NGI The Weekly Gas Market Report | E&P | NGI All News Access

EIA Forecasts Modest Gains For Henry Hub In 2017, Exports to Sustain Production

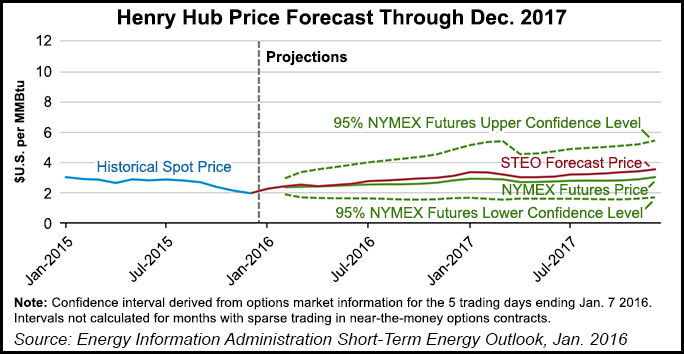

Debuting its 2017 forecasts with the release of the Short-Term Energy Outlook Tuesday, the Energy Information Administration (EIA) said it expects modest price increases for natural gas to arrive next year as the market slowly adjusts to the current oversupply.

At the Henry Hub, EIA is expecting an average price of $2.73/Mcf in 2016, with the price jumping to $3.32/Mcf in 2017. Some independent energy analysts see much lower prices at Henry this year (see Daily GPI, Jan. 12). Total dry gas production will remain essentially flat in 2016 at 74.82 Bcf/d, up slightly from 74.45 Bcf/d in 2015, according to EIA’s projections. In 2017, production is expected to increase to 76.21 Bcf/d.

An increase in exports and a decrease in Canadian imports are expected to help sustain current gas production levels even as domestic consumption levels off, EIA said. Demand for gas in Mexico is expected to increase as a result of growth in its electric power sector, while Cheniere Energy Inc.’s Sabine Pass liquefied natural gas (LNG) terminal is expected to add to an increase in U.S. gas exports as it comes online this month. Driven by activity at Sabine Pass, gross U.S. LNG exports will average 0.7 Bcf/d in 2016, increasing to 1.4 Bcf/d in 2017, EIA said.

In a conference call with reporters Tuesday, EIA Administrator Adam Sieminski said a recovery is on the horizon for the commodity markets that took such a beating in 2015.

“I’ve been following the energy sector of the global economy for a lot of years,” he said. “I’ve seen prices for various energy products go up and go down, and I’ve weathered through a bunch of cycles. I think we are likely to see prices recovering because that’s typically what they do.

“You tend to get overreactions both to the upside and the downside, and now we’re in one of those likely dips that go below what replacement costs really are, so we’ll see a recovery, but there’s a lot of pain involved in this.”

Domestic oil and gas producers were “very clever” at finding ways to increase efficiency and continue production growth in 2015 despite the lower rig count necessitated by depressed prices.

“I think it took longer for the U.S. production to slow down than we would have anticipated a year ago,” Sieminski said, although he added that domestic producers are “getting closer to a point where you’re turning and things will start to get better.”

Sieminski said commodity prices remained depressed in 2015 largely because “production has continued, actually, to stay at levels higher than demand, and the inventories have been building, and so we’ve got to work our way through those inventories.”

On the electric generation side, 2015 marked a year of significant new demand for natural gas, according to EIA. Consumption in the power sector jumped from 22.32 Bcf/d in 2014 to 26.49 Bcf/d in 2015. However, that trend isn’t projected to continue into the 2016-2017 forecast period, as EIA said it expects power demand to decrease to 26.4 Bcf/d in 2016 and 26.04 Bcf/d in 2017.

“We have not had a lot of [electricity] demand growth, but we have a lot of additional renewables coming on,” EIA Deputy Administrator Howard Gruenspecht said, adding that hydroelectric power is expected to perform better than it did in 2015, creating additional competition for gas-fired generation in the West.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |