Bakken Shale | E&P | NGI All News Access

North Dakota Production Stays Up Amid New Low Prices, Permitting, Rig Counts

While state officials reported the “bottom of the bottom” in oil/natural gas operations, North Dakota nevertheless held steady in its oil and natural gas production in November, the Department of Mineral Resources (DMR) reported on Friday.

DMR Director Lynn Helms said his theme for the state’s latest monthly oil/gas statistics was “running on empty,” which he took from a 1970s rock tune by singer/songwriter Jackson Browne. “Honestly, we’re down at the bottom of the bottom in terms of cash flows and rig counts,” Helms said.

The latest DMR report included sinking numbers in everything but production, including producing wells, permitting, rig count and the average price for North Dakota sweet crude oil, which hit $20/bbl on Friday, plunging from $27.57/bbl in December and $32.16/bbl in November.

Oil production was 35.2 million bbls (1.176 million b/d), compared with 36.3 million bbls (1.171 million b/d) in October, and natural gas production was 50.03 Bcf (1.66 Bcf/d) in November, compared with 51.36 Bcf (1.65 Bcf/d) in October.

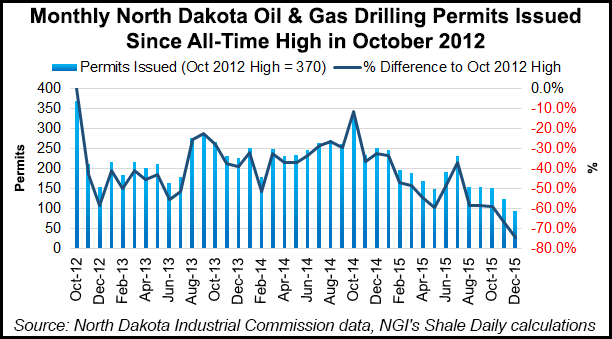

Permitting dropped to 95 in December from 125 in November and 152 in October, Helms said. And after staying steady from October through the end of the year at 64-65, the rig count plummeted to 49 as of Friday, he said.

“At this point, everybody is scrambling to figure out what to do with their business,” Helms said. “They are trying to determine how to maintain cash flow and production.”

In response to a question from NGI regarding whether the Bakken can maintain production of at least 1 million b/d in 2016 given low commodity prices, Helms said he has been reading a lot of oil price prognostications. “At the current $20-$30/bbl prices, there would be a continued reduction in rig count,” he said.

At $30/bbl, production could be sustained at 1 million b/d into 2017, Helms said, while at $20/bbl production would drop to 950,000 b/d in 2017.

Helms said the remaining operators in the Bakken are showing “deep pessimism” about short-term oil prices, given the big drop in new permits being sought. “Companies are saying that not until the very end of the year, if then, do they expect much of a turnaround,” he said.

He noted that prices have dropped rapidly since the first of the year to a level that he hasn’t seen since “well before the Bakken” upsurge.

In the latest statistics, November showed 969 wells still waiting for completion, a drop of six from the October numbers. Helms cited this as another sign of the pervasive pessimism over short-term oil prices.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |