Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

E&P Capex Outlook Grimmer, With U.S. Spending Possibly Falling 40-50%

Oversupplied oil and natural gas markets, now coupled with sharply declining oil prices, are setting up a dismal year for capital spending by exploration companies, with domestic operators possibly cutting their spend plans by as much as half from 2015, analysts said this week.

The hope that capital expenditures (capex) by the exploration and production (E&P) sector would increase this year is becoming less likely, one analyst said. The bottom line is simple, he toldNGI’s Shale Daily. If commodity prices were to rise, spending would follow, but at current prices, that scenario is tentative at best.

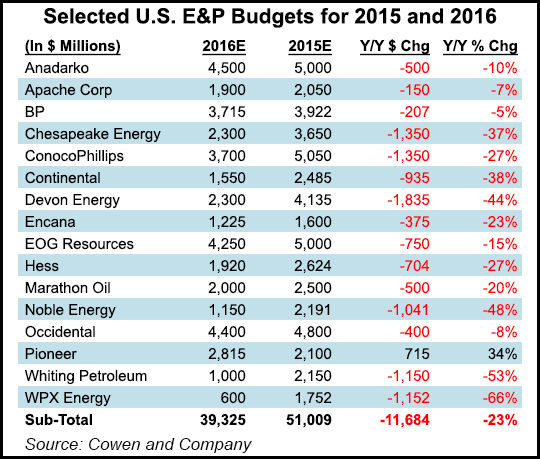

Cowen and Co. LLC this week issued The Original E&P Spending Survey, the signature report by analyst Jim Crandell, who initiated it in 1982. Worldwide capex plans were reviewed for 450 companies, with analysts asking detailed questions about the composition of budgets and strategic shifts. For 2016, it’s going to be a slice and dice world for the E&Ps.

“In the U.S., the 185 companies that we surveyed are planning an average decrease in their upstream capital expenditures of 24% to $89.6 billion,” Crandell said. “In Canada, we estimate that the 103 companies that we surveyed are budgeting upon a 22% decline.

“The cuts in U.S. E&P spending are broad-based and driven by reduced cash flows and uncertain economics. Under a 24% decline in spending, we estimate the average U.S. onshore rig count will fall by 29% in 2016, to exit the year at 660. We forecast completion activity will drop by 24% for the calendar year of 2016.”

Global capex is estimated to decline by 17% this year to $447 billion, but the estimate is based on $48.50/bbl West Texas Intermediate (WTI). International spend is expected to decline by less than in North America.

“We did notice that the companies that were among the later ones to respond to our survey used a bit lower oil prices,” Crandell said. “Because of the small difference, we treated Brent the same as WTI.”

The latest findings represent the “largest two-year declines” in North American (NAM) and international spending since the survey began more than three decades ago. There are “cutbacks across the board,” but “smaller companies are cutting back far more substantially.”

Domestic producers whose capex budgets are less than $50 million are reducing spending by an average of 63%, while the largest spenders — those with budgets of more than $1 billion — plan to cut spending by 20%. Canadian E&P spend is similar, with overall reductions of 22%. The companies spending under $50 million in Canada now are planning to reduce their budgets by 41% year/year, while the $1 billion-plus spenders see capex down by 19%.

The oil majors whose businesses are concentrated in NAM — BP plc, Chevron Corp., ExxonMobil Corp. and Royal Dutch Shell plc — are seen reducing their capex on average by 10% from 2015.

“We forecast a 20%-plus coming from Chevron, but single-digit declines at BP, ExxonMobil and Royal Dutch Shell,” Crandell said.

If oil prices were to stay at current levels, more capex reductions are likely. The “most common answer” to Cowen’s survey for what average oil price would cause E&Ps to reduce capex was $40/bbl.

“Since we are below these levels going into the year, it seems to us that there is a good chance of further reductions,” Crandell said. Most of the E&Ps surveyed (60%) said it would take a $60/bbl oil price to get them to increase spending; 21% said a $55 price would trigger a bump.

Based on the analysis by Cowen colleague Marc Bianchi, “this spending scenario would result in a year-end 2016 rig count of about 660 versus 685 today and an average 2016 rig count of 666 — down by 29% versus calendar 2015,” Crandell said. “The difference is increased capex per rig. Well counts would perform a bit better, down by 24% for calendar 2016.

“Assuming a 30% spending cut, rigs would need to fall by 75, exiting at 610 with well counts down by 28% for the calendar year.”

E&Ps have changed their thinking about “important technologies,” the Cowen survey noted.

“In recent years it has been a battle between horizontal drilling and fracturing/stimulation for the top spot,” Crandell said. “They were joined this year by reservoir recovery optimization. Other notable gainers included deepwater technology and intelligent well completions.

“It should be of no surprise that the majority of companies in every category called the economics of drilling poor. The one surprise was that there were both independents and majors who called the economics of drilling in the U.S. excellent.”

Evercore ISI’s James West said the E&Ps now are “at oil’s mercy.” West and his analyst team issued an updated capex forecast this week one month after publishing initial findings — all because of the decline in oil prices. Evercore’s initial survey estimated NAM capex would fall by 19% year/year, with U.S. spend down 20% to less than $100 billion total. Today’s projections at today’s oil price are grimmer.

“Our initial expectation was formed with E&P companies budgeting WTI prices at $47.60/bbl, roughly 29% above the current spot price and 17% above the current calendar ’16 strip price,” West said. A “record 74% of operators surveyed originally had selected oil prices as the key determinant of 2016 budgets, followed by cash flow at 59%. In addition, nearly 80% of companies we surveyed are expecting to spend within cash flow this year, up sharply from just 55% in 2015.”

More than half of the companies had stated they would decrease spend if WTI “remained below $40/bbl. Given continued weakness in the underlying commodity, we believe initial 2016 NAM budget announcements over the coming one to two months may amount to as much as 40-50% annual reductions — significantly steeper cuts than forecasted less than one month ago.”

Many E&Ps are “largely at the mercy of the commodity with under-hedged books,” according to West. Evercore analyst Stephen Richardson recently noted that 2016 hedged crude oil volumes stood at 27% at the end of December for his coverage universe of independent producers, while operators hedged only 6% of 2017 volumes.

“With laser focus on spending within cash flow, initial 2016 upstream budgets are now unlikely to start down just 15-20% in North America as WTI crude oil lingers below $40/bbl,” West said.

The “bear scenario would remove an incremental $65 billion of upstream spending this year. Assuming a 45% sequential NAM spending decline and a 15% international spending decline, global upstream capex would post a 23% year/year decline during 2016 compared to our initial forecast for a global spending decline of 11%,” which could “effectively remove an additional $65 billion of global upstream spending from this year’s market.

“However, as oil market fundamentals likely improve heading into second half of 2016, we think upward revisions to budgets, particularly for North America, should unfold. One caveat is that consolidation among the majors, which is increasingly likely in a more sustained low oil price environment, could present risks to increased overall spending levels.”

Whichever way the energy industry considers 2016, it looks to be a challenging year, said U.S. Capital Advisors analysts Cameron Horwitz and Omar Zakaria. The “pain trade has to spill over into the New Year. We think ’16 will be a period of capitulation, marked by the rationalization of high-cost supply sources that are no longer needed and a broad-based hunkering down of even the best asset/strongest balance sheet operators.”

The first six months “will invariably be painful,” they said. However, with “massive efficiency gains and cost structure improvements, we see E&Ps with core asset bases coming out of the ’16 abyss in position to more competently compete for global market share.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |