E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Cuts Another 30 Rigs; About 400 to Be Bottom, Analysts Say

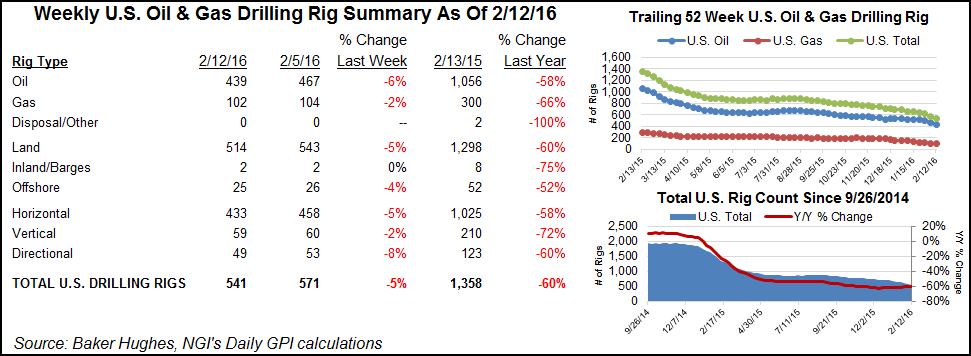

North American energy patch retrenchment continued with the withdrawal of 50 rigs from service in the United States and Canada, according to the Baker Hughes Inc. tally released Friday (Feb. 12).

The United States dropped 30 rigs to end at 541. Twenty-eight U.S. oil rigs left, and two natural gas rigs departed. The U.S. gas rig count is hovering just above 100 at 102. The oil count stands at 439. Of departing rigs in the United States, 25 were horizontals, while four directionals and one vertical rig left. All but one of the U.S. rigs departing had been working onshore.

Canada lost 20 rigs to close the week at 222. Thirteen oil rigs left to bring that count to 118, and seven Canadian gas rigs departed, leaving 104.

There are now 977 fewer rigs running in North America than one year ago; 817 of the departed left U.S. activity. U.S. oil rigs are down by 617, and gas rigs are down by 198. In Canada, 80 oil and 80 gas rigs have left in the last year.

As has been the norm lately, Texas took the hardest hit, losing 14 rigs, with the Permian Basin leading the declines among plays with the departure of eight rigs. Permitting and completions in the Lone Star State continue to be off sharply from year-ago tallies.

In January, the Railroad Commission of Texas (RRC) issued 510 original drilling permits compared to 1,102 in January 2015. The latest total included 425 for new oil/gas wells, five to re-enter plugged well bores and 80 for re-completions. The total was composed of permits for 141 oil, 41 natural gas, 282 oil or gas, 35 injection, two service and nine other wells.

Also in January, RRC staff processed 951 oil, 197 natural gas, 52 injection and four other completions, compared to 1,450 oil, 344 natural gas, 198 injection and five other completions in January 2015. Well completions year to date stand at 1,204, down from 1,997 recorded during the same period in 2015, according to the RRC.

There’s more pain to come for drilling and service companies as the industry continues to right an out-of-balance market, analysts said.

“…[W]e expect the rig count to continue falling over the next couple of months, bottoming in April at around 400 rigs [in the United States],” analysts at Raymond James said following the previous rig count release, which saw the U.S. drop 48 rigs (see Daily GPI, Feb. 5). “More importantly, we do not expect a meaningful ramp up in U.S. drilling activity until late 2016…”

Raymond James said companies will draw down on their inventories of uncompleted wells before deploying more rigs, and the injured among them will be repairing balance sheets before returning to the field. Also, Raymond James said, the industry will wait until higher prices are “established” before returning to activity.

That’s also what EOG Resources Inc. CEO Bill Thomas said in Houston at the deal-making NAPE Summit Business Conference. “…[W]e’re not going to be ramping up production the first time oil hits $60,” he said. “We’re going to make sure the market is in good shape and it’s balanced…The industry kind of tried that last year and it didn’t work [see Shale Daily, Feb. 11].”

In the weeks ahead, there will be blood, Wunderlich Securities Inc. said.

“…[W]e do see some positives in much lower capex budgets beginning to trickle out, declining production guidance, and restructuring/bankruptcies are beginning to become more apparent. These are all painful drivers that should help us bottom out, but we are still awaiting that process; and the next few weeks likely will bring pain as earnings reports should be ugly, guidance worsens and a backdrop of restructurings/bankruptcies emerges.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |