NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

More Pure-Play E&Ps Confronting Bankruptcy, Deloitte Finds

More than one-third of the global pure-play producers, an estimated 175 operators, face the risk of slipping into bankruptcy this year as they face fewer options than even last year, according to Deloitte LLP.

Researchers with the Deloitte Center for Energy Solutions studied financials and operating data for pure-play exploration and production (E&P) companies (excluding majors and national oil companies) between July 1, 2014 and Sept. 30, 2015, the period when oil prices began to crater. The period before the price crash, between April and June 2014, was used as the base period to compare how E&Ps are coping, which is detailed in the report issued Tuesday, “The Crude Downturn for E&Ps: One Situation, Diverse Responses.”

Many E&Ps have made sharp adjustments to keep their ships upright, but the year ahead will prove to be one of “hard decisions,” said Deloitte Vice Chairman John England, who oversees the U.S. oil and gas sector.

“Access to capital markets, bankers’ support and derivatives protection, which helped smooth an otherwise rocky road for the industry in 2015, are fast waning,” England said. “A looming capital crunch and heightened cash flow volatility suggest that 2016 will be a period of tough, new financial choices for the industry.”

The Deloitte Center in April 2015 issued “Following the Capital Trail in Oil and Gas,” which suggested ways E&Ps could cope with what were then low prices, although twice as high as today (see Daily GPI, April 15, 2015). The follow-up analysis issued Tuesday reviewed how pure-play E&Ps have prioritized over the past 18 months to navigate an increasingly hostile environment,

Researchers identified five ways that E&PS have navigated since early last year: bankruptcy, seeking financial aid, seizing opportunities through buying assets, pulling levers to correct balance sheets, and making operations more efficient through optimization.

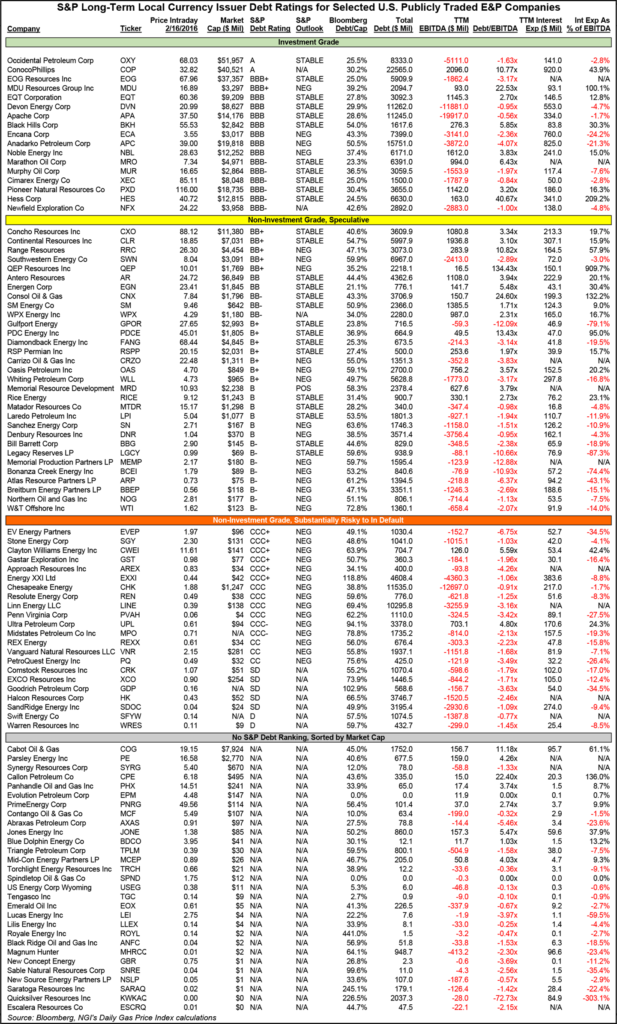

By Deloitte’s calculations, 35 U.S. E&P companies — new/old, small/large — with a cumulative debt of under $18 billion filed for bankruptcy protection (liquidation and debt restructuring) between July 1, 2014, and Dec. 31, 2015. What’s disquieting is that even though E&Ps have shown some resilience, the increase in bankruptcy filings in the second half of 2015 — 21 of 35 — and the $30 crude oil price at the start of 2016 point to a challenging year ahead.

“The probability of these companies slipping into bankruptcy is high in 2016, unless oil prices recover sharply, a large part of their debt is converted into equity, or big investors infuse liquidity into these companies,” the researchers said. “The situation is almost equally alarming for about 160 E&P companies, which are less leveraged but cash-flow constrained.”

During the oil price downturn of the Great Recession, defined by Deloitte as September 2008 through December 2009, 62 U.S.-based E&Ps filed for bankruptcy, almost 1.75 times the number today. More access to capital, hedge protections at favorable prices, and a focus on costs after natural gas prices slumped in 2012 have helped the producers withstand today’s weak environment — until now.

Since the price crash, global E&Ps have saved or raised an estimated $130 billion, with two-thirds of the savings achieved from measures not related to capital expenditures (capex), such as through asset sales and by issuing equity. However, property sales and issuing equity now are coming at much lower prices. That gives E&Ps only a few other options, such as cutting dividends and share buybacks.

With fewer financial levers to pull this year, the key to survival is through operational performance, England said.

“There is still more that can be done by oil players, particularly large ones, to reduce costs. Prices will eventually rebound and companies need to focus not only how to survive, but also how to position themselves to thrive for when things turn around and demand picks up.”

Cutting costs have provided a big uplift over the past 18 months.

About 95% of the production costs of U.S. players, including lease operating expenses and production taxes, have fallen below $15/boe, versus 65% pre-price crash. Current breakeven prices and near-term cash flow should give way to the future return on capital employed, or the ROCE potential of the industry.

“As the industry improves performance on costs/efficiency, its future emphasis will not be about its ability to make profits at low prices, but generating sufficient ROCE on a large base of devalued investments made in the past,” the Deloitte report said.

Overall, economies of scale and scope “appear to be benefiting natural gas players more, reflected in the widening gap between large and small gas-heavy companies and marginal cost differentiation between large and small oil-heavy players.”

Spending cuts in 2015 and 2016 would mark the first time capex has been reduced for two consecutive years, which likely is going to have a “substantial and long-lasting impact” on future oil and gas supplies and “open new chapters in the geopolitics of oil.”

E&Ps also risk slowing the conversion of resources to reserves in frontier locations and reducing capex required to maintain aging fields and facilities, the researchers said.

Future merger and acquisition activity “will most likely go beyond the typical buying reasons of the past,” with a preference for buying oil-heavy assets and buying for growth and scale, according to Deloitte. Prioritizing returns over size, with balanced and flexible production profiles, likely are going to prove a key to E&Ps thriving once prices improve.

“There is no silver bullet solution that applies to the whole industry,” said Deloitte Center Executive Director Andrew Slaughter. “Each company has its own set of unique factors to consider — from issues specific to each producing region and asset, to various states of financial circumstances. Staying solvent will require the same level of perseverance, innovative thinking and creativity as the technology breakthroughs that led to the boom in supply we have seen over recent years.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |