00/Mcf, with $2.50 as a long-term average. Analysts already were seeing lower-than-expected gas exports on the horizon and less demand for gas-fired power as renewables strengthen, but industrial demand also is proving to be a bit of a dud.

“While the medium-term picture is not quite that bleak, we get more cautious each time we’re ”burnt’ by forecasting industrial demand growth right around the corner,” Molchanov said. “We think there is still an opportunity for healthy growth in industrial demand in 2017/2018, but there is no escaping the fact that we’ve had to continually cut these assumptions, and thus the bias is still to the downside.”

Disappointing demand over the past year hasn’t been limited to one industrial subsector. In all the “key” categories, Raymond James found incremental demand well below forecasts.

Projects for fertilizer, ethylene and gas-to-liquids facilities have been canceled. but the demand decline last year also was attributed to weak base demand from currently operating infrastructure.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |