Analysts Differ on Pricing Outlook; NatGas Cash, Futures Inch Higher

Physical natural gas for Thursday delivery rose modestly in Wednesday’s trading as spot pricing received something of a lift from a firming screen, and buyers shrugged off forecasts calling for elevated temperatures in the Midwest markets by week’s end. The NGI National Spot Gas Average rose 5 cents to $1.85, and gains averaging upwards of 20 cents in the East helped raise the overall average.

Futures attempted to change direction and head back to $2.00/Mcf. At the close, March had added 3.9 cents to $1.942, and April was higher by 4.2 cents to $2.011. March crude oil rose $1.62 to $30.66/bbl.

A top forecasting group sees continued natural gas price erosion.

“No reason can be seen in the fundamental outlook to expect anything but a further deterioration in spot prices for the balance of the quarter,” said New York-based Pira Energy in a report Wednesday. “Gas and power markets on both sides of the Atlantic are headed down similar paths in 2016. Storage surpluses are building, gas supply cuts are slow to emerge, and the development of greater gas use in the power sector will offer concrete stages of growth in the weeks and quarters ahead.

“While European spot and contract prices are still roughly twice the level of Henry Hub prices, both gas markets are competing for coal demand in a manner that suggests more than just a temporary emergence of substitution. Given the price difference, the U.S. market is much farther down the road, but a more structural change is underway within the power sectors of both North America and Europe that will be increasingly linked once LNG exports begin to add to gas demand in the U.S. and gas supply in Europe.”

Pira researchers said residential/commercial use “is clearly the dominant demand center for gas at this time of the year. On average, this week should be the coldest of the year, but nothing could be further from the truth at this point. Storage withdrawals remain well below normal and point toward an upcoming entrance to injection season where stocks will be above the five year average on April 1, despite showing significant deficits going into the previous winter.”

Other analysts aren’t convinced prices have much room to move lower.

“To me, the last Commitments of Traders report shows the funds are not completely sold on whether this is a bottom or not,” said Tom Saal, vice president at FC Stone Latin America LLC. “That’s probably the key. In order for the market to continue lower you are going to need aggressive selling by funds, new shorts.

“The last Commitment of Traders report showed managed money is doing more oscillation at these prices than actually adding to short positions. They are in and out and in and out. They are not showing a trend of ever increasing shorts. Their behavior shows that they are not completely sold on the trend continuing. They are not convinced the market is going a lot lower. Historically the market does not spend a lot of time below $2. I think we are near the lows.”

Tuesday overnight weather model runs showed changes in the details, but the overall picture continued. MDA Weather Services in its six- to 10-day outlook said changes in the period “were generally mixed and detailed, with the Southeast coming in colder within the second half. At that time, temperatures are forecast to fall below normal in the Southeast as low pressure tracking off the East Coast pulls in colder high pressure.

“There remains some uncertainty with the intensity of these colder temperatures with the forecast taking a blend of the often better performing ensemble models. However, operational guidance offer additional cold risk in the eastern half. Troughing south of the Aleutians will continue to feed ridging and warmth in the western half.”

Risks to the forecast included a cold air damming setup, which could leave the East colder on days seven and eight, and nearby troughing and high pressure presents colder risks in the Midwest late.

The recent cold snap in the East presented pipelines with few problems.

“Northeast production held its ground against this weekend’s cold weather, showing few signs of freeze-offs or other cold-weather related operational problems,” said industry consultant Genscape Inc. in a report. “Spring Rock daily pipe data shows total Northeast production did fall to a 14-day low on Sunday, coming in just above 22 Bcf/d. That itself was a nearly 0.3 Bcf/d drop from the day prior.

“Those declines appear to have largely taken place in Ohio (-0.2 Bcf/d DOD) with some volumes lost from West Virginia and Southwest Pennsylvania too. However, such a swing in volumes during non-weather events is fairly common, too. Pipelines published OFO warnings prior to the weekend cold snap, but no notices were issued warning of production issues.”

Next-day pricing in the Midwest mirrored the overall market. Gas for next-day delivery on Alliance rose a penny to $1.93, and gas at the Chicago Citygate added a penny as well to $1.91. Parcels on Consumers rose 3 cents to $1.96, and gas on Michigan Consolidated changed hands 2 cents higher at $1.97.

Major trading hubs eased. Gas at the Henry Hub fell a penny to $1.91, and deliveries to Opal were seen a penny lower also at $1.63. Gas on El Paso Permian was quoted 2 cents lower at $1.63, and packages at the PG&E Citygate fell 2 cents to $1.99.

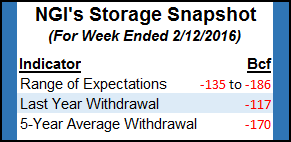

Traders Thursday will be taking a close look at the weekly storage report from the Energy Information Administration. Last year 117 Bcf was pulled from storage and the five-year pace stands at 170 Bcf. Citi Futures Perspective calculated a 160 Bcf withdrawal and Ritterbusch and Associates is looking for a 150 Bcf reduction. A Reuters survey of 20 traders and analysts showed a range of withdrawals from 139 Bcf to 186 Bcf, with an average 154 Bcf. Meanwhile, a Bloomberg survey of 14 industry experts produced a 135 Bcf to 163 Bcf withdrawal range with a median expectation of a 151 Bcf draw.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |