Tidewater Pays C$90.3M For AltaGas NatGas Processing Plants in Alberta’s Deep Basin

Tidewater Midstream and Infrastructure Ltd. plans to acquire eight natural gas processing facilities and related infrastructure in Alberta’s Deep Basin from two subsidiaries of AltaGas Ltd. in a cash-and-stock deal valued at C$90.3 million ($65.4 million).

On Tuesday, Calgary-based Tidewater said it would acquire a 100% working interest (WI) in the facilities in Windfall/Kaybob, Marlboro/Edson, Alder Flats, Gilby, Manola, Bonnie Glenn, Malmo and Sylvan Lake, as well as more than 2,000 kilometers (1,243 miles) of gathering lines and other associated infrastructure.

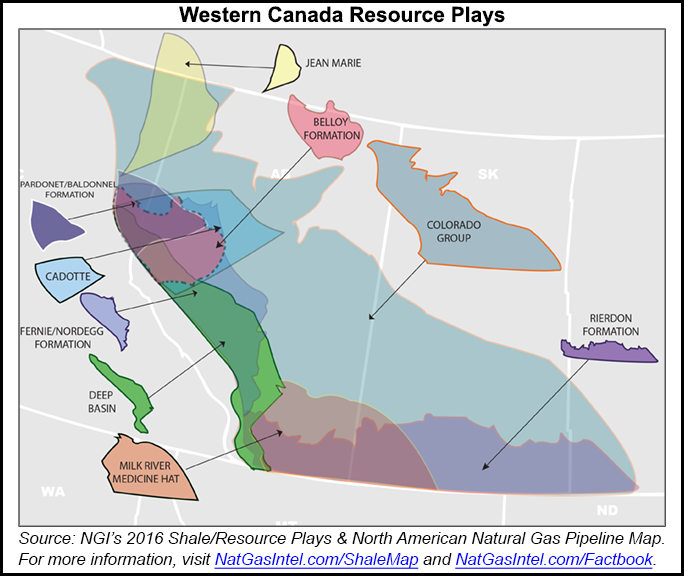

Tidewater CEO Joel MacLeod said the acquisition was consistent with the company’s strategy of capitalizing on Canadian natural gas liquids (NGL) market opportunities within the Deep Basin.

“The acquisition of strategic midstream infrastructure allows [us] to capture the value of infrastructure connectivity and offer additional options to producers,” MacLeod said. “The majority of the earnings from the acquired assets [is] derived from our strategic Deep Basin core area and will be highly synergistic with our existing BRC assets, allowing [us] the opportunity to optimize the currently under-utilized plants being acquired and further build out our natural gas and NGL network.”

The eight facilities being acquired near Tidewater’s Brazeau River Complex have a combined processing capacity of 490 MMcf/d and current throughput of 102 MMcf/d. Most of the facilities are also within Tidewater’s core West Pembina region.

Under the deal, Tidewater would issue 43.7 million of its common shares to Calgary-based AltaGas and pay C$30 million ($21.7 million) in cash, funded through cash on hand and debt. Shares of Tidewater were trading at C$1.38/share ($1.00/share) at mid-day on Canada’s TSX Venture (TSX-V) Exchange on Wednesday. At that rate, the stock part of the deal would be valued at C$60.3 million ($43.7 million).

The deal is expected to close during the first quarter subject to customary closing conditions. Approval from the TSX-V is also required. Upon closing, AltaGas would hold about a 19.9% stake in Tidewater and have the right to nominate one member to Tidewater’s board of directors. AltaGas has also agreed to a standstill agreement and would not acquire additional Tidewater common shares, basically not increasing its ownership interest above 19.9%, without the consent of Tidewater.

Tidewater management said it plans to continue drilling in the Deep Basin to increase throughput and utilization rates at its core facilities. The company said the utilization rates from the acquired Deep Basin plants average about 35%.

In a separate announcement Tuesday, AltaGas said the sale involved AltaGas Northcentral Processing LP, which contains some noncore gas gathering and processing assets. The partnership is owned by two of its subsidiaries, AltaGas Processing Partnership and AltaGas Holdings Inc.

“The sale of these assets aligns with AltaGas’ strategy to focus on operating and optimizing our larger plants and developing larger scale opportunities as part of our northeast British Columbia strategy,” said AltaGas CEO David Cornhill (see Shale Daily, Dec. 24, 2015). “Moving forward, AltaGas and Tidewater have agreed to work together to identify additional opportunities that could enhance value for each company’s respective producer customers and shareholders.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |