NGI Archives | NGI All News Access

Storage, Supportive Weather Outlooks Lift March NatGas Forward Prices

March natural gas prices climbed as much as 5 cents during the last week of January as storage news and weather forecasts provided a double dose of support for markets, NGI’s Forward Lookdata shows.

The Nymex March contract, which moved into the prompt-month position on Jan. 28, settled 4.1 cents higher between Jan. 22 and 28.

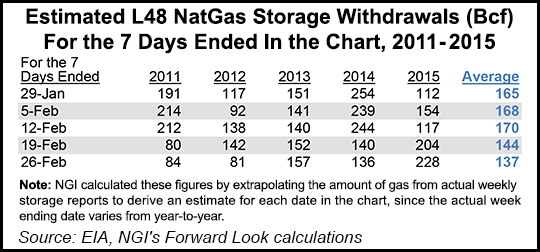

The strength, albeit modest, comes as the U.S. Energy Information Administration recently reported the largest natural gas storage withdrawal of the winter season so far.

The EIA reported a 211 Bcf draw from storage for the week ending Jan. 22, which was slightly above market expectations of around 207 Bcf.

Despite the large pull, inventories remain well above historical averages, roughly 21% above year-ago levels and about 16% above the five-year average.

But if current weather outlooks are any indication, storage stocks could be due for a few more large pulls before the winter season is over.

The latest weather data shows a powerful winter storm moving across the southern Plains during the week, with strong thunderstorms expected ahead of the cold front over the South and Southeast, and heavy snowfall into the colder air across the Plains and Midwest.

“What’s most important about next week’s system is it will again tap into frigid Polar air over Canada on the back side and drive it deep into Texas and the South, with hard freezes before advancing across the eastern U.S. late in the week,” forecasters with NatGasWeather said.

“This will bring a return to below-normal temperatures across many regions and stronger-than-normal natgas demand late Wednesday through Sunday,” the forecaster said.

The most recent weather data also has become more convincing in regard to weather beyond the first week of February.

“This has the potential to lead to potentially another approximately 200+ Bcf draw, if not very close. Over the weekend break, I expect weather patterns will have better chances of staying colder than warmer, but always with risk,” NatGasWeather said.

Indeed, it will take a very cold February and March in order to keep the current price rally afloat, as truly cold temperatures are necessary to warrant storage withdrawals big enough to pull end-of-season supplies down below 2 Tcf, according to Andrea Paltrinieri, a professor of finance working in conjunction with NatGasWeather.

Meanwhile, New England natural gas prices further out the curve got some support as the colder end to winter combined with maintenance scheduled to begin this spring.

Algonquin Gas Transmission citygates April fixed prices jumped 13.4 cents from Jan. 22 to 28 to reach $3.10, according to Forward Look. The balance of summer (May-October) rose 4.7 cents to $2.835.

Most other gas markets slipped a few cents for the same packages.

Algonquin’s strength comes as the pipeline is set to begin work at several compressor stations along its system, including the constrained Stony Point and Cromwell compressor stations.

AGT’s Burrillville and Oxford compressor stations are also included in the maintenance outage, which is expected to last until the end of October and will restrict capacity at these stations to varying degrees during that time.

A notice on the pipeline’s website said interruptions are expected to affect interruptible, secondary and primary firm services.

Meanwhile, some West Coast markets moved against the pack as prices along those forward curves fell slightly on the return of the DC intertie between the Bonneville Power Administration and the California ISO power grids.

The return of the DC intertie cuts into gas demand from power burn.

The Northwest Pipeline-Sumas March fixed price slipped 2.8 cents between Jan. 22 and 28 to reach $1.80, while April was down 8.8 cents to $1.61, Forward Look data shows. The balance of summer (May-October) fell 4.4 cents to $1.77.

At the Pacific Gas & Electric citygates, March dropped 5.9 cents to $2.44, April slid 7.8 cents to $2.40 and the balance of summer fell 8.4 cents to $2.60.

Southern California March prices were down 2.4 cents from Jan. 22 to 28 to reach $2.08, while April was generally flat at $2.05. The balance of summer (May-October), however, fell 6.3 cents to $2.35.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |