NGI Data | Markets | NGI All News Access

Advancing Weather Lifts Cash NatGas; Futures Mixed

Physical natural gas for Thursday delivery staged a broad, double-digit advance in Wednesday’s trading as a strong cold-weather system was expected to pound Rocky Mountain locations and move eastward impacting the East by the weekend. Nearly all points posted double-digit gains, but the Rockies and Midcontinent held a slight edge to the Midwest and Gulf.

The National NGI Spot Gas Average rose 11 cents to $1.98. Eastern locations added about a dime.

Futures trading continued its lackadaisical pattern from Tuesday. December futures inched higher by 0.9 cent to $2.262, and January fell by 1.8 cents to $2.445. December crude oil shed $1.58 to $46.32/bbl.

The Midwest and Midcontinent posted some healthy gains as much cooler temperatures were forecast to impact the Rockies to Chicago, and eventually the East Coast by the weekend. AccuWeather.com forecast that Wednesday’s high in Denver of 57 would fall to 46 Thursday and 47 Friday, 5 degrees below normal. Omaha, NE was anticipated to see its high Wednesday at 73 and 70 on Thursday before dropping to 59 by Friday. The normal high this time of year is 56. Chicago’s Wednesday high of 73 and Thursday high of 70 was seen falling to 56 by Friday, 1 degree above normal.

Gas on Alliance jumped 15 cents to $2.22, and deliveries to the Chicago Citygate added 21 cents to $2.19. Gas on Consumers rose 8 cents to $2.24, and parcels on Michigan Consolidated were seen 18 cents higher at $2.43. Further south, gas on Rex Zone 3 at Moultrie interchange gained 17 cents to $2.05.

Gas in the Midcontinent wasn’t too far behind. Deliveries on ANR SW were quoted 24 cents higher at $2.02, and gas on Northern Natural Ventura gained 16 cents to $2.17. Gas at the NGPL Midcontinent Pool traded 14 cents higher at $1.97, and gas on Panhandle Eastern changed hands 17 cents higher at $1.86.

For the most part, major hubs were also higher. Gas at the Henry Hub rose 12 cents to $2.02, but gas at the Algonquin Citygates shed 24 cents to $3.95. Deliveries on Transwestern San Juan were seen 19 cents higher at $1.98, and packages at the PG&E Citygates rose 4 cents to $2.68.

Next-day power was mixed, with Midwest locations showing modest strength. Intercontinental Exchange reported day-ahead peak power at the Indiana Hub rose $2.12 to $30.13/MWh.

Eastern locations also were mixed. Next-day peak power at the New York ISO Zone G delivery point (eastern New York) fell $1.31 to $30.00, and at the ISO New England’s Massachusetts Hub next-day peak power fell $3.05 to $41.89/MWh. At the PJM West Hub, real-time peak power for Thursday added $3.40 to $37.16/MWh.

The change in temperatures and conditions will be a big departure from recent weather. “Soaking rain and accumulating snow will continue to accompany a sweep of dramatically cooler air over a large part of the West this week,” said AccuWeather.com meteorologist Alex Sosnowski.

“Temperatures will plunge 15-30 degrees F over much of the interior West as the leading edge of the cool air arrives. Ahead of and near the leading edge of the chilly air will be strong winds. The strongest gusts into Wednesday night will be focused on New Mexico and the central and southern High Plains.”

The list of cities Sosnowski expects will experience “their chilliest air in months” includes Los Angeles and Sacramento, CA; Phoenix and Flagstaff, AZ; Las Vegas; Salt Lake City; Portland and Pendleton, OR; Seattle and Spokane, WA; Boise and Pocatello, ID; Missoula and Great Falls, MT; Jackson, WY; and Aspen, CO.

Futures traders saw trading open higher Wednesday as longer term weather forecasters noted some cooling trends, but the overall warmer pattern hasn’t changed appreciably. Commodity Weather Group (CWG) in its morning six- to 10-day outlook showed increased coverage of below-normal temperatures extending in a broad arc from southeast Oregon to southwest Colorado to southeast Arizona.

“Some demand gain is noted…mainly due to some cooler changes in the South and West at times, but the six-10 day map looks warmer, thanks to progressing a warmer day from [the previous] 11-15 day. The 11-15 day itself is slightly cooler…but still favors a warm-dominated pattern focused toward the Midwest. Below-normal demand continues to dominate the first half to two-thirds of November in stark contrast to last year.

“Overnight models are mixed again: the European ensemble continues to show the warmest option for the six-10 day, and the upper-level pattern — especially on the Pacific side — still seems to support that warmer outcome the best. The last two European ensemble runs have pulled back some on the warm intensity for the 11-15 day, with more near normals on the map than before.

“We see some variability on the clusters at the end of the 11-15 day, but the best cool chances are mainly in the South and West,” said CWG President Matt Rogers.

Natgasweather.com’s Andrea Paltrinieri estimated a storage build for Thursday’s Energy Information Administration report at a relatively lean 51-53 Bcf compared to consensus estimates around 65 Bcf. She noted current bullish market factors at “a supply-demand balance with production below 71 Bcf [Tuesday] (at 70.7 Bcf), after Monday’s upward revision to 71.4 Bcf, and power burns, weather adjusted, running pretty strong at 24.4 Bcf, signaling a potential switch to gas for some generators.”

Bearish factors include “residential-commercial demand due to much warmer than normal temperatures over the Eastern two-thirds and along with high winds over Texas/ERCOT, which could cause a disappointing storage number for next week on an absolute basis.”

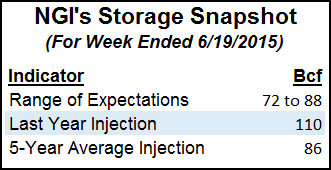

Thursday’s storage report marks the final report for the traditional injection season. Last year 90 Bcf was injected and the five-year pace is a 58 Bcf build. PIRA predicted a build of 57 Bcf, and industry consultant Genscape Inc. calculated a fill of 61 Bcf. A Reuters poll of 23 traders and analysts revealed an average 59 Bcf with a range of 52 Bcf to 69 Bcf.

Analysts, however, are looking for the injection season to carry well into November. Tim Evans of Citi Futures Perspective calculated an increase of 69 Bcf this week, but for the next three weeks, figures show combined injections of 145 Bcf reaching a season-ending total of 4,091 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |