E&P | NGI All News Access | NGI The Weekly Gas Market Report

Schlumberger Lays Off 10,000 More People; U.S. Land Activity Decline ‘Sharpest’ Since 1986

Schlumberger Ltd. lost more than $1 billion in the fourth quarter and reduced its workforce by another 10,000 as tight exploration budgets slammed profits for the world’s largest oilfield services company.

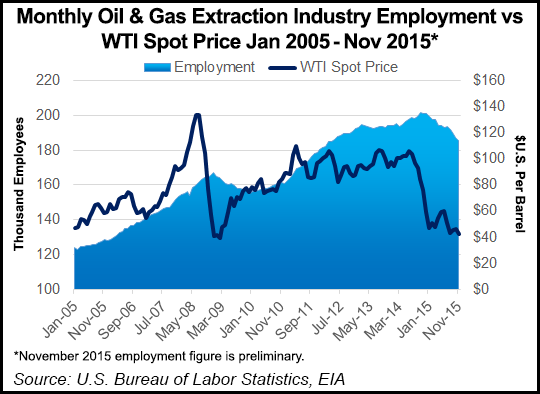

With the United States continuing to be the No. 1 region for its business, the earnings report foreshadows what’s ahead for the rest of the services sector as well as exploration and production (E&P) results.

To cope with the poor environment and likely downturn through at the least the first half of this year, Schlumberger laid off another 10,000 people during the fourth quarter. The company had indicated in December it was reducing the workforce, but it had not indicated how many people would lose their jobs (see Shale Daily, Dec. 1, 2015).

In January 2015 the company laid off close to 11,000 employees, or 15% from 3Q2014 levels (see Shale Daily, April 17, 2015). At least 20,000 jobs were cut by Schlumberger prior to the December layoffs (see Shale Daily, Oct. 16, 2015). The company currently employs about 105,000 people.

The “extended activity weakness” is seen persisting through June, CEO Paal Kibsgaard said. Reducing the workforce led to pretax restructuring charges in 4Q2015 of $530 million.

The number of land rigs exploring for oil and gas in the United States was down 68% in the fourth quarter from its 2015 peak, he said.

“The decrease in land activity was the sharpest seen since 1986,” and “massive overcapacity in the land services market offers no signs of pricing recovery in the short to medium term.”

A 39% drop in revenue and accounting charges led to a loss of $1.02 billion (minus 81 cents/share) for 4Q2015. Revenue totaled $7.74 billion from $12.64 billion a year ago. For the year, profits totaled $2.07 billion ($1.63/share) on revenue of $35.48 billion.

North American revenue was down 14% sequentially, as the U.S. land rig count declined 15%, E&P customer cash flows diminished and budgets were exhausted.

Land revenue from the United States and Canada dropped 18% from 3Q2015 because of lower activity and persistent pricing pressure, while offshore revenue decreased 4%. One usual bright spot, a year-end surge in multi-client seismic license sales, was “largely muted compared to previous years,” Kibsgaard said.

“Negative market sentiments intensified in the fourth quarter, with oil overproduction continuing and extending the bearish trend in global inventories,” he said. “The worsening market conditions added further pressure to a deepening financial crisis in the E&P industry, and prompted customers to make further cuts to already significantly lower E&P investment levels. Customer budgets were also exhausted early in the quarter, leading to unscheduled and abrupt activity cancellations.”

In North America, pretax operating margin declined 175 basis points (bp) from 3Q2015 to 7% because of pricing pressure that impacted all services and products. In the pressure pumping market in particular, ” unsustainable industry pricing levels led to more equipment being stacked and crews released.” Pre-tax operating margin for the year was down 874 basis points to 10.2%. In some basins, however, Schlumberger kept hydraulic fracturing fleets deployed “in pursuit of market share and new technology opportunities.”

Even though revenue declined sequentially in North America, the decremental operating margin was 20%, “underpinned by prompt cost and resource management, effective supply chain processes and strong operations management.”

Production Group unit revenue declined by 10% sequentially on lower pressure pumping services in North America. Reservoir Characterization revenue fell 7% from 3Q2015 while Drilling Group revenues were off 8%, on lower demand for exploration-related products and services in the international areas as customer budgets were chopped.

“These effects were amplified by the almost complete absence of the year-end product, software, and multiclient seismic license sales that have typically offset seasonal winter slow-downs in previous years,” Kibsgaard said. “In spite of the challenging business landscape, we generated approximately $5 billion in free cash flow in 2015, after taking into account capex of $2.4 billion and $1.4 billion of investments in future revenue streams. We returned $4.6 billion in cash to our shareholders, through $2.4 billion in dividend payments and $2.2 billion in stock buybacks.

“We also spent approximately $500 million on technology acquisitions, while increasing our net debt by only $160 million. Our ability to generate cash in this environment has been unmatched in the oilfield services industry, and has given us an unrivaled ability to capitalize on a variety of significant business opportunities.”

The pending takeover of Cameron International Corp., announced last summer, is progressing (see Shale Daily, Aug. 27, 2015). “Pre-close integration plans are substantially complete, and we will be ready to close once all regulatory approvals are received,” Kibsgaard said. “We expect this to occur in the first quarter of 2016 and we have already received approvals from regulators in the U.S., Canada, Brazil and Russia. “In addition, Cameron shareholders have voted to adopt the merger agreement and we have secured the necessary financing for our U.S. subsidiary that will make the acquisition. The large stock component of the deal, with 78% in stock and 22% in cash, has largely insulated us from market volatility…

“In this uncertain environment, we continue to focus on what we can control. Throughout the year we took a number of actions to streamline and resize our organization as we continued to navigate the downturn. In continuing to accelerate the benefits of the transformation program across both our Technologies and GeoMarkets in 2016, we believe we will emerge as a stronger company relative to industry peers and competitors once the price of oil and the market conditions in our industry turnaround.

“We remain constructive in our view of the market outlook in the medium term, and continue to believe that the underlying balance of supply and demand will tighten, driven by growth in demand, weakening supply as E&P investment cuts take effect, and by the size of the annual supply replacement challenge.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |