Bakken Shale | E&P | NGI All News Access

North Dakota Production Falls; Low Prices Expected in Bakken Through 2016

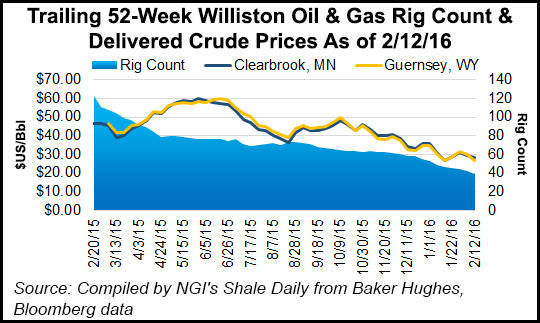

North Dakota officials on Wednesday said they expect low oil and natural gas prices to prevail throughout 2016, and said the rig count could fall by another 25%.

Based on a recent discussion with seven of the Bakken Shale’s largest oilfield service companies and pipelines, Lynn Helms, director of the Department of Mineral Resources, said the attitude of operators has shifted significantly from a year or six months ago. Operators now agree prices will be “lower and for a longer period.”

If the prices were to remain at current levels — $16.50/bbl on Wednesday for Bakken crude– North Dakota oil production may drop below 1 million b/d by the end of this year, Helms said.

Oil production fell 2.5% in December from November, hitting 35.4 million bbls (1.15 million b/d) compared to 35.7 million bbls (1.18 million b/d) in November. Natural gas stayed basically flat at 51.7 Bcf (1.670 Bcf/d) in December, compared to 50.2 Bcf (1.67 Bcf/d) in November.

Permits issued are at a seven-year low, and the rig count had fallen to 40 on Wednesday. With a continuation of current prices, another 10 or 11 rigs are expected to shut down, Helms said. The rig count at the end of last year stood at 64.

While there is still mid- and long-range optimism as evidenced by nearly 700 wells that have transferred owners to equity investment firms, Helms said the grim facts are that there are 1,183 inactive wells in the Bakken. He expects that number to continue to climb.

About 365 of the inactive wells are marginal producers (15-35 b/d). Helms said today’s price levels place a lot of stress on low-production wells. “I expect the inactive well numbers to keep going up.”

The prospects of more bankruptcies after mid-year are more real than ever, according to Helms, who noted that most bank redeterminations done twice a year on producer reserves would be recalculated by June. Unless there are significant upward trends in commodity prices, operating reserve values won’t be able to sustain current debt levels for many operators.

Helms pointed out that a year ago the Securities and Exchange Commission (SEC) required producers to value reserves at $90/bbl, and that was almost cut in half, going to $50/bbl last December. Today’s prices are substantially lower so it is expected the SEC requirement in June would also be lower.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |