Markets | NGI All News Access | NGI Data

Cash NatGas Slides, Futures Weaken After Storage Data; March Sub-$2

Gas for Friday delivery weakened in trading Thursday as most traders hunkered down and got deals done before the release of Energy Information Administration (EIA) inventory data.

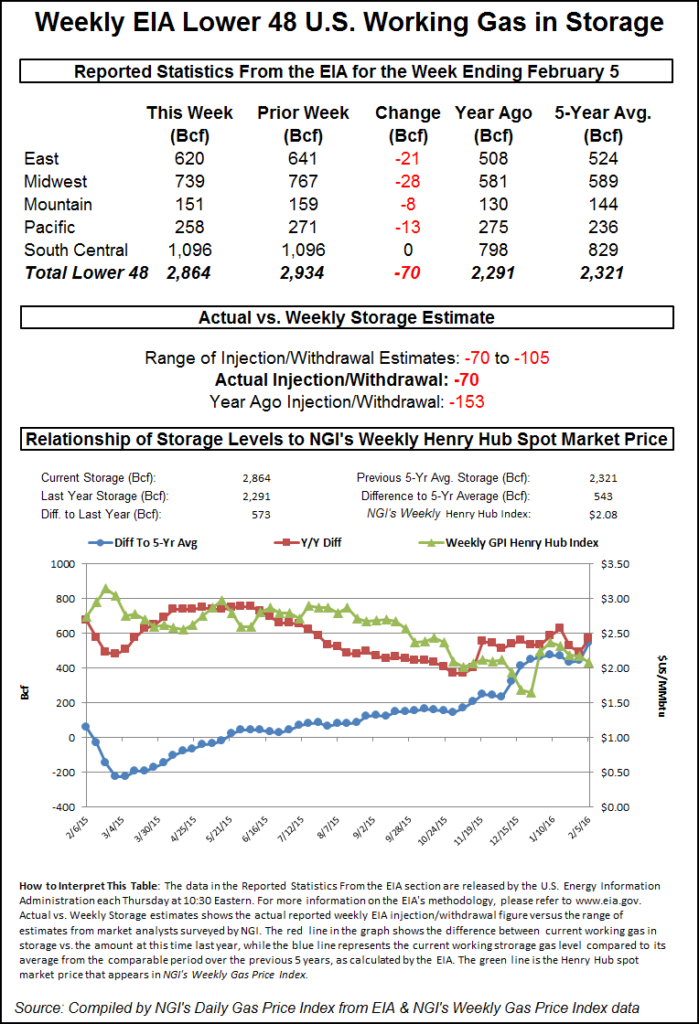

Most points were off a few pennies, and the NGI National Spot Gas Average fell 6 cents to $2.32. The EIA reported a withdrawal of 70 Bcf, well below estimates about 10 Bcf more. At first the spot March contract eased just a couple of cents, but at the closing bell March had retreated 5.2 cents to $1.994 and April had weakened 5.0 cents to $2.061. March crude oil continued its losing streak and dropped $1.24 to $26.21/bbl.

The modest storage build raised the year-on-five-year surplus to a whopping 543 Bcf, and the mild El Nino-driven winter has been a large component of that surplus. Take away weather, however, and analysts see an underlying increase in demand that may be just what the doctor ordered to help rebalance the market.

“If we normalize overall demand by taking weather out of the picture, total demand this winter to date has been running at an average 7.4 Bcf/d higher than historical models indicate at the same temperatures,” said RBN Energy in a Thursday morning report. “Without this underlying growth in demand, the impact of warmer winter weather on the gas surplus this year would be far more pronounced. While this underlying growth hasn’t been enough to offset the mild winter, it should be a key factor in tightening the supply-demand balance during the remainder of 2016.”

RBN calculates lower demand by 4.4 Bcf/d, and that combined with 0.7-Bcf/d lower total supply so far this winter, “add up to a balance that is a net 3.7 Bcf/d higher supply this winter versus last. “[L]ast week’s EIA storage report showed a 600 Bcf surplus to last year’s level at this time. Based on [Thursday’s] 15-day weather forecasts, our forward storage estimates show the surplus growing over the next three weeks to nearly 800 Bcf above year-ago levels and more than 600 Bcf above the five-year average.

“Assuming 30-year normal weather beyond the 15-day weather forecasts, we would expect the gas inventory to bottom out at just above 2,100 Bcf in the March/April time frame, still carrying a 600 Bcf surplus to last year. As a result of this continued surplus growth through what should be the coldest, highest demand months of the year, recent futures contracts have expired at the lowest prices in more than a decade — close to $2/MMBtu.

Futures traders see limited downside in the near term. “I think we’ll test a little bit lower. About 10 cents to 15 cents lower is probably a bottom, and I thought prices would come off a bit more than they did. I was thinking more like a dime,” a New York floor trader told NGI. “I look for some buying in the mid-$1.80s.”

Going into the storage report analysts were keeping their fingers crossed. February storage is always tricky, said John Sodergreen, editor of Energy Metro Desk (EMD). “We see a low baller bias this week, upper-mid-to-late-70s [Bcf] should be right. Our bank analyst category had a median forecast of -76 Bcf, and the independent analyst category was at -78 Bcf. The pattern in EIA reports over the past couple months against weather HDD patterns shows a high-low-low-high sort of pattern. That said, this week is due a low baller. As we were saying… Not terribly scientific.”

The EMD model predicted an 83 Bcf pull, but the EMD survey resulted in an average 80 Bcf draw.

Last year 154 Bcf was withdrawn, and the five-year pace stands at 167 Bcf. ICAP Energy calculated a 77 Bcf withdrawal, and Citi Futures Perspective was looking for a 98 Bcf decline. A Reuters survey of 23 traders and analysts revealed an average -82 Bcf with a range from -70 to -105 Bcf.

Once the number hit trading screens at 10:30 EST March futures fell to a low of $2.002 and by 10:45 a.m. March was trading at $2.005, down 4.1 cents from Wednesday’s settlement.

“Nothing has really changed. It’s $2 on the downside and $2.25 on the upside,” said a New York floor trader. “We were trading about $2.02 before the number came out, so the report pushed the market lower by a couple of pennies.”

“The net withdrawal of 70 Bcf was bearish relative to market expectations,” said Tim Evans of Citi Futures Perspective. “This was a second consecutive bearish miss, suggesting that the background supply-demand balance has weakened. There may have also been a greater sensitivity to last week’s warm temperatures than forecast. Either way, it’s a bearish result.”

Inventories now stand at 2,864 Bcf and are a whopping 573 Bcf greater than last year and 543 Bcf more than the five-year average. In the East Region 21 Bcf was pulled, and the Midwest Region saw inventories fall by 28 Bcf. Stocks in the Mountain Region were down by 8 Bcf, and the Pacific Region was lower by 13 Bcf.

Weather forecasts overnight drifted warmer. WSI Corp. in its Thursday morning report said, “[Thursday’s] six-10 day forecast depicts a warming trend and widespread above average temperatures. Anomalies are forecast to range 5-15+ across the Rockies and central U.S. Today’s forecast is generally a bit colder over the Upper Midwest to the Northeast, but a bit warmer elsewhere. CONUS GWHDDs are up 0.4 and are forecast to be 104.7 for the period. Forecast confidence is average today as models are in reasonably good agreement with a moderating trend and pattern shift.

“However, there remain differences with the timing and details with frontal systems. The details with frontal systems are key, but a prevailing eastern U.S. trough supports a slight risk to the cooler side early in the period. The West Coast also has a slight downside risk.”

In the physical market next-day gas at eastern points weakened amidst a mixed power environment. Intercontinental Exchange reported next-day power at the PJM West terminal fell $1.52 to $39.98/MWh but on-peak Friday power at the ISO New England’s Massachusetts Hub rose $3.55 to $55.27/MWh. In western New York on-peak power for Friday delivery at NYISO A gained $6.50 to $27.50 and next-day on peak power at the Indiana Hub fell $4.16 to $27.42/MWh.

Gas for delivery Friday at Texas Eastern M-3, Delivery fell 72 cents to $3.97, and gas bound for New York City on Transco Zone 6 slipped 57 cents to $5.42.

Marcellus gas softened as well. Gas on Dominion South fell 18 cents to $1.35, and deliveries to Tennessee Zn 4 Marcellus shed 2 cents to $1.20. Gas on Transco-Leidy Line came in 10 cents lower at $1.22.

Price movement at major hubs was more benign. At the Chicago Citygate Friday packages were quoted a penny lower at $2.16, and gas at the Henry Hub shed a penny as well to $2.12. Gas on El Paso Permian changed hands down a penny at $1.88 and gas delivered at the SoCal Border Avg. Average price retreated a nickel to $1.95.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |