Natgas Cash Tumbles, But Futures Hold Their Ground Ahead of Inventory Stats

Physical natural gas for Thursday delivery fell hard and fell often in Wednesday’s trading as even stormy forecasts were unable to lift next-day prices in the Midwest and East. Lifted pipeline restrictions in the Marcellus Shale prompted a re-balancing of prices, and the NGI National Daily Spot Gas Average tumbled 34 cents to $2.29.

Futures held their ground ahead of Thursday’s storage report, which is expected to show a triple-digit seasonal inventory withdrawal. At the close, February had added 1.2 cents to $2.269, and March was higher by 2.9 cents to $2.290. February crude oil rose 4 cents to $30.48/bbl.

Next-day gas at Marcellus points rose and downstream points fell, as the Transco-Leidy Line Southeast project is up and running.

Effective Thursday, “reductions of primary firm transportation services on Leidy will not be required,” Transco said on its website. The project required 30 miles of looped pipeline, four compressor turbines in the Leidy area and two compressor upgrades in Pennsylvania and New Jersey.

The fully subscribed 525 MDth/d project began construction in January 2015 and began service on the first 130 MDth/d of the project on Dec. 1. “A second partial service request for another 160 MDth/d of incremental capacity, for a total of 290 MDth/d, was filed Dec. 17 for a Dec. 23 in-service date,” according to Genscape Inc. But ramp up was delayed by the Federal Energy Regulatory Commission until approval was granted on Dec. 30.

Next-day gas on Transco-Leidy Line rose 42 cents to $1.38, and deliveries on Tennessee Zn 4 Marcellus added 19 cents to $1.33.

Downstream prices tumbled. Gas on Texas Eastern M-3 Delivery fell $1.41 to $1.99 and deliveries headed to New York City on Transco Zone 6 dropped $3.98 to $2.83.

Weather forecasts are calling for higher temperatures going into the weekend. AccuWeather.com forecast the high of 30 in Boston on Wednesday would rise to 31 Thursday and 41 on Friday, 6 degrees above normal. New York City’s 31 degree reading Wednesday was seen advancing to 39 Thursday and 46 by Friday, 8 degrees above normal.

Gas at the Algonquin Citygates fell $1.53 to $4.40, and gas on Iroquois, Waddington fell 86 cents to $2.87. Deliveries to Tenn Zone 6 200L dropped $1.68 to $4.38.

Major hubs were seen about a dime lower. Gas at the Chicago Citygates was off 9 cents to $2.32, and packages at the Henry Hub changed hands 8 cents lower at $2.30. Deliveries to Opal were quoted 10 cents lower at $2.22, and gas at the PG&E Citygate fell 11 cents to $2.55.

Natural gas bulls have contended that falling rig counts would eventually slow production, and for the moment that seems to be the case.

Genscape reported that Lower 48 dry gas production “has been in steady decline since Jan. 7.” Spring Rock’s pipe-based estimates showed Wednesday production at 70.93 Bcf/d, about 1.15 Bcf/d below the 72.08 Bcf/d from Jan. 7.

“All regions (except West Coast) are in decline during this period,” Genscape said. “The bulk of the declines are in Texas, where…estimated production is 0.64 Bcf/d below Jan. 7. San Juan and Gulf Coast are showing the next largest declines at 0.15 Bcf/d and 0.13 Bcf/d, respectively. Gulf volumes are recovering from recent declines, however.

“Volumes through Discovery’s Offshore Mainline meter had fallen from 600 MMcf/d down to 136 MMcf/d but are now up to 409 MMcf/d in evening cycle nominations.

Tuesday overnight weather modeled near-term cold over populous eastern and Midwest energy markets. The forecast saw a mix of changes for Wednesday but continued to feature below “normal temperatures on average from the Midwest to the East Coast,” said MDA Weather Services in its Wednesday morning six- to 10-day forecast.

“This is as a cold Canadian air mass drops southward into the North-Central U.S. this weekend and encompasses the Midwest at the start of this period. The feature progresses into the East by mid-period, with temperatures expected to peak at much below normal levels for a large part of the eastern half. However, as the feature further presses eastward and into the Atlantic, return southerly flow provides warming trends beyond mid-period in the eastern half.”

MDA said risks to the forecast arise from its forecasters favoring the European Centre for Medium-Range Weather Forecasts, but the Global Forecast System “holds onto a much colder pattern” in the central United States.” Warmer risks remained in the West because of storminess along the coast.

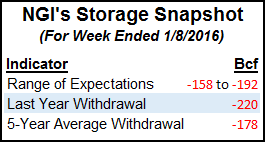

Thursday’s inventory report is expected to feature the second triple-digit storage withdrawal of the season, although the anticipated pull is nowhere close to last year.

Last year 221 Bcf was withdrawn and the five-year average stands at a 177 Bcf pull. ICAP Energy is looking for a withdrawal of 182 Bcf, and IAF Advisors calculates a decline of 177 Bcf. A Reuters poll of 21 traders and analysts revealed a -178 Bcf average with a range from -158 Bcf to -192 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |