Weak Northeast NatGas Offsets Broader Gains; Futures Slide 6 Cents

Physical natural gas for Thursday delivery fell modestly in Wednesday trading, in spite of hefty declines posted at eastern points. Outside of the Northeast, gains of a few pennies to a nickel were common, but at the end of the day the NGI National Spot Gas Average fell 4 cents to $2.38.

The Northeast fell about a quarter on average as near-term, above-normal temperatures and a low power price environment scuttled any price advance. Futures worked lower as traders focused on the likelihood of a late-January return of market-crushing El-Nino weather patterns.

At the close, February had given up 5.8 cents to $2.267, and March was off 5.7 cents to $2.289. Crude oil continued to collapse, and February futures tumbled $2.00 to $33.97/bbl. Brent crude oil traded at its lowest level in 11 years.

Gas at New England points was generally lower as eastern and Midwest temperature forecasts gave little hint at the need for incremental supplies. Wunderground.com predicted Wednesday’s high in Chicago of 38 would hold Thursday and rise to 43 Friday, 11 degrees above normal. Philadelphia’s 41 high on Wednesday was seen making it to 43 Thursday and 46 by Friday, 6 degrees above normal.

Gas at Algonquin Citygate fell 81 cents to $4.76, and gas on Tenn Zone 6 200L fell 2 cents to $4.61. Actively traded Iroquois, Waddington gas shed 31 cents to $2.75.

Deliveries to Texas Eastern M-3, Delivery came in 71 cents lower at $2.30, and gas bound for New York City on Transco Zone 6 skidded 60 cents to $3.01.

Next-day power prices also gave little encouragement to those seeking gas for power generation.

Intercontinental Exchange reported that on-peak power at the PJM West terminal fell $5.26 to $31.50/MWh, and peak power Thursday at the ISO New England’s Massachusetts Hub declined $12.68 to $45.11/MWh. Next-day power at the New York ISO’s Zone G (eastern New York) retreated $7.64 to $40.93/MWh.

Next-day gas in the Midwest made small gains, while next-day power eased slightly. Intercontinental Exchange reported that on-peak power at the Indiana Hub for Thursday fell $1.62 to $26.13/MWh.

Gas on Alliance added 4 cents to $2.41, and parcels at the Chicago Citygate were quoted 6 cents higher at $2.42. Deliveries to Consumers rose 3 cents to $2.44, and gas on Michigan Consolidated changed hands 2 cents higher at $2.42.

In California, prices rose modestly as forecast power loads for the most part held steady. The California Independent System Operator reported that peak power demand Wednesday was expected to reach 30,839 MW and ease slightly to 30,181 MW Thursday.

Gas at Malin rose 2 cents to $2.50, and deliveries at the PG&E Citygate rose 6 cents to $2.82. Gas at the SoCal Citygate was quoted a penny higher at $2.71, and packages on El Paso S. Mainline/N. Baja rose a nickel to $2.58.

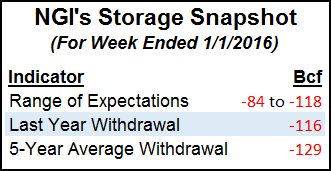

Traders Thursday will be eyeing their trading screens when the Energy Information Administration (EIA) storage report is released at 10:30 a.m. EST. Supplies currently stand at a plump 3,756 Bcf, 448 Bcf above than the five-year average. Traders will be looking for any sign that increased coal-to-gas switching or lower production because of producer shut-ins might increase withdrawals above expectations.

Last year 116 Bcf was withdrawn, and the five-year pace is for a 129 Bcf pull. Forecasts aren’t coming close to those numbers.

Citi Futures Perspective is looking for a pull of 95 Bcf, and a Reuters survey of 20 traders and analysts revealed a sample mean of -99 Bcf with a range from -84 Bcf to -118 Bcf. Pira Energy calculated a 100 Bcf decline, and Genscape Inc. is predicting a 104 Bcf withdrawal.

Weather models have changed little, with the pattern of near-term warmth giving way to an intense cold blast.

“No major changes” were made to the Wednesday for the six- to 10-day period, “which continues to feature very cold temperatures in the Midcontinent,” said MDA Weather Services. “Several rounds of high pressure are forecast to dive into the region from Canada, bringing much below normal temperatures to the Midwest, with belows spanning into the South as well.

“While the Northeast holds on to seasonal readings in the composite, belows are expected to return there late. Cold air support comes from higher-latitude sources,” Arctic Oscillation/North American Oscillation), with the period “expected to feature the coldest air of the season thus far in the Midwest.”

MDA forecasters cautioned that risks include “uncertainty” in the “intensity of cold in this period, with risks being warmer as cold could underperform guidance. The European model brings warmer risks to Texas in the second half.”

Harrison, NY-based Bespoke Weather Services in its Wednesday morning report said, “all models struggle to determine just how significant the influence of the El Nino is as we move into the second half of January.”

Market technicians see the move higher still intact.

United ICAP market technician Brian LaRose said he was still pegging “$2.385-2.457 as the gatekeeper to higher prices…” If there’s a bust through, “the bulls have room up to $2.667 next” but if they “fail to clear this narrow band of resistance…a deeper retracement of the $1.684 to 2.387 advance becomes possible near term.

“At this time we will be counting any deeper pullback as corrective in nature, not a resumption of a down trend,” LaRose said.

For adherents of Market Profile, it was time to implement the Monday-Tuesday trading rule for weekly price targets. Tom Saal, vice president at FC Stone Latin America LLC, said to look for the market to test Tuesday’s value area at $2.289 to $2.263 before moving on and testing a second value area at $2.229 to $2.199.

The Monday-Tuesday rule requires traders to follow a market breakout of the initial balance, $2.376 to $2.257, either higher or lower. Saal placed trading targets higher at $2.493 and $2.434, and trading targets on the downside at $2.198 and $2.134.

February futures traded as low as $2.241.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |