NGI The Weekly Gas Market Report | E&P | NGI All News Access

Three Gas Rigs Return; Next Year Could Reveal Decline Insight, Analyst Says

The combination of weak prices for both oil and natural gas are setting the market up for a struggle by U.S. onshore production to outperform expectations for the first time since the rise of shale drilling, a Societe Generale analyst said in a note Thursday.

“While the uncompleted [well] backlog is a perpetual wildcard — it saw a significant increase through the first half of 2015 — we expect it to be used strategically to deliver a relatively flat [production] profile over the next year; no incentive for growth exists at this point,” wrote Societe’s Breanne Dougherty.

While the 2012 downturn in gas drilling saw production declines offset by rising associated gas output from liquids drilling, this time around both are in decline. “2016 is thus potentially the first opportunity the North American market will have to see at least some of the impact that shale declines have on a production trajectory,” Dougherty wrote.

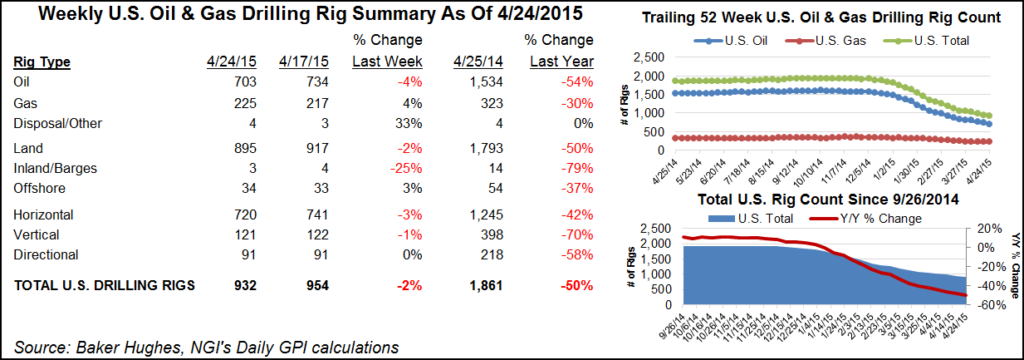

Meanwhile, the U.S. rig count continued to fall in the latest tally from Baker Hughes Inc., which was released Friday, Oct. 16.

Overall, eight units were lost as nine land rigs departed and one rig was added offshore. Ten oil-directed rigs departed, but three gas-directed rigs were added. Seven horizontal drilling units left the game, and four vertical units were pulled back.

The U.S. oil and gas rig count stood at 787 units, down almost 59% from the year-ago tally of 1,918 rigs.

While the Eagle Ford was the biggest loser among plays, New Mexico saw the largest exit of rigs among states, losing five units.

Canada experienced a net gain of one rig: two oil rigs were added while one gas rig was lost. The Canadian count stood at 181 units, down almost 57% from a year ago when it was 417.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |