Markets | NGI All News Access | NGI Data

Dangerous Winter Storm Having Limited NatGas Market Impact; Futures Post Small Gain

Next-day physical natural gas at most points outside the East added a few pennies to a little more than a nickel in trading for Friday delivery.

The market response to a much anticipated and intense snow storm with expected blizzard-like conditions was highly focused with points outside the strike zone between New York City and Washington, DC, showing losses. The NGI National Spot Gas Average shed 3 cents to $2.28, but the Northeast posted a decline of 11 cents.

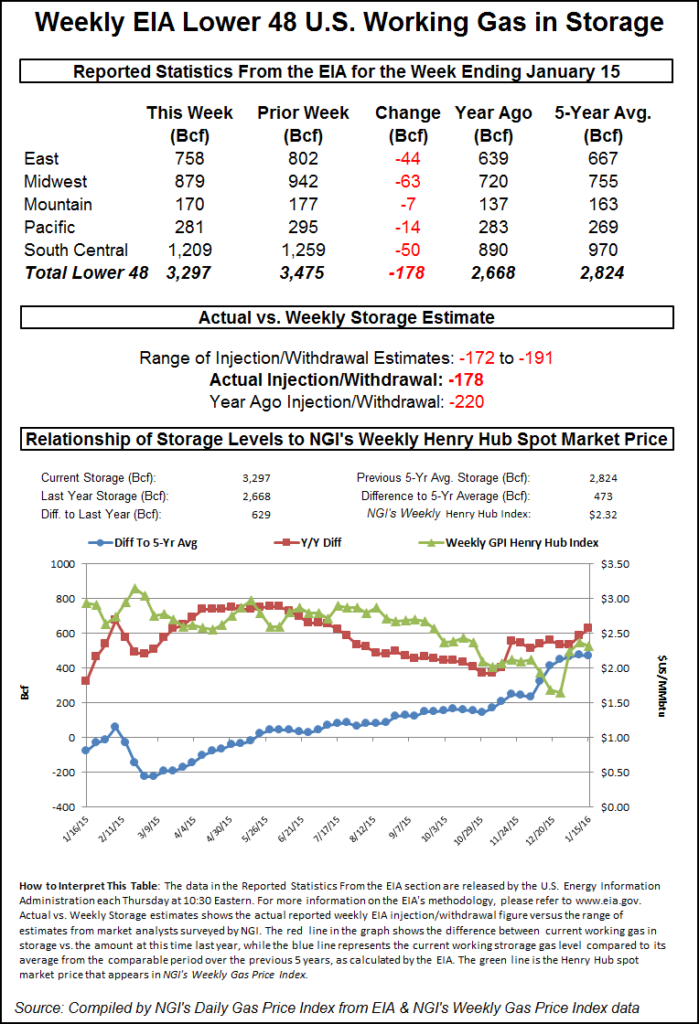

The Energy Information Administration (EIA) reported a storage withdrawal of 178 Bcf, less than what the market was expecting, and initially prices dropped to the lows of the day. Prices managed to rebound off the lows as crude oil began a $1 plus rally at mid-session. At the close, February was 2.0 cents higher at $2.138 and March had gained 1.6 cents to $2.139. March crude oil added $1.18 to $29.53/bbl.

Although the forecast eastern blizzard was expected to dump 12 inches or more of snow between New York and Washington, DC, the temperature outlook was not as intense. Temperatures in New York and Philadelphia were seen right around seasonal norms, although the outlook for the Nation’s Capitol was about 10 degrees below normal. Forecaster Wunderground.com predicted that New York City’s Thursday high of 38 would slide to 35 Friday and 31 Saturday, 7 degrees below normal, with about five to eight inches of snow. Philadelphia’s high Thursday of 35 was seen easing to 34 Friday and 31 Saturday, 3 degrees below normal, with a foot of snow. Washington, DC, was forecast to see Thursday’s high of 34 fall to 32 Friday and 31 Saturday, about 12 degrees below normal. Anywhere from eight to 12 inches of snow was forecast for both Friday and Saturday in Washington.

“I would think the greatest pipeline impact would be Transco Zone 5,” said a pipeline industry veteran. “All the crabs in Maryland are probably running for cover!”

Next-day gas on Transco Zone 5 gained a stout 54 cents to $3.41, but gas headed for New York City on Transco Zone 6 eased 8 cents to $3.50. Deliveries to Transco non New York North covering southeastern-most Pennsylvania, Trenton and southern New Jersey rose 27 cents to $3.41.

Texas Eastern M-3, Delivery came in 7 cents higher at $3.20.

New England prices fell on light volume. Gas at the Algonquin Citygate fell 69 cents to $4.86, and deliveries to Tennessee Zone 6 200 L were seen 66 cents lower to $4.98 as well.

Marcellus gas was quoted slightly lower. Deliveries on Dominion South shed 3 cents to $1.58, and packages on Tennessee Zone 4 Marcellus were quoted a penny lower at $1.35. Gas on Transco-Leidy Line changed hands 2 cents lower at $1.38.

For the moment the market response to the storm appears narrow, but government forecasters were calling the storm potentially dangerous. The blizzard, expected to roar through the Mid-Atlantic and parts of New England beginning Friday, will be “a potentially paralyzing storm” that could affect as many as 50 million people, according to Louis Uccellini, director of the National Oceanic and Atmospheric Administration’s National Weather Service.

“It is setting up to affect the entire mid-Appalachian region through the Mid-Atlantic toward New York City, Long Island and extreme southern New England, with the potential of very heavy snowfall,” Uccellini said Thursday afternoon. Conditions are also ripe for severe weather from East Texas to the Florida panhandle as the system develops, and there is potential for flooding in the Delaware Bay north to Long Island and New York City.

“Right now we’re saying that the heaviest snow should start falling in the Mid-Atlantic late Friday afternoon or it could be even as late as early evening…and then progress steadily up the coast to the New York City area by Saturday morning,” Uccellini said. “The cold temperatures and strong winds — and we expect the winds to be very strong with this storm system, especially along the I-95 corridor — will add to the impact.” Blizzard watches and warnings were in effect Thursday from Virginia to New York. Expected impacts include heavy snow, strong winds, coastal flooding and, further south into Kentucky and North Carolina, icing.

Traders noted that extreme snowfall is not necessarily a driver of higher spot gas prices. “Demand drops in a lot of cases. Everything slows down, there are often power outages,” the pipeline veteran said.

Longer term, forecasters are expecting the cold air to slide through eastern markets followed by a period of moderation. It’s after that when patterns become less well defined. “Overall, we continue to see enough cold Canadian air being tapped by U.S. weather systems to drive near or stronger than normal natgas demand for the next 10 days,” said Natgasweather.com in a noon update Wednesday. “It’s what happens after where the weather data keeps showing milder temperatures arriving and leading to quite bearish looking national eight-14 Day Outlook maps.

“It would be no surprise to have the weather data again delay the arrival of colder air, or more likely only bring several days of it before colder temperatures again return to the northern and eastern U.S. Simply put, the coming pattern through next week is fairly cold and snowy with strong winter storms, although, still not intimidating enough after as a milder break keeps showing up in the weather maps days 12-14, although continuously being delayed by an eastern U.S. cool bias.”

The 10:30 a.m. EST release of storage figures by the Energy Information Administration did show the strongest demand so far this season, and estimates approached 200 Bcf. Last year 220 Bcf was withdrawn, and the five-year average was for a 177 Bcf decline. Problem is, little impact is likely in the five-year storage surplus.

IAF Advisors calculated a 191 Bcf pull, and ICAP Energy was expecting a withdrawal of 182 Bcf. A Reuters survey of 21 traders and analysts revealed a sample mean of -184 Bcf with a range of -172 to -191 Bcf.

Once the number was released February futures fell to a low of $2.085, and by 10:45 a.m. February was trading at $2.085, the low for the day and down 3.3 cents from Wednesday’s settlement. Traders see important $2 support in sight, but “we are far enough from the $2 level at this time and I don’t think we are in danger of seeing that,” a New York floor trader told NGI.

The remainder of the petroleum complex, however, is highly bearish. “We’ve got seven months of the heating oil under $1. It’s all very negative,” he said.

Longer term, analysts see expected seasonal warming taking hold of the market. “[T]he 178-Bcf net withdrawal was a match with the five-year average, and therefore neutral on a seasonally adjusted basis,” said Tim Evans of Citi Futures Perspective. “But it was less than expected given the weather and so also suggests some weakening of the background supply/demand balance. We see some small chance for prices to rally on this week’s cold and the larger net withdrawal it implies for the next round of numbers, but expect the market to remain more focused on the seasonal warming trend going into February.”

Using the 5-region format inventories now stand at 3,297 Bcf and are 629 Bcf greater than last year and 473 Bcf more than the five-year average. In the East Region 44 Bcf was pulled, and the Midwest Region saw inventories fall by 63 Bcf. Stocks in the Mountain Region were down by 7 Bcf and the Pacific Region was lower by 14 Bcf. The South Central Region shed 50 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |