NGI Data | Markets | NGI All News Access

NatGas Futures Jump a Dime Following Stout EIA Storage Figures

Natural gas futures surged Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was significantly greater than what the market was expecting.

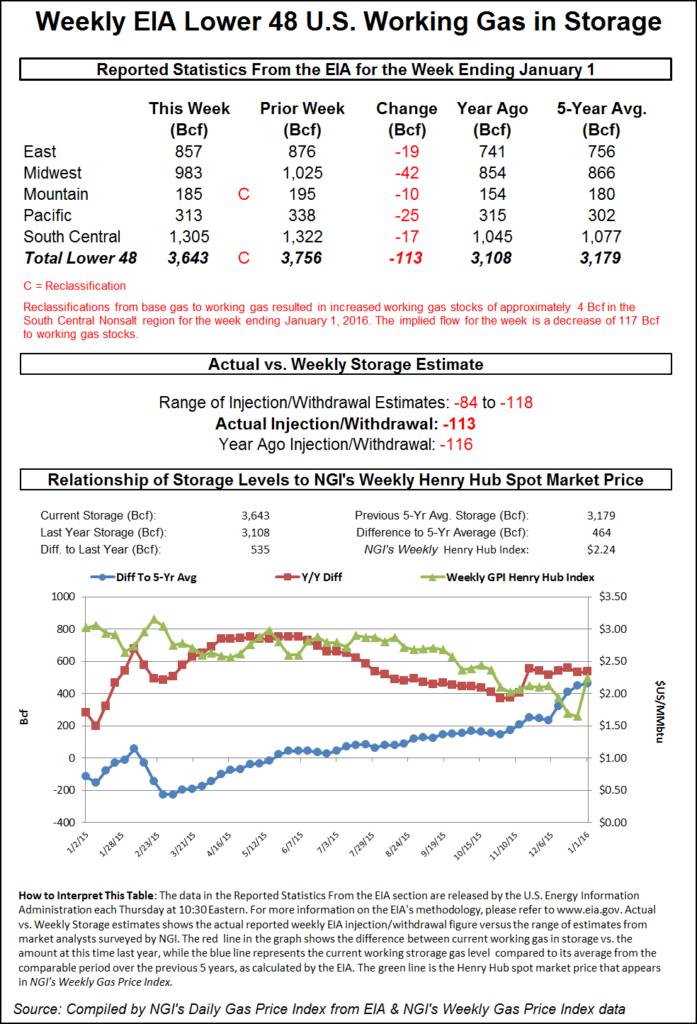

EIA reported a 113 Bcf withdrawal in its 10:30 a.m. EST release for the week ending Jan. 1, but also noted a 4 Bcf reclassification from base gas to working gas, thus making the pull that much greater. The withdrawal put inventories at 3,643 Bcf. February futures rose to a high of $2.378 following the release of the storage data, and by 10:45 a.m. February was trading at $2.366, up 9.9 cents from Wednesday’s settlement.

Prior to the release of the data, analyst estimates were in the 100 Bcf area. PIRA Energy was looking for a pull of 100 Bcf, and a Reuters survey of 20 traders and analysts showed a range from -84 to -118 Bcf with an average -99 Bcf. Citi Futures Perspective calculated a 95 Bcf withdrawal.

“We were hearing a number of 99 Bcf, so this was a clear surprise,” said a New York floor trader. “We were trading slightly higher at the time, so it made a good run up of about 8 cents.”

Tim Evans of Citi Futures Perspective saw the figure as “significantly more than expected, even after the DOE moved 4 Bcf from working gas into the base gas category. This implies either some moderation on the supply side of the market or a greater sensitivity to declining temperatures than anticipated. Some of this should carry over into stronger expectations for the reports to follow.”

Inventories stand at 3,643 Bcf and are 535 Bcf greater than last year and 464 Bcf more than the five-year average. In the East Region 19 Bcf was pulled, and the Midwest Region saw inventories fall by 42 Bcf. Stocks in the Mountain Region were down by 10 Bcf, and the Pacific Region was lower by 25 Bcf. The South Central Region shed 17 Bcf.

Salt cavern storage was up 1 Bcf to 379 Bcf, while the non-salt cavern figure fell 19 Bcf to 925 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |