Regulatory | NGI All News Access

Sempra, Pemex Respond to Mexican Regulators’ Antitrust Concerns

San Diego-based Sempra Energy said Monday that its Mexican subsidiary and Mexico’s national energy company, Petroleos Mexicanos (Pemex), will push ahead to salvage the unit’s buyout of Pemex’s 50% interest in a joint venture.

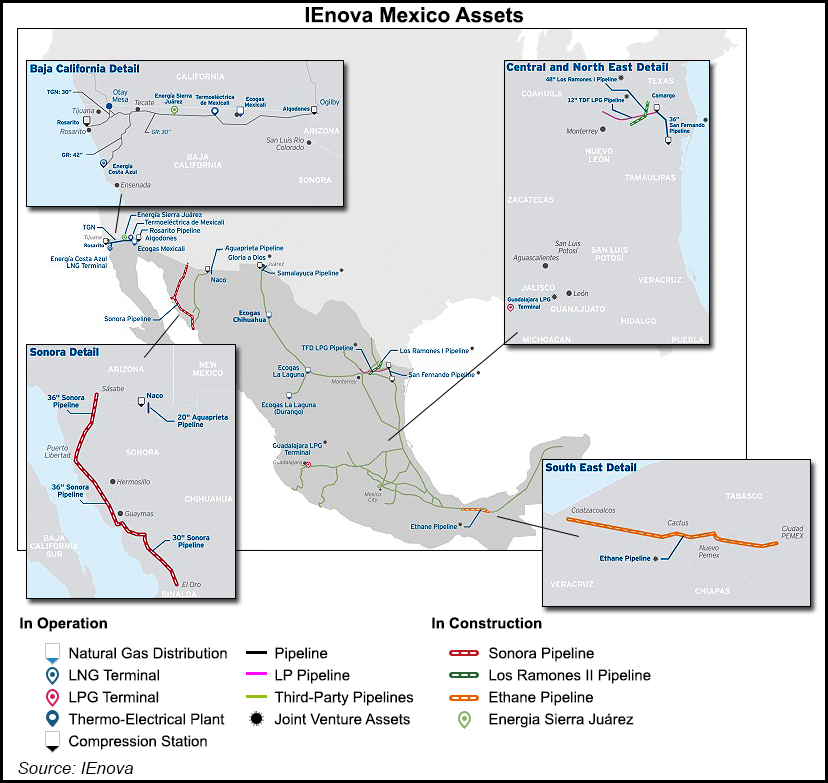

Infraestructura Energetica Nova, SAB de CV’s (IEnova) buyout of Pemex’s interest in Gasoductos de Chihuahua joint venture has been challenged by Mexico’s antitrust commission, the Comision Federal de Competencia Economica (COFECE). The transaction was among a quintet of buyouts announced this summer, valued at $1.325 billion, which included three natural gas pipelines, an ethane pipeline, and liquid petroleum gas pipeline and storage facilities (see Daily GPI, Aug. 3).

Based on past antitrust rulings on Pemex’s indirect ownership of the TDF propane pipeline and the San Fernando pipeline, COFECE concluded that the assets must be offered by Pemex in a competitive bidding process.

There was no objection to IEnova’s acquisition of the assets on a market concentration basis, a Sempra spokespersons said.

“The parties are in the process of restructuring the transaction so that Pemex can proceed with a bidding process on these two assets in accordance with the commission’s ruling,” the spokesperson said. “IEnova will have the right of first refusal and the right, as a partner, to approve the winning bidder.”

The bidding process and transaction restructuring are anticipated to be completed in the first quarter of 2016. They will be subject to satisfactory completion of the Mexican antitrust review and may require further approvals from Mexican authorities. Terms and conditions of the new deal are still being negotiated, the spokesperson said.

At the time the deal was announced, Sempra said that Pemex relinquishing a stake in infrastructure projects was not unprecedented, since it sold a 45% Mexican government-owned interest in the Los Ramones Norte pipeline to U.S. private equity firms BlackRock and First Reserve earlier this year (see Daily GPI, March 27).

IEnova and Pemex agreed in August to maintain a joint venture for the Los Ramones Norte pipeline project.

IEnova develops, builds and operates energy infrastructure projects in Mexico. At the end of 2014, it reported investments in Mexico were valued at about $3.5 billion.

“We look forward to working with Pemex to address the issues raised by Mexico’s antitrust commission,” said Sempra President Mark Snell. The Mexican subsidiary and Pemex will move ahead based on guidance from the Mexican regulators, Snell said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |