NGI Data | NGI All News Access

Hefty Storage Builds Show Little Impact On Weekly Natgas Physical Trading

It must be the calm before the storm, but physical natural gas prices moved little for the week ending Oct. 9. Outside of the Northeast most market points moved within about 3 cents of last week, and the NGI Weekly Spot Gas Average closed higher by just 2 cents to $2.22.

Storage volumes continue to grow by close to triple digits, yet little movement was seen in weekly quotes. Eastern locations showed the most price movement and of the actively traded points, Algonquin Citygate posted the week’s greatest gain, 89 cents, to average $2.71, followed closely by Tennessee Zone 6 200 L with an addition of 80 cents to $2.60.

At the bottom of the leader board Tetco M-3 Delivery skidded 17 cents to average $1.04, and Tetco M2 30 Receipt was only slightly better with a drop of 13 cents to 96 cents. Regionally the Northeast rose the most adding 15 cents to $1.73, and the Midwest brought up the rear with a loss of 3 cents to $2.46.

The Rockies, Midcontinent, and East Texas all lost a penny to $2.23, $2.29, and $2.34, respectively.

South Louisiana was unchanged at $2.34, and South Texas added a penny to $2.34. California managed to add 3 cents to average $2.57.

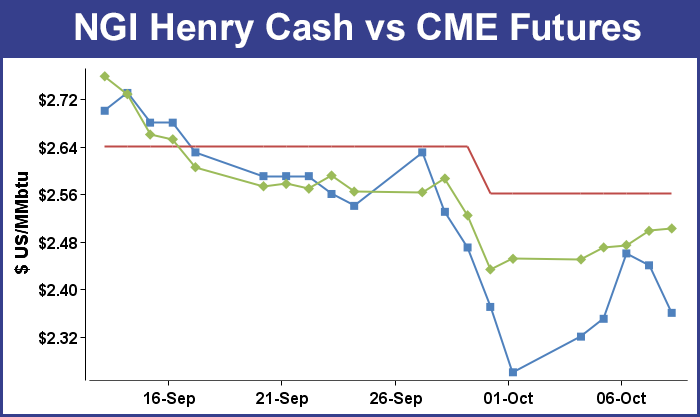

November futures did as well as most any region and gained 5.1 cents to $2.502 for the week. Much of that gain came Thursday when the Energy Information Administration (EIA) inventory report for the week ending Oct. 2 caught a few bears napping with a 95 Bcf increase in storage, slightly less than expectations, and prices rose. At the close Thursday, November futures had added 2.4 cents to $2.498 and December was up by 3.6 cents to $2.712.

Going into the report, estimates were centered around a 98 Bcf build. ICAP Energy calculated a 97 Bcf injection, and Bentek Energy was looking for a 100 Bcf increase, according to its flow model. A Reuters survey of 26 traders and analysts showed an average 98 Bcf with a range of 87 to 103 Bcf. Last year, 106 Bcf was injected and the five-year average stood at 92 Bcf.

Analyst Andrea Paltrinieri of Natgasweather.com said, “U.S. Lower 48 production is flat [Wednesday] at 71.5 Bcf and power burns are averaging around 24 Bcf.” Paltrinieri was estimating a build on the low end of the scale at 94 Bcf, somewhat below market consensus. “I see greater impact on [Thursday’s] number due to nuke outages and switching from coal, with more tightening compared to other weeks. I think that any number below 96 Bcf will be bullish, while any number above 100 bearish, and the trading range 96-100 neutral.”

When the number hit trading screens the reported 95 Bcf injection was about 3 Bcf less than expectations. November futures rose to a high of $2.530 after the number was released, and by 10:45 a.m. November was trading at $2.515, up 4.1 cents from Wednesday’s settlement.

“We were trading at about $2.49 before the number came out, and once that number comes it’s like a flash. If you are not looking up, you don’t even see it,” a New York floor trader told NGI. “The main consensus was 95 Bcf to 98 Bcf, but I think if you had seen around a 102 number this would have come off. If this market settles over $2.50 I would be surprised. For next week I am hearing numbers of like 96 Bcf.”

Inventories now stand at 3,633 Bcf and are 433 Bcf greater than last year and 155 Bcf more than the five-year average. In the East Region 57 Bcf was injected, and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region rose by 30 Bcf.

In Friday’s trading physical natural gas for the weekend and Monday was broadly lower in spite of some isolated market strength in the Northeast and Gulf Coast.

Overall, traders found it unattractive to make weekend and Monday deals as mild weather was forecast over many natural gas markets. The NGI National Spot Gas Average fell 7 cents to $2.17, and eastern points on average were down about a nickel as well.

Temperatures from the Mid-Atlantic to the Great Lakes were expected to be mild and pleasant over the weekend. Forecaster Wunderground.com predicted New York’s Friday high of 76 degrees would slide to 64 Saturday but bounce back to 74 by Monday. The normal high in New York in mid-February is 66. Chicago’s peak of 68 Friday was seen easing to 67 Saturday before climbing to 73 Monday. The seasonal high in the Windy City is 66.

Prices across the nation’s populous midsection were mostly lower. Gas at the Chicago Citygates fell 4 cents to $2.40, and deliveries to the Henry Hub skidded 8 cents to $2.36. Packages at the NGPL Midcontinent Pool changed hands 7 cents lower at $2.28, and gas at the SoCal Citygates was seen 4 cents lower at $2.73.

Marcellus points were on the defensive. Gas for weekend and Monday delivery on Millennium shed 9 cents to 76 cents, and gas at Transco Leidy gave up 7 cents to 74 cents. Gas on Tennessee Zn 4 Marcellus was quoted 7 cents lower at 72 cents, and deliveries on Dominion South were seen down 13 cents to 79 cents.

New England points did manage to post some gains. Gas at the Algonquin Citygate added 12 cents to $2.49, and deliveries to Iroquois Waddington fell 9 cents to $2.51. Gas on Tenn Zone 6 200L rose 9 cents to $2.39.

Forecast summer-like conditions across the Midwest typified the gas trading landscape for the weekend. “The Chicago area will experience dry, sunny skies into the middle of the week that will make for ideal autumn conditions, said AccuWeather.com’s Katy Galimberti. “Dry weather will create pleasant conditions for spectators of the Chicago Marathon on Sunday, but higher temperatures could make for uncomfortable heat for runners. Temperatures are expected to hit into the middle to upper 70s F, about 10 degrees higher than average for this time of year. After the brief shot of warmth, temperatures will begin to pull back down to normal levels on Monday. Daytime highs are expected to fall near the 70-degree mark.”

Baker Hughes reported Friday that nationally the land rig count dropped from 776 to 760 for the week ended Oct. 9. However a closer look provided by industry consultant Genscape’s Utica Permit Model, a tally of activity in the Utica Shale of southeastern Ohio, shows activity more like “pedal to the metal.”

For the last three weeks Genscape shows total wells drilled, drilling, and permitted on a steady rise, from 1,004 as of Sept. 19 to 1,003 Sept. 26 to 1,010 Oct 3. “The number of wells permitted isn’t as high as it used to be, but that doesn’t mean that the wells we have aren’t producing at a high level,” Genscape analyst Erik Fabry told NGI. “We’ve seen a high level of production from existing wells whether that is from deferred inventory or active wells in general.”

Analysts see any further advances in near-term futures as selling opportunities. “Although the reported 95 Bcf injection was only a couple Bcf below average street expectations, it appears that the money managers are still looking for reasons to trim a sizable short holding ahead of an extended holiday weekend that could bring some significant adjustments to the short-term temperature views,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday.

“But for now, most outlooks remain skewed in favor of above-normal trends with extension out to about the 21st of this month. This virtually assures some additional unusually large injections that could culminate in an end of October supply of about 4 Tcf with an additional week or two of increase possible into November should mild trends be sustained. Finally, we will concede to some bullish spillover from the stout liquid markets. We anticipate some modest upside price follow-through, and we would suggest shorts within December futures on further rallies into the $2.75-2.80 zone.”

Longer term, analysts also see a soft market. Earlier in the week, Raymond James & Associates Inc. reduced its 2016 Henry Hub price estimate by 90 cents, while Tudor, Pickering Holt & Co. (TPH) cut its price deck by $1.00, citing decreasing industrial demand growth and rising takeaway capacity from the Northeast.

Raymond James cut its Henry Hub estimate for the second time in two months to $2.35/Mcf from $3.25; the long-term forecast was cut to $2.75 from $3.25. In August the firm had cut its forecast for 2016 to $3.25/Mcf from $3.75. TPH lowered its forecast to $3.00 from $4.00; longer term, prices now are forecast at $3.50.

Buyers for power generation over the weekend across the MISO power pool may be able to cut back on their purchases as hefty wind generation is forecast. WSI Corp. in its Friday morning report said, “A cold front will slide across the lower Midwest and Mississippi Valley [Friday], bringing a round of showers and a few storms. This will begin to usher more seasonable temperatures into the power pool. Temps will retreat into the upper 50s, 60s and 70s.

“After a brief decline, a southwest-to-northwest flow will likely cause wind gen to ramp up and become relatively strong during the weekend into the start of next week. Output might top out around 8-10 GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |