E&P | LNG | NGI All News Access

Kenai, AK, LNG Reauthorized as Utilities Buy Stake in Area Gas Field

The U.S. Department of Energy has reauthorized exports of liquefied natural gas (LNG) from the ConocoPhillips Alaska Natural Gas Corp. (CPANGC) export terminal at Kenai, AK. Meanwhile, two area utilities have taken a stake in the producer’s Beluga River Unit (BRU) in order to secure natural gas supply for their customers.

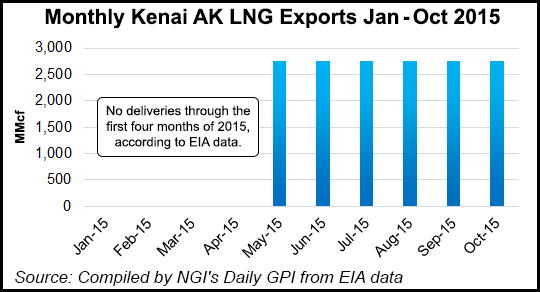

Last November, CPANGC sought free trade agreement (FTA) and non-FTA export authorization for up to the equivalent of 40 Bcf of LNG for a period of two years beginning Feb. 19, 2016 (see Daily GPI, Nov. 16, 2015). The Kenai LNG facility has exported LNG for almost 50 years under multiple export authorizations over that period.

“As projects get under way in the rest of the nation, and planning continues for an even larger [LNG] project here in the state, we should remember that Kenai set the precedent for the historic buildout of export capability now under way in North America,” said U.S. Sen. Lisa Murkowski (R-AK). Murkowski has been a proponent of the Alaska LNG and pipeline project, which would commercialize North Slope natural gas reserves via export as LNG, particularly to Asian markets.

“Receipt of an export authorization ensures the flexibility necessary to pursue an export program if local gas supply and market conditions support LNG exports,” a ConocoPhillips spokesperson said in an email. “We’re still evaluating whether or not to pursue an export program this year. The Kenai LNG export program supports local gas supply needs by providing an important market for excess Cook Inlet gas, which encourages exploration and drilling in the inlet.”

Separately, Cook Inlet area utilities Municipal Light & Power (ML&P) and Chugach Electric Association have bought a one-third interest in the BRU natural gas field in the Cook Inlet. The agreement transfers 70% ownership of the stake to ML&P and 30% ownership to Chugach. The total purchase price is $152 million.

ML&P, which is owned by the Municipality of Anchorage, already owns one-third of the BRU gas field after buying the interest in 1996. Since then, ratepayers have saved an estimated $239 million on gas costs, according to the utility. “ML&P’s initial investment in the Beluga River gas field proved to be highly beneficial to our ratepayers,” said ML&P General Manager Mark Johnston. “We were glad to partner with Chugach to spread the financial benefits and energy security of gas ownership to more Anchorage families and businesses.”

ML&P and Chugach said they expect the BRU stake to supply “a significant portion” of the utilities’ gas needs over the next 10 years while saving the residents of Anchorage millions during the same period. In 2018, under currently signed contracts, Chugach will pay $7.53/Mcf and ML&P will pay $8.78/Mcf of purchased gas. ML&P’s current cost of producing gas from BRU is $4.35/Mcf.

ML&P will now own 56.67% of the overall BRU, Hilcorp will own 33.33% and Chugach will own 10%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |