E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rig Count to Remain ‘Frustratingly Flattish’ in 2016, Says Tudor

Earnings results for the leading oilfield services (OFS) operators begin Friday with Schlumberger Ltd. kicking it off, and the conference call comments may set the tone for what to expect in North America over the coming year.

Most energy investors think OFS pricing is at or near a bottom but it’s going to get worse for onshore rigs before it gets better, according to a survey of clients by Tudor, Pickering, Holt & Co. (TPH). The survey of 200-plus energy investment clients was conducted in mid-December.

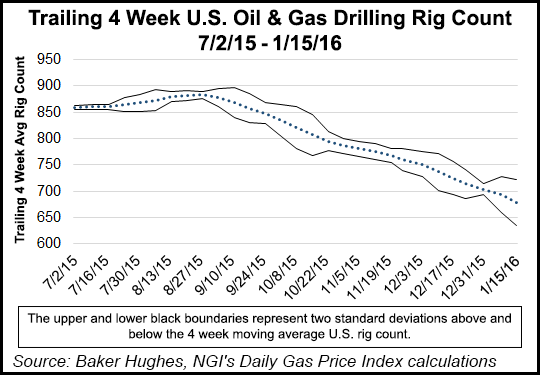

Investors generally believe that the U.S. land rig count will exit 2016 somewhere between 700 and 900 working rigs, a bit higher than the year-end 2015 count. TPH’s team is not as optimistic.

“We’re biased toward the U.S. land rig count remaining frustratingly flattish through 2016 at the 650 trough level,” said the oil service research team led by Byron Pope.

More than one-third (37%) expect the U.S. land rig count to average 713-799 this year, while close to the same number (34%) expect to see 800-899 rigs running. However, 18% said the onshore rig count will be lower than the current level.

Those responding to the survey also said that the North American onshore was the best way to invest in OFS in an oil price recovery scenario.

“While we agree, over the next 12 months, we prefer to do so via well completions exposure and we favor better balance sheets in the first half of 2016, given very low near-term demand visibility,” Pope said.

When asked what their expectations were for OFS costs throughout 2016, 69% said they were at or near the bottom, while 19% see additional running room. Eleven percent actually believe costs will increase at some point this year, but “this mindset will start to shift as we exit this year, as the OFS industry won’t redeploy people/assets for zero-margin work.”

“TPH’s key underlying OFS assumptions for U.S. land through the first quarter is that rig count activity heads lower versus year-end 2015, but it should find its cyclical trough exiting 1Q2015,” Pope said. “Well completions activity should begin to perk up in the last six months as exploration and production companies work down drilled but uncompleted wells in response to higher oil and gas prices.”

Over the next three years, TPH expects U.S. onshore rig count activity to trend higher — but it won’t get anywhere near its 2014 peak. Pricing should improve for most OFS lines over that time period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |