NGI The Weekly Gas Market Report | E&P | NGI All News Access

Two Gas Rigs Come Back, But Outlook Is For More Declines

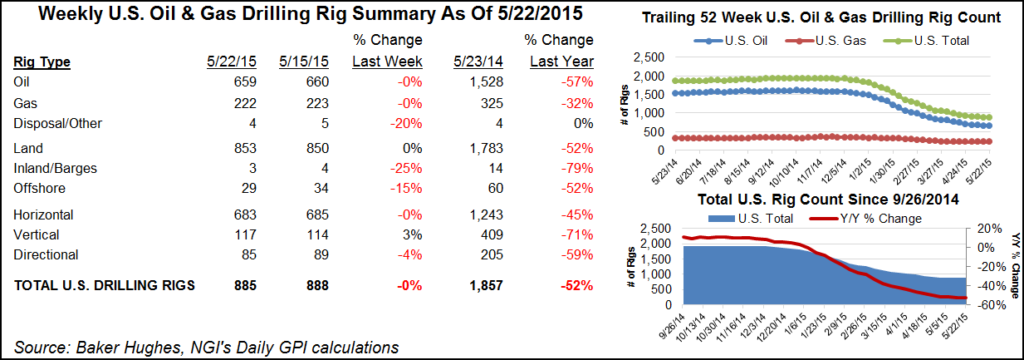

The pace of decline in the number of active U.S. drilling rigs has slowed a bit, according to the most recent count, but there is still further to fall if the comments of producer and service company executives are a guide.

The United States saw a net loss of four rigs in the most recent count by Baker Hughes Inc. released Friday, Nov. 6. According to the count, four U.S. land rigs were lost along with one rig in the offshore; one rig was added in the inland waters. The U.S. count now stands at 771 rigs. Six oil rigs were lost in the United States, but two gas rigs returned. Five directionals and seven verticals left the game, but eight horizontals came back.

New Mexico was the biggest loser among states, giving up five rigs, while the Cana Woodford lost four rigs, making it the biggest loser among plays. Texas actually added a rig this time around, and the Permian Basin gained three rigs while the Eagle Ford gave up three. The Haynesville, Marcellus, Utica, Fayetteville, Ardmore Woodford and Denver-Julesburg/Niobrara all held steady with the prior week.

In Canada, the net loss was six rigs (five oil and one natural gas). Combined with the U.S. count, that made for a North American decline of 10, bringing the current tally to 956, just 41% of the year-ago level of 2,335.

The most recent peak-to-trough rig count decline is more pronounced than the previous three (see chart), according to Oklahoma-based Seventy Seven Energy, a provider of drilling, pressure-pumping and oilfield rental tools.

Based to what producers have been saying during third quarter earnings conference calls (producing more with less; focusing on high-grading and efficiencies while cutting budgets), it’s safe to expect that the rig count will decline further in the coming weeks.

Some oilfield service companies have said they expect the slowdown in drilling to continue into the first quarter of next year. Many of their clients have already blown through 2015 drilling budgets, these companies have said. Several operators have reported that they expect to slow down activity significantly after Thanksgiving through the end of the year. What is also noteworthy about the current cycle is the composition of the rig count, said NGI‘s Patrick Rau, director of strategy and research.

“The 60% rig decline is even more significant compared to prior cycles because of how many horizontal rigs have been laid down this time around,“ he said. “At the start of the 2008-2009 downturn, horizontal rigs accounted for only 31% of total operating rigs, and they were just 6-7% at the start of the two downcycles near the turn of the century.

“However, horizontal rigs made up a full 70% of all rigs in action when this current downcycle started last September. Those horizontal rigs are capable of generating higher producing wells than vertical and directional rigs, by and large, so I would argue the productive capacity of the rigs that have been idled this go-round is much greater than indicated by the simple 60% peak-to-trough decline, meaning the magnitude of this downturn is significantly greater than the previous three.”

For October, the average U.S. rig count was 791, down 57 from the 848 average in September and down 1,134 from the 1,925 average in October 2014, Baker Hughes said. The average Canadian rig count for October was 184, up one from the 183 in September and down 240 from the 424 in October 2014.

In the tally from the week prior, Baker Hughes said the U.S. count had fallen 12 to land at 775. Eleven U.S. land rigs were lost, and two gave it up in the offshore while one unit was added in inland waters (see Daily GPI, Oct. 30). Two rigs left the U.S. Gulf of Mexico. The departure of 16 oil-directed rigs was offset somewhat by the return of four natural gas rigs to yield the net loss of 12. Fourteen horizontal rigs left, as did one directional unit, but three vertical rigs came back.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |