Bakken Shale | NGI All News Access

North Dakota Governor Slashes Budget Due to Low Oil Prices

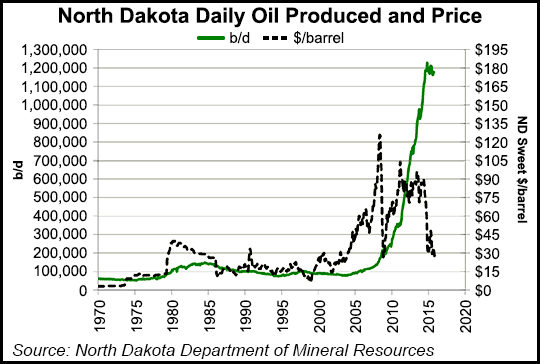

Responding to a $1 billion budget shortfall attributed to the crude oil price crash, North Dakota Gov. Jack Dalrymple on Monday ordered across-the-board cuts for state agencies and dipped into the state’s reserve funds.

A record-high two-year budget of $14.4 billion, effective last July 1 was built on much higher oil prices, and its has crashed on the fall of those prices.

Dalrymple said the decline in oil prices and the assumptions supporting the budget have fallen to a “much greater extent than anyone would have predicted.” After 15 years of mostly relentless good news and growth, the Republican governor, who is not running for re-election, told a meeting of state agency officials it is hard to come to grips with the fact that the situation has reversed itself so quickly.

Dalrymple ordered state agencies, including universities, to cut their budgets by 4.05%, a move estimated to save the state $245 million. In addition, he plans to take nearly $500 million from the reserves, or Budget Stabilization Fund, the surplus built on the good years of robust oil production and profits that vaulted North Dakota into the position of the nation’s second-biggest oil producer (see Shale Daily, May 17, 2012).

Dalrymple said the backup fund will be depleted to $75 million, and he will be only the third governor in the state to tap the fund. Previously, it was raided in the 1980s and 2002.

The rest of the billion-dollar shortfall will be made up with a previously anticipated ending-fund balance of about $331 million, according to a report on the governor’s presentation by the Associated Press in Bismarck, ND.

State budget officials have told local news media, however, that North Dakota has plenty of financial cushion, including about $875 million in surplus cash in various reserve accounts. That doesn’t include the oil tax-funded “Legacy Fund” with its more than $3.5 billion. The fund was approved by voters in 2010 and receives 30% of the state’s oil tax collections, but none of the money can be spent until 2017.

In April 2015, as part of the tax package signed by Dalrymple, a so-called large trigger for the oil/gas industry in response to sustained low oil prices that would have amounted to a multi-billion-dollar savings for the industry over the next two years was eliminated. It could have meant substantial cuts in state revenues that stakeholders agreed would not be good for the industry or the state.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |