NGI The Weekly Gas Market Report | E&P | NGI All News Access

Haynesville, Marcellus/Utica Seen Most Susceptible to Rig Departures

Analysts at U.S. Capital Advisors on Thursday published a 78-page slide deck outlining their views on the year ahead, including what’s in store for drilling activity across the various plays. Among other things, the analysts looked at operator debt burdens by play as a potential signal for where things are heading.

Exploration and production (E&P) companies with high-yield debt are seen to be most at risk for dropping rigs, and their presence is not equivalent from one play to the next.

“…[W]e screened for rigs being run by E&Ps with publicly traded debt yielding north of 10%,” U.S. Capital said. “We count 122 rigs operated by what the market is considering higher-risk balance sheets, which represents about 17% of the current total U.S. drilling rig count.

“The Haynesville and Marcellus/Utica stand out as having the most risk of further rig deterioration as elevated debt yield operators account for about 50% of respective rig counts, followed by the Bakken at about 30%. Permian stands out as the lowest incremental rig risk with 7% of rigs operated by high debt yield E&Ps.”

Operators’ stronger financial position in the Permian jibes with the recent staying power of activity there as well as findings by IHS, which looked recently at well economics and productivity in the play (see Shale Daily, Jan. 7). U.S. Capital noted the permitting activity in the Permian’s Northern Delaware Wolfcamp.

“While the bulk of resource play activity is in retreat, one of the few areas bucking the trend is the Wolfcamp Shale in the northern part of the Delaware Basin,” U.S. Capital said.

“Specifically, Northern Delaware Wolfcamp permits have increased from fewer than five issued per month in June 2014 to 20 issued in December 2015. We see 2016 as a year of further Wolfcamp delineation, which should provide a better understanding of both aerial and zonal prospectivity, setting up for potential inventory upgrades heading into 2017.”

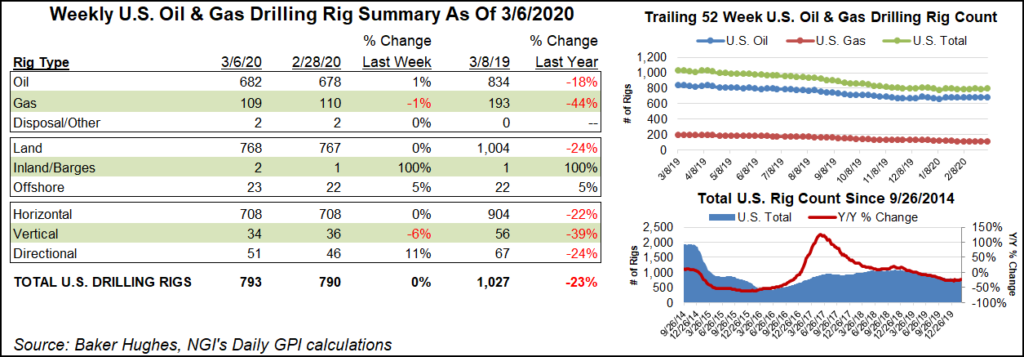

The U.S. rig count dropped by a net of 34 units in the first Baker Hughes Inc. tally of 2016. Eighty-three rigs returned to the hunt in Canada, but this sort of stampede is typical for the new year/post-holiday period. Look for U.S. rigs to keep dropping in the months ahead under the weight of depressed commodity prices, analysts have been saying.

The latest Baker count has the total number of active U.S. rigs at 664, with 515 directed at oil and 148 focused on natural gas. The vast majority, 635, are on land. Twenty oil units left the game, joined by 14 natural gas rigs. Thirty horizontal units fell, along with eight vertical rigs, but four directional units returned.

In the latest Baker tally, Texas was by far the biggest loser among states, giving up 13 rigs, while the Permian lost eight units, the biggest loser among plays. However, the Permian rig count is still up there at 209 compared with other plays whose rig counts only chart in the double digits.

In Canada, Baker Hughes said the dramatic return of 83 rigs was typical. “This is the normal increase after the holidays,” Alondra Oteyza, investor relations director, said in an email. “If you look at prior years, you will see a similar increase in early January.”

The Canada count was up by 100% overall, with Saskatchewan up by 1,600% and Northwestern Alberta up by 600%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |