E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Laredo Weathering Downturn on Lower Well Costs, Returns on Infrastructure Investments

Improved well economics and savings resulting from pipeline infrastructure investments have Permian Basin pure-play operator Laredo Petroleum Inc. ready to endure continued low commodity prices in 2016, the company told investors Wednesday.

The Tulsa-based exploration and production (E&P) company said in its fourth quarter and full-year 2015 results that it has achieved substantial savings in drilling and completion costs.

Drilling costs improved 39% year/year in 2015, while completion costs improved by 16%. Laredo said it has set its 2016 capital budget at $345 million, down from $521 million in 2015. Spending is to focus on drilling 10,000-foot lateral wells in the Upper and Middle Wolfcamp Shale in the Permian using multi-well pads that management estimated would cost roughly $5.9 million/well, a 13% reduction versus per-well costs from the second half of 2015.

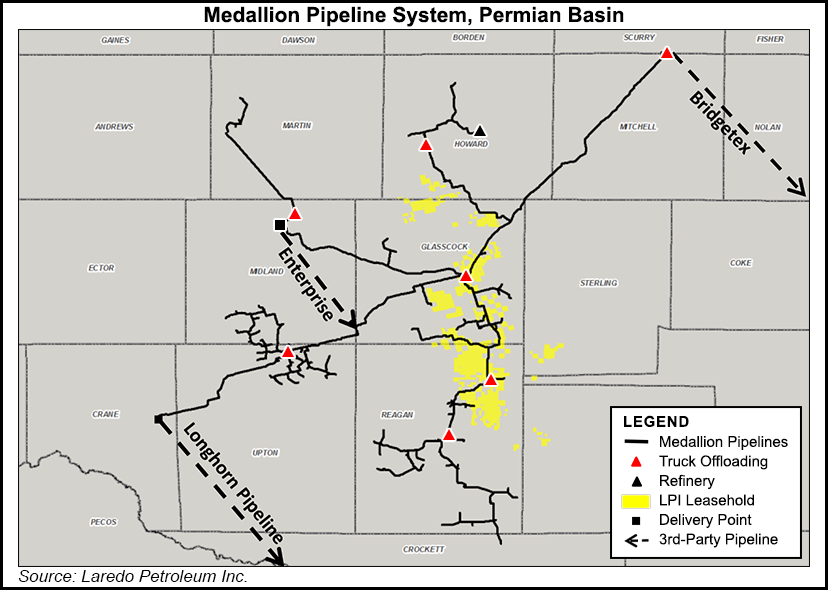

Meanwhile, Laredo’s investments in infrastructure buildout in its core operating area — including the Medallion pipeline system (49% owned by subsidiary Laredo Midstream Services LLC) and water distribution infrastructure — yielded $13 million in 2015 in reduced lease operating expenses (LOE), reduced capital costs and higher realized returns for the midstream segment. That figure is expected to increase to $21 million in 2016, the company said.

“We have invested capital in building out infrastructure on our contiguous acreage,” CEO Randy Foutch said. “Well we are now seeing the benefits of this early investment, especially in this period of depressed commodity prices.”

Midstream and marketing chief Dan Schooley said Laredo’s water treatment plant would be able to provide more than 60% of the water needed for completions in 2016. The Medallion pipeline system grew transported volumes to an average of about 69,000 b/d during 4Q2015.

“Based upon current estimates from producers, including us, we expect throughput on the system to increase from 85,000 b/d in the first quarter of 2016 to approximately 150,000 b/d by the end of the fourth quarter 2016,” Schooley said. “This volume increase is expected to be somewhat lumpy as construction projects are completed and as more of the production comes from larger, consolidated tank batteries in which multiple wells are brought online at the same time.”

Laredo’s infrastructure investments in its contiguous acreage of the Permian helped the company complete an 11-well project along a one-mile stretch of its Reagan North corridor that wrapped up in early January. The infrastructure investments helped deliver roughly 4.75 million barrels of water for the project, while Laredo’s midstream segment is currently recycling 100% of the flowback water from the wells.

Full-year 2015 production was 16.3 million boe, up from 11.7 million boe in 2014. For 2015, the company produced 7.66 million bbl of oil, 4.3 million bbl of natural gas liquids and 28.9 Bcf of natural gas.

Production guidance for 1Q2016 is 3.7-4 million boe, 48% weighted to oil. Roughly 85-90% of its projected 2016 oil volumes and 70-75% of expected 2016 natural gas volumes were hedged as of year-end 2015, management said.

Laredo is changing how it calculates its proved undeveloped reserves (PUD) “in order to maximize its flexibility to drill the highest rate of return wells” and avoid over-committing to specific drilling locations for its five-year plan. The company said it determined that limiting PUD locations to wells it plans to drill within two years “provides the most flexibility to maximize its rate of return at prevailing conditions and minimize the requirements to drill wells assigned as specific PUD locations.”

Largely reflecting downward revisions resulting from this change in approach, year-end proved reserves totaled 125.7 million boe as of Dec. 31, 2015, compared with a year-ago total of 247.3 million boe.

Laredo reported a net loss for the quarter of slightly more than $1 billion (minus $4.57/share), compared with a net income of $32.6 million ($1.42/share) a year earlier. For full-year 2015, the producer had a net loss of close to $2.5 billion (minus $11.10/share), compared with a net income of $226.4 million in 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |