Markets | NGI All News Access | NGI Data

Cash NatGas Boosted by Strong East, While Futures Traders Mull Lean Storage Pull; March Loses 7 Cents

Physical natural gas traders were reluctant Thursday to make deals after the release of Energy Information Administration (EIA) storage data, and, with the exception of the Northeast, gas for Friday delivery at all points moved lower.

A few points were unchanged. The NGI National Spot Gas Average, however, rose by 2 cents to $1.97, aided and abetted by a surge in the Northeast averaging about 25 cents. Futures prices at first moved nominally lower following the release of storage data showing a draw of 152 Bcf, somewhat thinner than expected, but at the close bears were in full control as March fell 6.6 cents to $1.972 and April shed 6.1 cents to $2.062. March crude oil fell 56 cents to $31.72/bbl.

The day’s principal price driver was the 10:30 a.m. release of weekly storage statistics by the EIA, with most forecasters expecting the number to be in the upper 150 Bcf area.

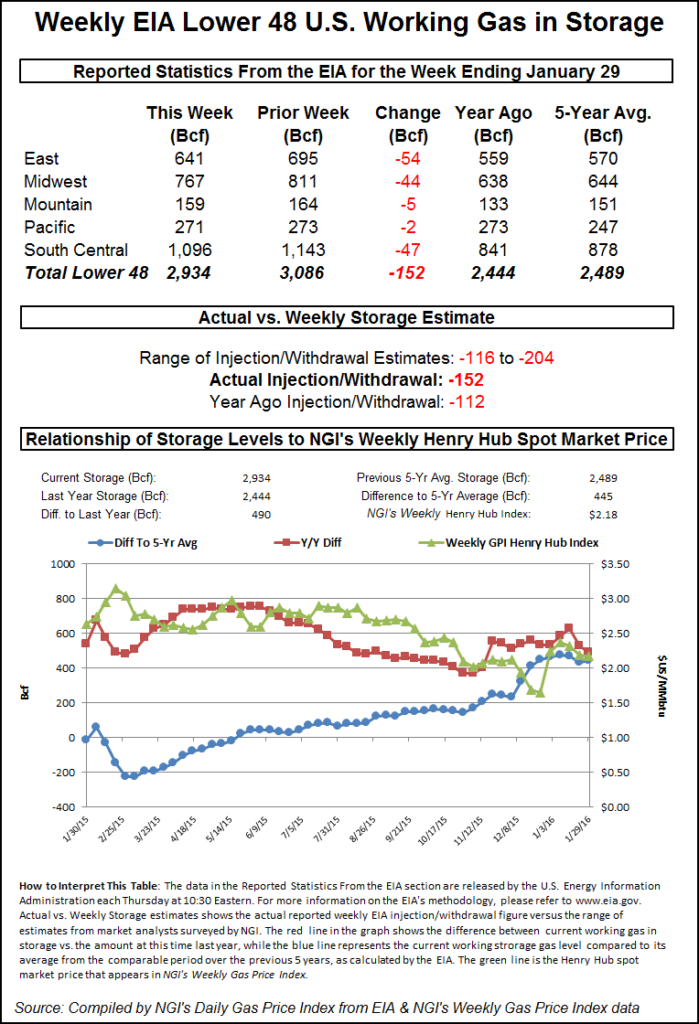

Before the numbers were released, IAF Advisors was looking for a pull of 150 Bcf, and a Reuters survey of 23 traders and analysts showed a range from -116 to -202 Bcf with an average -158 Bcf. Last year, 112 Bcf was withdrawn and the five-year average is for a 165 Bcf pull.

March futures fell to a low of $1.984 following the storage report, and by 10:45 a.m. March was trading at $2.015, down 2.3 cents from Wednesday’s settlement.

Analysts suggested that the eastern snow of last week may have forced a one-time “low” withdrawal.

Tim Evans of Citi Futures Perspective said it looked like the decline in industrial demand from the major East Coast snowstorm Jan. 22-23 “may have helped limit withdrawals for last week. If so, that’s a one-off change that may not indicate a weakening of the underlying supply-demand balance. However, we’d still say this is a bearish result, further reducing the chances that storage levels tighten this winter.”

With Thursday’s settlement at $1.972, the stage may be set for further declines.

“We have to see if this trades under $2 and settles under $2 for a couple of days,” a New York floor trader told NGI. “If we settle above $2, maybe we get a little bounce back.”

Inventories now stand at 2,934 Bcf and are 490 Bcf higher than last year and 445 Bcf more than the five-year average. In the East Region, 54 Bcf was pulled, and the Midwest Region saw inventories fall by 44 Bcf. Stocks in the Mountain Region were down by 5 Bcf, and the Pacific Region was lower by 2 Bcf. The South Central Region shed 47 Bcf.

Weather forecasts Wednesday overnight were only slightly cooler, with heating load estimates in the near term close to Wednesday’s estimates.

WSI Corp. in its Thursday morning report said Thursday’s “six-10 day period forecast is a little colder over the East, not as warm along the West Coast, but warmer” over portions of the central United States. “GWHDDs are up 0.3 and are now forecast to be 145.4 for the period. Forecast confidence is average at best…as models appear to be gradually converging on a solution and two cold shots. However, there remain key differences with the magnitude and scope of the cold over the East.

“Once again, the forecast over the eastern two-thirds of the nation has room to waver in either direction, especially during the end of the period. The north-central and eastern U.S. have the most risk to the colder side.”

Physical prices at major trading hubs mirrored the market as a whole, with losses of a few pennies. Gas at the Henry Hub retreated a penny to $2.05, and deliveries at the Chicago Citygate also were seen a penny lower at $2.06. Gas at Opal fell 5 cents to $1.96, and packages at the PG&E Citygate were quoted a nickel lower at $2.22.

In the Northeast, however, a strong power price environment aided the case for incremental gas purchases for power generation. Intercontinental Exchange reported on-peak Friday power at the ISO New England’s Massachusetts Hub rose $6.51 to $28.69, and on-peak power at the PJM West terminal gained $3.46 to $29.08.

Gas at the Algonquin Citygate jumped $1.02 to $2.92, and deliveries to Iroquois, Waddington added a dime to $2.18. Deliveries to Tenn Zone 6 200L changed hands 82 cents higher at $2.75.

Gas on Texas Eastern M-3, Delivery was seen 6 cents higher at $1.56, while gas bound for New York City on Transco Zone 6 scooted higher by 28 cents to $2.07.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |