Shale Daily | NGI All News Access | NGI Archives

U.S. NatGas Industry’s ‘Exuberance’ Waned in 2015, Survey Says

Safety, aging infrastructure and environmental regulation ranked as the top three issues facing the natural gas industry in 2015, according to a group of industry stakeholders surveyed by Black & Veatch Insights Group.

Meanwhile, the 2015 survey showed less optimism about the potential for the industry’s near- and medium-term growth prospects compared with 2014.

The survey responses, detailed in the firm’s 2015 Strategic Directions: U.S. Natural Gas Industry Report, were collected from a range of upstream, midstream and downstream stakeholders from July 23 through Aug. 19. Of the 404 participating, 77.2% identified as natural gas services providers, such as producers and pipeline operators, while 22.8% identified as industry providers, including consultants, equipment and service providers, law firms, financial institutions and others.

Other major industry issues identified in the 2015 survey included economic growth, available pipeline capacity, gas supply reliability, rate and regulatory certainty and electric-gas interdependency, among other issues.

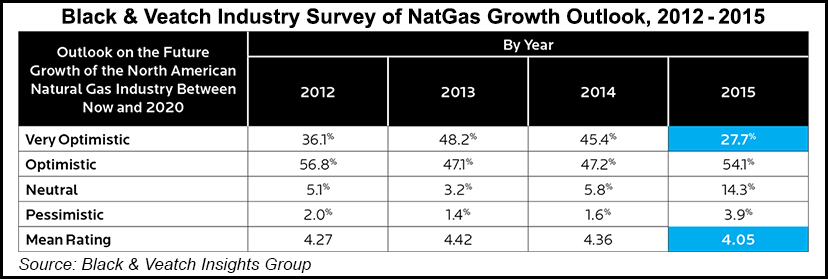

Rating their outlook for industry growth between last summer, when the survey was conducted, and 2020, 27.7% of respondents said they were “very optimistic,” with 54.1% “optimistic” and 14.3% “neutral.” That compares with 45.4% “very optimistic” in 2014, with 47.2% “optimistic” and 5.8% “neutral.”

“While the majority of survey respondents remain optimistic about the future growth of the North American natural gas industry between now and 2020, mean importance ratings were also significantly lower compared to previous years,” Black & Veatch wrote. “What is clear is that the exuberance of 2014 is waning. In its place is a more cautious optimism buoyed by an expectation that LNG [liquefied natural gas] exports and natural gas-powered electric generation — along with opportunities in transportation — will fuel industry growth, but pricing will remain depressed by historical standards.”

Electricity generators and LNG exports were rated as the top two growth markets for natural gas in the survey, with 32% of respondents pointing to exports to Mexico as another prospect for growth.

Respondents were also asked about the impact of proposed regulations on the industry, namely the Environmental Protection Agency’s (EPA) Clean Power Plan (CPP), proposed rules on methane emissions from oil and gas development and transportation rule updates by the Pipeline and Hazardous Materials Safety Administration. Black & Veatch said the industry now finds itself “caught between the potential implications of the CPP and methane rules.”

On a five-point scale, where five means “very positive” and one means “very negative,” respondents rated the industry impact of EPA proposals to limit carbon dioxide emissions from new and existing power plants at 3.69 and 3.72 respectively. U.S. international commitments to limit greenhouse gases rated a 3.27, while proposed cuts on methane emissions from the industry rated a 2.81.

Regulatory uncertainty was also identified as a major barrier to constructing pipeline capacity in 2015, with 68% of respondents citing it as a chief concern, compared to 57.1% in 2014. The survey showed an increased concern over delays from opposition groups in 2015, with 78% of respondents pointing to the uptick in protests and obstructionism as a major barrier to pipeline expansion, up from 71.4% in 2014.

“Environmental activists have recently turned their attention to FERC’s extensive pipeline siting process as an opportunity to slow or block projects,” Black & Veatch said. This environmental opposition to Federal Energy Regulatory Commission proceedings “creates additional hurdles for maintaining project timelines and has the potential to derail pipeline projects because of rising development costs and missing key milestones in contract obligations.”

That said, the 2015 survey found less urgency to add incremental pipeline capacity than in 2014.

“The urgency for adding incremental capacity dropped off in every major market area — by nearly 18 percentage points for New England, 14 points for the Mid-Atlantic and nearly 10 for the West Coast,” the firm said, offering various explanations for the shift in the responses.

“It may be that respondents perceived ”incremental’ as something in addition to the various major projects that have already been announced. There has also been conflicting information, particularly coming from New England, where different studies have frequently come to different conclusions about the need for capacity. Or, it may be that the announcement of numerous pipeline projects has calmed the anxiety of the industry as attention is focused on securing regulatory approvals for the proposed projects.”

The majority of respondents (60.2%) identified the Appalachian Basin as likely to be the most prolific gas-producing region in North America in 2020, with 9.6% saying the Gulf Coast would be the most prolific and 6.6% choosing the Permian Basin. Respondents identified a “need for incremental takeaway capacity in the Mid-Atlantic market” that centers around this “projected growth of the Marcellus and Utica shales,” according to Black & Veatch.

The report also highlighted changing strategies among utilities as they adjust to the growing demand for natural gas. Black & Veatch noted that “some utilities are exploring new business models that include ownership on the production side. Others, such as Atlanta-based electric utility Southern Company, have looked to acquisitions as a path to expand pipeline capacity and secure supply.”

A growing number of local distribution companies (LDC) are participating “in new pipeline projects upstream of the city gate,” Black & Veatch said. Meanwhile, more LDCs are securing accelerated cost recovery mechanisms from regulators to support distribution pipeline replacements to improve system resiliency and address aging infrastructure, the firm found.

Of the LDC participants surveyed, 63.1% reported having such a cost-recovery mechanism, compared with 53.7% in 2014 and 46.3% in 2013, “a clear signal these mechanisms are becoming even more prevalent,” the firm said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |