Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Kinder Cuts Planned Spending After 4Q Loss

Kinder Morgan Inc. (KMI) Wednesday retrenched again in the face of weak commodity prices, cutting spending plans while it emphasizes self-funded growth through only the highest-return projects. A $1.15 billion impairment drove the fourth quarter to a net loss of $637 million compared with net profit of $126 million in the year-ago quarter.

The impairment was triggered largely by a decline in market values of KMI and comparable midstream companies, the company said. Fourth quarter net income before certain items was $491 million compared with $664 million for the same period in 2014. The decrease was driven by higher taxes and interest expense.

For full-year 2015, KMI had net income of $311 million compared with nearly $1.03 billion in 2014. The disappointing results follow a recent 75% dividend cut in concession to weak commodity prices and unattractive equity markets (see Daily GPI, Dec. 9, 2015; Oct. 22, 2015).

Executive Chairman Richard Kinder noted “a tremendously challenging commodity environment” and a 65% decline in KMI shares during 2015 but said, “…we are glad to have generated the greatest amount of annual distributable cash flow [DCF] in the company’s history…”

KMI reported full-year DCF of $4.699 billion versus $2.618 billion for 2014, an increase of 79%, due primarily to the KMI merger transactions completed in late 2014 (see Daily GPI, Aug. 11, 2014). However, KMI reported fourth quarter DCF of $1.233 billion versus $1.278 billion for the comparable period in 2014, with the decrease mainly due to a decline in the CO2 segment and higher interest expense.

CEO Steve Kean said KMI is high-grading its projects “…to the highest-return opportunities, including efforts to reduce spend, improve returns and selectively joint venture projects where appropriate. We have reduced our expected 2016 spend by approximately $900 million, reduced our backlog by $3.1 billion from the third quarter of 2015 and expect further reductions in the coming months as we continue to high-grade our capital investments.

“In light of the continued weak commodity price environment, we continue to closely monitor our counter-party exposure. However, we are a diverse company with operations across a broad set of industries and we have a large customer base with only a few customers that account for more than 1% of our annual revenues. Additionally, the great majority of our largest customers remain solidly investment grade.”

KMI’s revised growth capital budget for 2016 is $3.3 billion, which is a reduction of approximately $900 million. Expectations assume an average 2016 West Texas Intermediate crude oil price of $38/bbl, an average 2016 Henry Hub natural gas price of $2.50/MMBtu and interest rates consistent with the current forward curve.

“…[W]hat we’re trying to do is really make sure that we’re investing capital on the highest-return opportunities that we have, make sure that we’re fulfilling our commitments and delaying spend where it can’t be delayed or deferred, and taking on partners where it makes sense for us to take on partners,” Kean said in response to an analyst question during a conference call Wednesday. “And I think what we’ve been able to do successfully over the years is originate really good returning midstream energy projects. And so because we’re able to do that even though we’re viewing our capital as quite finite, there are people out there who are happy to participate with us as partners and we’re exploring those opportunities where those makes sense.”

The company’s natural gas pipelines business turned in segment earnings that were $1.098 billion in the fourth quarter, compared with $1.057 billion in the year-ago quarter. The segment also posted a full year increase of 1% over 2014.

“Growth in this segment compared to the fourth quarter last year was led by contributions from the Hiland acquisition [see Shale Daily, Jan. 21, 2015] and improved performance on Tennessee Gas Pipeline (TGP) driven by projects placed into service,” Kean said. “Fourth quarter growth was partially offset by lower commodity prices affecting certain of our midstream gathering and processing assets. The expiration of a minimum volume contract at KinderHawk also negatively impacted earnings.”

Gas transport volumes were up 5% compared to the fourth quarter of 2014, driven by higher volumes on Texas intrastate pipelines due to higher demand, including increased deliveries of gas into Mexico, and higher throughput on the El Paso Natural Gas Pipeline due to higher deliveries of gas into Mexico and greater power generation load, KMI said. Throughput for power generation was up 10% compared to the fourth quarter of 2014 and up 16% for the full year compared to 2014.

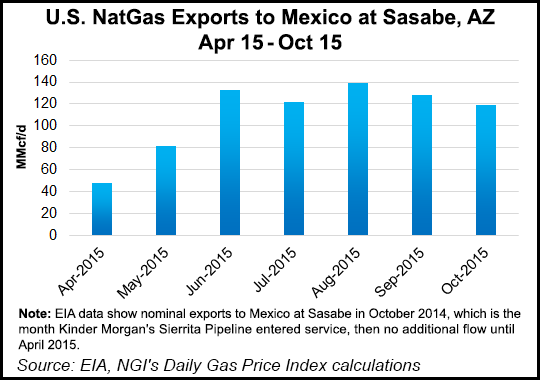

KMI also announced details of its Sierrita Gas Pipeline LLC expansion and development of compression facilities on the pipeline, which entered service in October 2014. The approximately 60-mile, 36-inch diameter pipeline currently provides 200,846 Dth/d of firm capacity and extends from KMI’s El Paso Natural Gas south mainlines, near Tucson, AZ, to the U.S.-Mexico border near Sasabe, AZ.

Sierrita held an open season last year and received a binding bid from Mexico’s Comision Federal de Electricidad (CFE) and awarded to CFE a minimum expansion volume of 230,254 Dth/d by April 2020 for a term of 19.5 years. CFE can elect to increase the expansion capacity to 309,154 Dth/d by Feb. 29. Sierrita is planning to install a 16,000-21,000 hp compressor station and undertake modifications to existing meter station facilities. The pipeline’s current design capacity is fully subscribed under a 25-year agreement with CFE. Depending upon CFE’s final volume election, the revised firm transportation capacity of the pipeline will be 431,100 Dth/d or 510,000 Dth/d, after commissioning of expansion facilities.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |