NGI Weekly Gas Price Index | NGI All News Access | NGI Data

Cash NatGas Nosed Out By Surging Futures At Week’s End

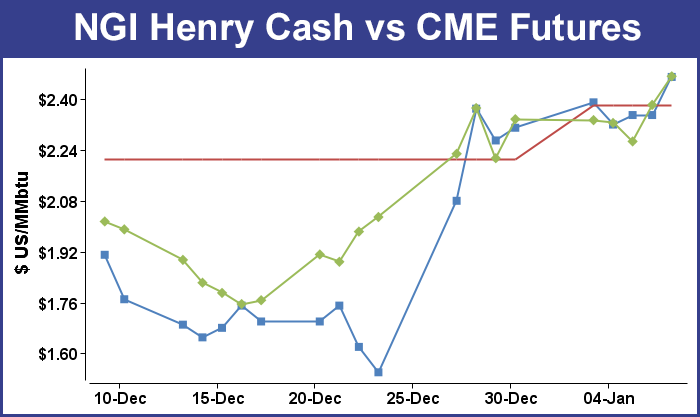

Futures and cash raced each other higher in trading for the week ended January 8, with the February futures squeaking out a narrow half-cent margin over a strong cash market.

The NGI Weekly Spot Gas Average rose 13 cents to $2.46, but February futures nosed ahead with a 13.5-cent gain to $2.472. Gains and losses were spread across the board with the Northeast, boosted by some early week cold, posting the largest advance of 62 cents to $2.64. The Rocky Mountains floundered, putting in the weakest performance with a loss of 26 cents to $2.42 as a soft California market lessened the need for westbound Rockies gas.

Of the actively traded locations, the market point showing the week’s greatest gain was Transco Zone 6 New York with a rise of $1.91 to $3.93, and three points vied for the week’s biggest loser with 37-cent declines. Both El Paso non-Bondad and Transwestern San Juan dropped to $2.45 and El Paso S Mainline shed 37 cents to $2.59.

Regionally, California fell 17 cents to $2.64 and the Midcontinent was also in the loss column with a 3-cent setback to $2.36.

Both East Texas and the Midwest were higher by 8 cents to $2.32 and $2.44, respectively; South Texas tacked on 11 cents to $2.32 and South Louisiana added a dozen to $2.34.

February futures for the week rose 13.5 cents to $2.472 and a healthy chunk of the gain came from Thursday’s Energy Information Administration (EIA) report of an outsized 113 Bcf withdrawal in its morning inventory report. In addition, a 4 Bcf reclassification resulted in an implied offtake of 117 Bcf, well above expectations closer to 100 Bcf. Futures traders took note and at the close February had risen 11.5 cents to $2.382 and March was up 10.5 cents to $2.394.

Futures bulls were pleased with the day’s trading. “We were expecting a withdrawal of 98 Bcf and it came in at 113 Bcf. Prices rallied and held some solid numbers,” a New York floor trader told NGI.

“I like the $2.50 area, but the climb could be hard. You could get some downside, but I would look higher.”

Mother Nature will have the last word. “It’s a weather market,” said Tom Saal, vice president at FC Stone Latin America LLC. “People are thinking its going to be an El Nino winter and temperatures are going to be above normal the whole winter. That is what pushed the prices down below $2.

“But now I was in Chicago this week and I can attest to people are burning gas. There is demand. We got some cold weather and the market reacted to that, and if we get more cold weather it will react to that as well. This may be the beginning of somewhat higher prices. Any unfilled expectations of an El Nino winter will lead to higher prices.

“The market is expecting an El Nino winter, warm temperatures, not much demand, low withdrawals and lots of gas in storage at the end of the season.

“I always look for extremes in the Commitments of Traders reports. It shows speculators are net short, and they are the culprits for these lower prices. If they can’t make any money being short, then they will cover. That’s what you look for,” Saal said.

He added that Friday’s price action was key, and if the market could end trading at the high end of the week’s range, that would be an indicator of higher prices next week.

Prior to the 10:30 a.m. release of the data it looked as if the markets might finally have to deal with the season’s first triple-digit storage draw, but even that was expected to fall far short of historical metrics. The market was expecting right around a 100 Bcf withdrawal to be reported, but last year 116 Bcf was pulled and the five-year rate comes in at 129 Bcf. Stocks currently stand at 3,756 Bcf, and if inventories are to be whittled down to a seemingly manageable 2,000 Bcf by the end of March, 135 Bcf will have to be withdrawn weekly.

PIRA Energy was expecting a withdrawal of 100 Bcf, and industry consultant Genscape calculated a 104 Bcf pull. A Reuters survey of 20 industry cognoscenti revealed an average 99 Bcf decline with a range of -84 to -118 Bcf.

Industry consultant Bentek Energy calculated a 101 Bcf draw utilizing its flow model and said there might be low-side risk to the number “as lingering holiday effects may have lead to some overestimation of demand, though it is unclear what the magnitude of the overestimation may have been, given the already lower than average demand.”

Using the 5-region format inventories now stand at 3,643 Bcf and are 535 Bcf greater than last year and 464 Bcf more than the five-year average. In the East Region 19 Bcf were pulled, and the Midwest Region saw inventories fall by 42 Bcf. Stocks in the Mountain Region were down by 10 Bcf and the Pacific region was lower by 25 Bcf. The South Central Region, closely similar to the former Producing Region, shed 17 Bcf.

A top trader is looking to position himself to play the downside. “[A]lthough temperature moderation is being forecasted beyond next week, there are no significant warming trends on the horizon that appear sufficient to spur much selling interest. While an argument can be made that the current supply surplus of 465 Bcf is enough to cushion occasional up spike in HDDs, this heavy usage cycle is not far enough advanced to diminish the impact of the weather factor,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments to clients Thursday.

“The market is also looking ahead to some much larger stock draws that could total more than 350 Bcf during the next couple of weeks combined. From a technical perspective, today’s advance above our expected resistance at $2.38 would appear to set this market up for further gains to the $2.45 area. But we have shifted back into a bearish posture per [Thursday’s] advance to above $2.38, and we would suggest holding any short positions with protection above the $2.50 level. Ultimate downside possibilities still exist to around the $2 mark but are unlikely until next month.”

In Friday’s trading buyers weren’t taking any chances in acquiring supplies of weekend and Monday gas. Weather forecasts called for a frosty start to the week, and in major eastern markets restrictions helped boost prices by close to $1.

The NGI National Spot Gas Average added a stout 18 cents to $2.48, and next-day quotes in the East averaged gains close to 50 cents. Futures continued their grind higher, and at the end of the day February had made a new high for the move and settled 9.0 cents higher at $2.472 and March had gained 7.7 cents to $2.471. February crude oil sank 11 cents to $33.16/bbl.

Weekend and Monday prices for gas into the New York-Philadelphia area jumped as traders had to deal with and early-week compressor failure on Texas Eastern and the resultant process of restoring linepack. Early in the week a compressor in Texas Eastern’s M-3 market zone in central Pennsylvania went out for several hours, and although it is now back online, “linepack will need to be restored, which will limit TETCO’s ability to deliver gas in excess of nominations. The event could trigger moderate volatility around the M3 hub as flows through Entriken have been in excess of reported operational capacity in recent days,” Genscape said in a report.

Volatility was certainly in play for weekend and Monday gas, yet observers were optimistic that warmer weather might diminish demand in the area, which may alleviate pressure on over-nominations.

Gas on Texas Eastern M-3, Delivery was quoted a stout 86 cents higher at $2.45, and gas bound for New York City on Transco Zone 6 changed hands 60 cents higher at $3.21. Gas packages on Transco non-New York North, southeastern-most Pennsylvania and southern New Jersey surged 84 cents to $3.01.

California traders are warily eyeing developments at the SoCal Gas Aliso Canyon Storage Facility within the greater Los Angeles area. A leak detected at the facility’s injection site on Oct. 23 has led to above-average withdrawals this winter in attempts to reduce pressure and mitigate the leak. Previous attempts to plug the well were unsuccessful, and a relief well being drilled by SoCal is not expected to be completed until later this winter.

“The market impact depends on how Aliso Canyon affects southern California’s ability to import gas. If you are de-rating northern and southern zone import capacity then that can affect the relationship between SoCal Border Avg., El Paso Mainline and the SoCal Citygate system,” said an analyst with EnergyGPS, a Portland, OR-based power and natural gas market and consulting firm.

“If you can’t move gas from the Border into SoCal Citygate, then there will be a decoupling of those prices.”

That decoupling may have already begun. The SoCal Border Avg. winter 2016-2017 strip jumped some 18 cents during the week alone, settling at $3.16 on Jan. 7, as California Gov. Jerry Brown declared a state of emergency, forcing the evacuation of more than 2,000 residents from the Porter Ranch neighborhood atop the Aliso Canyon field.

The 2016-2017 winter strip sat Oct. 23 at $2.98, according to historical NGI data.

Rick Margolin, senior natural gas analyst for Genscape, said concerns are mounting the Aliso Canyon storage field — the largest on SoCal’s system and one of the largest in the country — will have to be abandoned.

“Summertime flows from inbound supply sources (El Paso, Transwestern, Baja Path, etc.) will likely decline as less of that gas could go to storage refilling. But dependence on flowing supply will likely increase in winter due to less storage available for withdrawals,” Margolin said.

Gas for weekend and Monday delivery at Malin rose 9 cents to $2.60, and deliveries to PG&E Citygate gained 2 cents to $2.82. Gas at the SoCal Citygate also added 2 cents to $2.81, and packages priced at the SoCal Border Average jumped 12 cents to $2.65. Gas on El Paso S. Mainline/N. Baja rose 14 cents to $2.68.

Other market hubs posted solid gains. Deliveries to the Chicago Citygate rose 17 cents to $2.59, and deliveries to the Henry Hub added 12 cents to $2.47. Gas at Opal tacked on 10 cents to $2.56, and parcels on El Paso Permian rose 15 cents to $2.47.

Weather forecasters are not convinced of the return of El Nino-like weather patterns over the last half of January. Natgasweather.com in a Thursday midday update said, “After the Midwest and eastern U.S. warms back above normal through Saturday, a frigid polar blast will gradually begin pushing through the central U.S., and eventually into the East early Monday. A second reinforcing shot of polar air is expected Tuesday, with the track very important and likely to shift slightly before arriving. The combination of the two will drive around five days of strong heating demand.”

The forecaster also said it is expecting a brief milder break late next week or the following weekend as the cold pool over Canada reorganizes around Jan. 16-19 and a strong Pacific jet stream approaches the West Coast. However, this could play out to be be a trap for model followers. The Pacific jet very well could ease or shift slightly, providing opportunity for cold Canadian air to surge right back into the north-central U.S. Therefore, coming weather patterns are going to be critical for the last 10 days of January to see if a tease in milder temperatures around Jan. 16-19 turns into a trap with subfreezing temperatures returning shortly after.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |