Shale Daily | E&P | NGI All News Access

Shales Throwing Off Too Much Gas For Duke Energy to Resist

Two months after rival Southern Company announced an acquisition driven largely by shale gas abundance, Duke Energy announced a friendly takeout of its Charlotte, NC, neighbor and Atlantic Coast Pipeline project partner Piedmont Natural Gas.

Duke’s a $4.9 billion cash deal to acquire Piedmont would give it “a growing natural gas platform.” Including debt, the value of the deal is $6.7 billion.

Southern Company is in the process of acquiring AGL Resources, which is also a partner in Atlantic Coast (see Shale Daily, Aug. 24). Southern also said it wants to wet its beak in the natural gas stream.

“This transaction establishes a valuable natural gas infrastructure platform, which will provide strong growth opportunities for years to come,” Duke CEO Lynn Good said during a conference call to discuss the deal.

“Abundant, low-cost natural gas will become an increasingly important part of the nation’s energy mix as the shift away from coal continues. Duke Energy has been a leader in the coal-to-gas transition in the last decade, and this acquisition further solidifies our leadership for the future.”

Duke is the largest electric power holding company in the United States, with regulated utility operations serving 7.3 million customers in six states in the Southeast and Midwest. Its commercial power and international energy business segments own and operate power generation assets in North America and Latin America, including a portfolio of renewable energy assets in the United States.

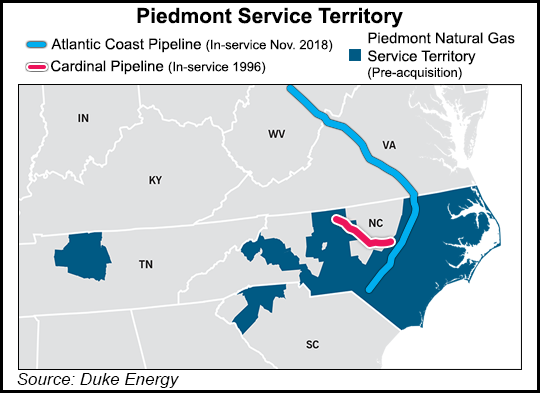

Piedmont mainly distributes gas to more than one million residential, commercial, industrial and power generation utility customers in portions of North Carolina, South Carolina and Tennessee, including customers served by municipalities, which are wholesale customers of Piedmont. Piedmont subsidiaries are invested in joint ventures (JV) such as unregulated retail natural gas marketing, regulated interstate natural gas transportation and storage, and regulated intrastate natural gas transportation businesses.

The combined company would be called Duke Energy, but Piedmont would retain its name as a subsidiary. More than 90% of the combined company assets would be regulated, and it would have “major” natural gas operations, including those serving 1.5 million local distribution company customers, three times as many as a standalone Duke Energy. The combination also would have seven natural gas-oriented JV ownership interests and more than 32,000 miles of natural gas pipelines.

Besides gas customers, the combined company would also serve 7.3 million electric customers and have 31,100 employees (29,200 from Duke and 1,900 from Piedmont). Operations would span seven states: North Carolina, South Carolina, Tennessee, Florida, Indiana, Ohio and Kentucky.

Duke Energy and Piedmont are key partners in the $5 billion Atlantic Coast Pipeline, which would be the first major natural gas pipeline to serve eastern North Carolina, they said. The 1.5 Bcf/d project is a JV led by Dominion (45%) and includes Duke (40%), Piedmont (10%) and AGL (5%). A 564-mile interstate pipeline, it would carry Appalachian Basin gas to power generation and other markets in Virginia and North Carolina (see Daily GPI, Sept. 18).

Duke, a major power generator, has turned its attention more to natural gas for environmental and economic reasons, with plans to replace coal-fired generation with gas (see Daily GPI, June 29; May 19).

Piedmont has ownership interests in Hardy Storage Co. LLC, a natural gas storage operator; Pine Needle LNG Co. LLC, which operates liquefied natural gas storage; Cardinal Pipeline Co. LLC, a 104-mile intrastate pipeline in North Carolina; and SouthStar energy Services, a retail gas marketing company. It also has a stake in the planned Constitution Pipeline (see Shale Daily, Oct. 23; Dec. 3, 2014), as well as its interest in the Atlantic Coast project.

Piedmont Natural Gas was formed in 1951 in Charlotte from assets sold by Duke. Duke was founded in the city in 1904.

Boards of both companies have approved the deal. Approvals are needed from the North Carolina Utilities Commission and Piedmont shareholders. Antitrust clearance is also necessary. Deal details will be provided to Public Service Commission of South Carolina and the Tennessee Regulatory Authority, the companies said. Closing is targeted by the end of 2016.

Piedmont shareholders would receive $60 in cash for each share of Piedmont common stock, representing a 40% premium to Piedmont’s Oct. 23 closing. Duke would also assume $1.8 billion in Piedmont debt, representing a total enterprise value of the deal of $6.7 billion.

A fully underwritten bridge facility is in place with Barclays to complete the transaction. Duke Energy would finance the transaction with a combination of debt, between $500 million and $750 million of newly issued equity and other cash sources.

Piedmont Natural Gas would retain its name, operate as a business unit of Duke Energy and maintain its presence and headquarters in southeast Charlotte.

Duke would add one member of Piedmont’s board to its board after closing. An existing member of Piedmont management would lead Duke’s natural gas operations in the Carolinas, Tennessee, Ohio and Kentucky.

“The strategic combination of our two companies will deliver compelling value to our shareholders, greatly expand our platform for future growth, enhance our ability to provide excellence in customer service and give our employees more opportunities in one of the largest energy companies in the United States,” said Piedmont CEO Tom Skains.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |