Utica Shale | Marcellus | NGI All News Access

Consol Keeping 2016 Drilling Plans Flexible

Consol Energy Inc. on Wednesday sharply reduced its exploration expenditure plans and said spending would remain flexible as it continues responding to the commodities downturn, with no decision expected on reviving its idled drilling program until mid-year and making clear its production guidance would be a moving target.

The company said last July it would likely budget $400-500 million this year for its exploration and production (E&P) division, but it trimmed that figure further on Wednesday to $205-325 million. Consol said the lower end of the budget reflects capital associated with completing 37% of its well inventory, while the higher end could include “adding back a modest level of drilling activity.” At the end of last June, the company idled its two-rig program and stop drilling wells until 2017 (see Shale Daily, July 29, 2015).

“The extent of drilling activity in 2016, if any, will primarily be a function of rates of return and commodity prices, and the assessment of the dry Utica wells drilled in 2015,” Consol said. “The company expects to make a decision regarding drilling capital allocation before mid-year 2016.”

The company tested its Gaut 4IH Utica Shale well in Westmoreland County, PA, last year at more than 61 MMcf/d and had planned to turn more attention to its Utica assets. But the company still has a backlog of wells in the Marcellus Shale. This year’s plans call for completing 18 of its 29 operated drilled but uncompleted (DUC) Marcellus wells and turning in line (TIL) 48 altogether. In the Utica, where Consol has one operated DUC, the company plans to TIL five operated wells. It also plans to TIL 47 coalbed methane wells this year.

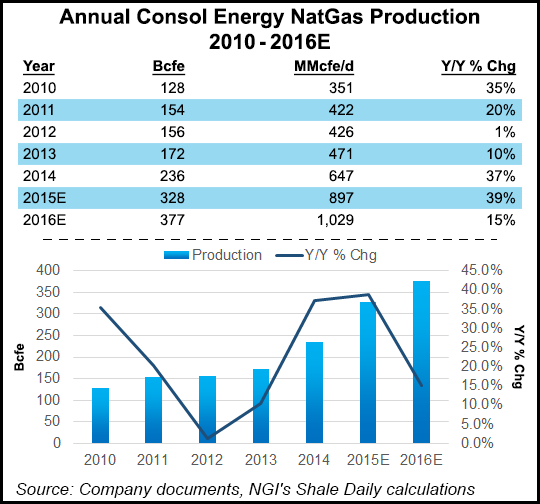

While it offered no update on 4Q2015 production and no concrete production guidance for the year, Consol said its operated and nonoperated TIL schedule is weighted toward the first half of 2016, and production volumes should grow by 15% from 2015 levels to 377 Bcfe. The company also said that it would defer wet gas completions until 2017, but offered no other details.

In October, in an effort to raise more cash and deleverage its balance sheet, the company said it was marketing coal and natural gas assets valued at up to $2.3 billion (see Shale Daily, October 27, 2015). Some coal assets have been sold since, but the company offered no update about those efforts on Wednesday.

Overall, Consol said its 2016 budget could include $110-210 million for drilling and completion activity; $40-50 million for midstream infrastructure and $55-65 million for land, permitting and business development. CEO Nicholas Deluliis said Consol expects an average rate of return on this year’s capital spending of more than 30%, which could go higher on drilling efficiencies if the program resumes.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |