NGI Archives | NGI All News Access

NatGas Futures Lead Most Cash Points Lower In Weekly Trading

Most physical natural gas points lost between a nickel and a dime for the week ending Jan. 15, but the overall market lost just 3 cents as double-digit gains at eastern locations acted as a strong balance to a very soft California market. The NGI Weekly Spot Gas Average eased 3 cents to $2.43, but that decline was overshadowed by a more ominous drop of close to 40 cents in the futures.

Transco Zone 6 non NY North grabbed the spotlight as the week’s strongest actively traded individual point with a gain of 79 cents to average $3.73, and Algonquin Citygate brought up the rear with a loss of 39 cents to $4.69. Regionally California was the weakest with a drop of 21 cents to $2.43, and the Northeast proved to be the strongest with a rise of 26 cents to $2.90.

The Rocky Mountains were hit with a decline of 18 cents to $2.24 and the Midcontinent, South Texas, and East Texas endured losses of 8 cents to $2.28, $2.24, and $2.24, respectively.

The Midwest and South Louisiana both shed 7 cents to $2.37 and $2.27, respectively.

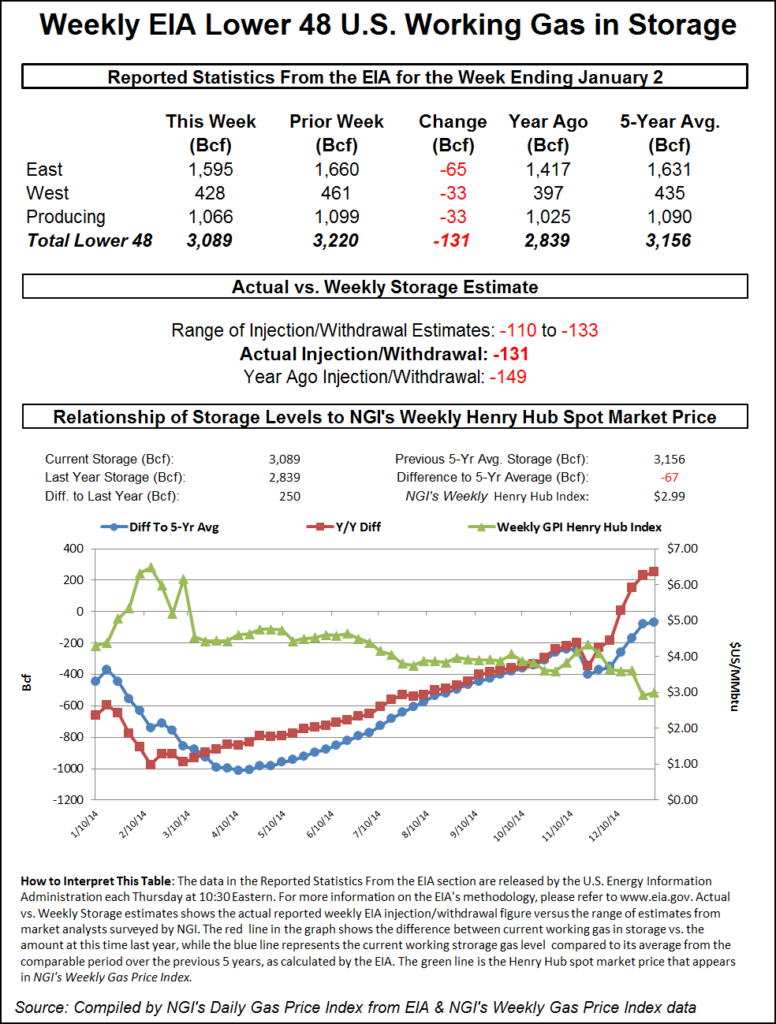

February futures for the week outdid most cash points with a gut-wrenching loss of 37.2 cents to $2.100, and a healthy chunk of that came at the hands of an inventory report Thursday which showed usage below market expectations. The Energy Information Administration (EIA) reported a withdrawal from natural gas inventories of 168 Bcf for the week ending Jan. 8, about 10 Bcf less than expectations and futures immediately headed south. At the close Thursday, February had retreated 13.0 cents to $2.139 and March was off 11.0 cents to $2.180.

Market bears lost no time seizing on the unsupportive inventory figure. The EIA reported withdrawal sent February to a low of $2.166 following the release of the storage data, and by 10:45 a.m. February was trading at $2.180, down 8.9 cents from Wednesday’s settlement.

Prior to the release of the data, analysts’ estimates were in the 177 Bcf range. ICAP Energy was looking for a pull of 182 Bcf and a Reuters survey of 21 traders and analysts showed a range from -158 Bcf to -192 Bcf with an average -178 Bcf. Industry consultant Bentek Energy utilizing its flow model calculated a 180 Bcf withdrawal.

“We were looking for a number around 178 Bcf and it came in at 168,” said a New York floor trader. “We were trading around $2.225 when the number came out and it came off about 6 cents off the number. I don’t think you will see anything [support] until $2.10, but greater support will be at $2.”

“The 168 Bcf in net withdrawals was less than the consensus expectation, a minor bearish surprise that suggests at least a modest weakening of the background supply/demand balance,” said Tim Evans of Citi Futures Perspective. “This will increase market confidence that it can ignore the prospect of higher withdrawals expected for this week and next, jumping to the conclusion that winter may as well be over.”

Using the 5-region format inventories now stand at 3,475 Bcf and are 587 Bcf greater than last year and 474 Bcf more than the five-year average. In the East Region 55 Bcf were pulled, and the Midwest Region saw inventories fall by 41 Bcf. Stocks in the Mountain Region were down by 8 Bcf and the Pacific region was lower by 18 Bcf. The South Central Region, closely similar to the former Producing Region, dropped 46 Bcf.

In Friday’s trading weekend and Monday natural gas buyers weren’t taking any chances of getting caught shorthanded over the extended holiday weekend as a surging Monday power market sent strong signals to anyone contemplating going into the weekend short.

Forecast strong loads and double-digit power price gains were enough to lift average eastern prices close to $1.50, and the NGI National Spot Gas Average rose by 28 cents to $2.45.

Futures had a hard time getting out of their own way and were caught in a mix of a softening weather outlook and a maelstrom of selling in petroleum and equity markets.

At the close, February was down 3.9 cents to $2.100, and March was off 5.3 cents to $2.127. February crude oil settled below $30 at $29.42, down $1.78, and the Dow Jones Industrial Average plummeted 391 points to 15,988, capping the worst 10-day start to a year in history.

Gas traders at eastern locations were unperturbed and looked to lay in supplies for what looked to be a busy holiday weekend. The New York ISO and PJM Interconnection both forecast a stout increase in power load by Monday.

New York ISO predicted system peak load Friday of 20,330 MW would make its normal weekend dip to 18,884 Saturday and then surge to 21,481 MW by Monday. The broad PJM grid was expected to see Friday’s peak load of 36,278 MW slip to 33,309 MW Saturday but vault to 42,180 MW Monday.

Gas and power prices responded accordingly. Weekend and Monday gas bound for New York City on Transco Zone 6 jumped $4.41 to $6.58, and gas on Texas Eastern M-3, Delivery added $1.08 to $2.69.

Deliveries to the Algonquin Citygate jumped $1.31 to average $4.77, and packages at Iroquois, Waddington rose by 94 cents to $3.39. Gas on Tenn Zone 6 200L added 94 cents to $4.19.

Intercontinental Exchange reported that Monday on-peak power at the ISO New England’s Massachusetts Hub rose by $20.66 to $54.30/MWh, and deliveries to the New York ISO’s Zone G delivery point Monday surged $26.50 to $59.50/MWh. On-peak power at the PJM West terminal gained a stout $21.92 to $46.11/MWh.

In Appalachia, a major delivery enhancement was made to the REX Zone 3 East to West Expansion. REX announced Thursday the addition of the REX/Ohio River System Bear Wallow receipt point.

“This was supposed to come online during 4Q2015 but was probably delayed due to the state of the industry,” said NGI Market Analyst Nate Harrison. “The Ohio River System is now the largest Zone 3 receipt point to come online by operational capacity and currently accounts for 27.4% of total REX Zone 3 receipt capacity.

“Utilization on opening day is unsurprisingly small with only 15.5% of the point’s available 842 MMcf in use. The addition brings total Zone 3 capacity to 3,073 MMcf/d.”

Prices at Marcellus points were mixed. Gas on Tennessee Zn 4 Marcellus fell a penny to $1.32, and deliveries to Transco-Leidy Line added 2 cents to $1.37. Gas on Dominion South, however, jumped 23 cents to $1.65.

Natural gas traders aren’t immune to the weak petroleum sector.

“Although this market appears to be getting swept up in bearish spillover from the new lows in the liquids, the temperature factor has also seen a swing to the bearish side in recent days,” said Jim Ritterbusch in a Friday morning report to clients. “Adding to downside momentum was Thursday’s smaller than expected storage withdrawal that fell short of street ideas by about 7-8 Bcf. Furthermore, chart deterioration following Thursday’s support violation at the $2.19 level is prompting liquidation of fresh spec longs that were established late last year, to move to the sidelines.

“But, although our acceptance of profits out of short holdings in Thursday’s trade appears premature, we are not ruling out another price pop back to above the $2.20 mark next week following possible cold adjustments to the short-term temperature views during the upcoming extended holiday weekend. But we will also note that the weather factor will soon be subsiding in importance given this late stage of the heavy usage cycle. This will force greater focus on nonweather related items such as production, coal to gas displacement and industrial usage.”

Gas buyers for weekend power generation across the broad MISO footprint look to have plenty of renewables generation to offset gas purchases.

“A weak and fleeting storm system will support a chance for light snow and rain [Friday], mainly east,” WSI Corp. said Friday morning. “A northerly flow behind this system and subsequent arctic cold front will drive the next shot of bitterly cold arctic air into the power pool during the weekend into early next week.

“This air-mass may be even colder than last weekend as sub-zero minimum temps will return to the north along with highs hard pressed to rise into the single digits and teens. The storm system and influx of arctic air will likely cause wind generation to rebound during today into the weekend. Output is forecast to top out between 7-9 GW. Wind generation will likely decrease and become light by Monday.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |