Permian Basin | NGI All News Access | NGI The Weekly Gas Market Report

Permian-Focused Callon to Target Lower Spraberry in 2016

Permian Basin-focused Callon Petroleum Co. said it will drop one of its two drilling rigs during the first quarter of 2016 and will cut operational capital expenditures (capex) for the year in half, but the independent exploration and production (E&P) company plans to increase production and be cash flow neutral by the middle of the year.

Meanwhile, the Natchez, MS-based company said it has also recently completed the acquisition of an additional 4.9% working interest (WI) — as well as a 3.7% net revenue interest — over more than 300 net acres in its Casselman and Bohannon (CaBo) fields for $9.3 million. The properties are primarily in Midland County, TX.

In an operational update Monday, Callon said it plans to spend $75-80 million on capex, including drilling and completion costs. That’s about half of the operational capex budget of $150-165 million the company announced a year ago, for 2015.

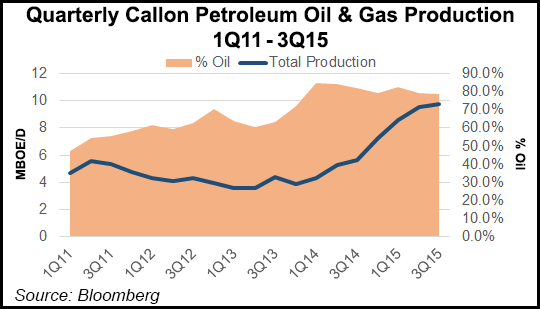

Callon said it expects 4Q2015 net daily production to range from 10,500-10,700 boe/d — of which 79-81% would be oil — and expects lease operating expenses for the quarter to range from $6.40-6.60/boe. But the company said it forecasts 2016 net daily production will range from 11,500-12,000 boe/d (78-80% oil), up from the production guidance of 8,000-8,400 boe/d it issued a year ago for 2015.

The independent also said its estimated total proved reserves was 54.3 million boe at the end of 2015, a 65% increase over the previous year-end (32.8 million boe). The most recent proved reserves include 80% oil and 53% proved developed volumes. Callon said the PV-10 (present value of net estimated future revenues, discounted at an annual discount rate of 10%) value of its proved reserves decreased approximately 9% over the same time frame (from $629.7 million to $570.9 million).

Nearly all of the $75-80 million the company plans to spend on capex in 2016 will be devoted to the Lower Spraberry formation. Callon said it plans to put 19 gross (13.7 net) operated horizontal wells into production in 2016. Of those, 17 gross (12.6 net) wells will target the Lower Spraberry and two gross (1.1 net) wells will target the Wolfcamp B interval. The E&P said all of the wells will be completed from pads ranging from two to three wells.

The E&P will also place two gross (0.4 net) non-operated horizontal wells into production in 2016. The wells will target the Lower Spraberry and the Wolfcamp A interval in Midland County.

Callon said it has the option of returning the second drilling rig to service, but it also has the option of terminating the rig contract. A decision to do the latter would incur a declining payment schedule of approximately $4.5 million.

“We delivered exceptional operational results in 2015 while pivoting our focus to our highest return investment opportunities in a difficult commodity environment,” CEO Fred Callon said Monday. He later added that the company would retain “the option to quickly redeploy the second rig to either our existing acreage or new acreage related to an acquisition opportunity.

“Based on current strip pricing and operational assumptions, we believe that Callon is on target to achieve our goal of being net cash flow neutral by mid-year 2016 while delivering economic growth above our 4Q2015 production rate.”

Six horizontal wells — four targeting the Lower Spraberry and one the Middle Spraberry in Midland County, plus one well targeting the Lower Wolfcamp B in Reagan County, TX — achieved peak production during 4Q2015. Callon is currently producing from 83 horizontal wells.

“With the recent Lower Spraberry activity, Callon continues to add to its portfolio of wells producing from this horizontal zone and refine its projections of estimated ultimate recoveries [EURs],” the company said. “Based on observations to date, the performance of Lower Spraberry wells in the Central Midland Basin has been tracking a type curve — normalized for 7,500-foot drilled lateral length — that is in excess of 1 million boe of gross production over the life of the well.”

The company said it has been able to secure well reduction costs over the last several months. Coupled with current type curve estimates in the Lower Spraberry, Callon said internal rates of return at current strip prices are exceeding 30% for 5,000-foot laterals, and are more than 35% for 9,000-foot laterals. The 5,000- and 9,000-foot laterals are the two types of horizontal lateral lengths the company plans to deploy in 2016.

Callon said the recently completed acquisition of 305 net acres in the CaBo fields had estimated net daily production of 170 boe/d (75% oil) in December 2015. That figure includes production from three established horizontal zones in the Lower Spraberry, the Middle Spraberry and the Wolfcamp B, as well as some legacy vertical production. The acquisition gives Callon a 71.3% WI (53.5% net revenue interest) in the CaBo fields.

Callon will host a conference call to discuss 4Q2015 and full-year 2015 financial and operating results on March 3 at 8:00 a.m. CST.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |