NatGas Cash Values Drop; Futures Yawn Despite First 200-Plus Bcf Withdrawal

Moderating temperatures across much of the country proved more than a match for an already priced-in 200-plus Bcf storage withdrawal report as physical prices for natural gas delivery Friday through Sunday dropped across the board on Thursday.

The natural gas futures market was similarly unimpressed with Thursday morning’s storage report, which revealed that 211 Bcf was removed from underground storage for the week ending Jan. 22.

While the season’s first 200-plus Bcf draw was significantly larger than historical comparisons for the week, many analysts and traders had a pretty good bead on what the Energy Information Administration (EIA) report would show. As a result, the March natural gas futures contract in its first regular session action as the prompt month had a muted response. Despite no reaction following the report, front-month futures went on to notch a seventh consecutive regular session gain, finishing at $2.182, up 2.5 cents from Wednesday’s regular session close.

In the minutes prior to the 10:30 a.m. EST report release, the March contract was trading at $2.111. Immediately after the report, the prompt-month contract hovered around $2.135 before inching higher in the afternoon to close.

The muted market response to such a large draw likely had to do with the fact that a significant draw was already priced into the market, and to the recent revisions to the weather forecast. Ahead of the report, Citi Futures Perspective Analyst Tim Evans said he was concerned that the reaction to the large storage withdrawal might be the market’s last chance to rally since the relatively warm temperatures forecast for next week will translate into a much smaller storage decline. He added that natural gas futures were “on the defensive Thursday morning after the temperature outlook turned slightly warmer than a day ago, undercutting heating demand for the fuel.”

Following the fresh storage data’s release, Evans called the report “supportive” and doubled down on his earlier comments.

“While the draw was moderately above the consensus forecast for 207 Bcf, it was still within the range of expectations and may not fully offset the forecast for milder temperatures going forward,” he said. “To some extent, this minor bullish surprise may be the market’s best opportunity to move higher for at least the next few weeks. Failure to rally would underscore the downside vulnerability, with traders concluding that winter is effectively over, banking on the seasonal warming trend to limit storage withdrawals over the balance of the season.”

Randy Ollenberger, an analyst with BMO Capital Markets, agreed that weather is the focus. “We believe the storage report will be viewed as neutral, given the draw was roughly in line with expectations,” he said on Thursday. “Weather will remain the key driver of natural gas prices over the next two months; however, we see limited upside.”

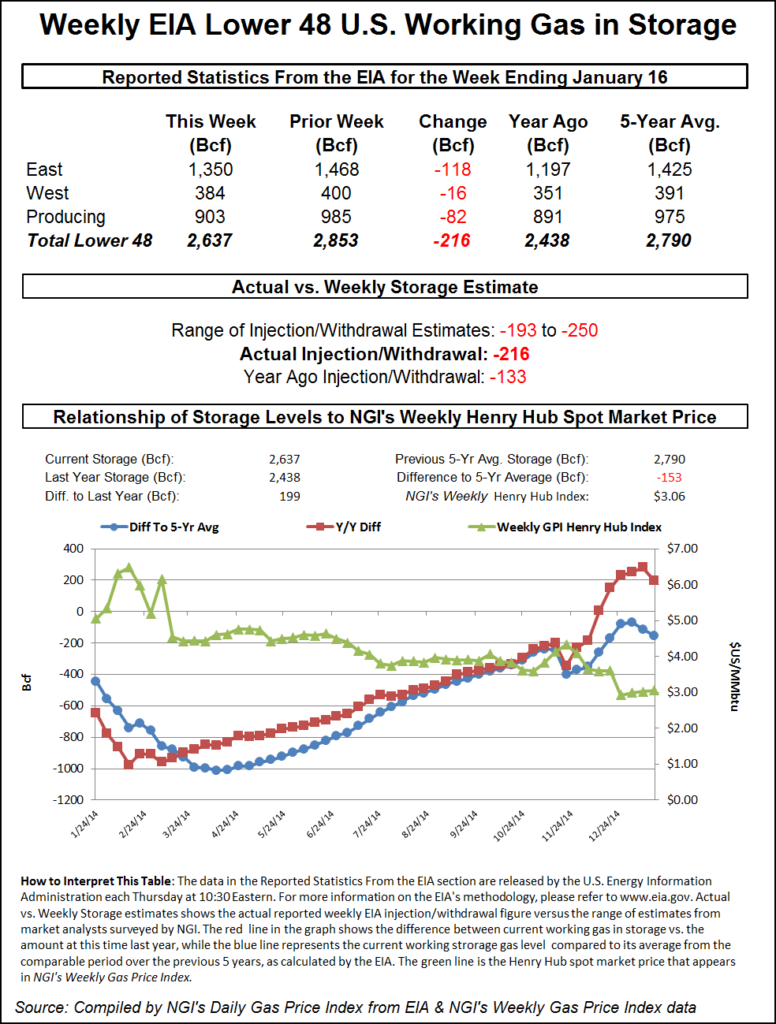

Heading into the report, most industry insiders were looking for a withdrawal north of 200 Bcf. Evans hit the nail on the head with his 211 Bcf withdrawal expectation. A Reuters survey of 23 industry traders and analysts produced a 180 Bcf to 245 Bcf withdrawal range and a consensus expectation that 207 Bcf was removed during the week. Last year saw a 111 Bcf draw for the week and the five-year average decline stands at 170 Bcf.

As of Jan. 22, working gas in storage stood at 3,086 Bcf, according to EIA estimates. Stocks are still 530 Bcf higher than last year at this time and 432 Bcf above the five-year average of 2,654 Bcf. The Midwest Region made the largest draw for the week at 68 Bcf, followed by the South Central Region (66 Bcf) and the East Region (63 Bcf). The Pacific and Mountain regions removed 8 Bcf and 6 Bcf, respectively.

Over in the physical gas arena, the nation’s price chart was a sea of red as most points across the country dropped between a dime and 20 cents on weather forecasts that were slightly warmer than the ones released Wednesday. NGI‘s National Spot Gas Average sunk 13 cents to $2.01.

Moderating temps led Chicago Citygate on Thursday for Friday and weekend delivery 9 cents lower to average $2.13, while Consumers Energy slid 12 cents to also average $2.13. The Gulf Coast was not immune to the slide. Henry Hub dropped 12 cents to average $2.12, and Columbia Gulf Mainline came off 10 cents to $2.07.

The volatile Northeast Region continued to live up to its reputation as Algonquin Citygate slid 98 cents to average $2.54, while Tenn Zone 6 200L came off $1.06 to average $2.44.

Frontier Weather Inc.’s six- to 10-day forecast for Feb. 2-6 is calling for cooler than normal temperatures from the Southeast and Rockies through the Plains and into the upper Midwest. However, warmer than normal readings are expected along the East Coast. In the 11-to 15-day forecast covering Feb. 7-11, temperatures are seen averaging warmer than normal along the West Coast, while cooler than normal readings may persist in the upper Midwest. “Both the 6-10 and 11-15 day periods look somewhat warmer than a day ago,” Evans said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |