NGI Archives | NGI All News Access

Stout NatGas Storage Stocks, Ample Production Weigh on Dominion, M3

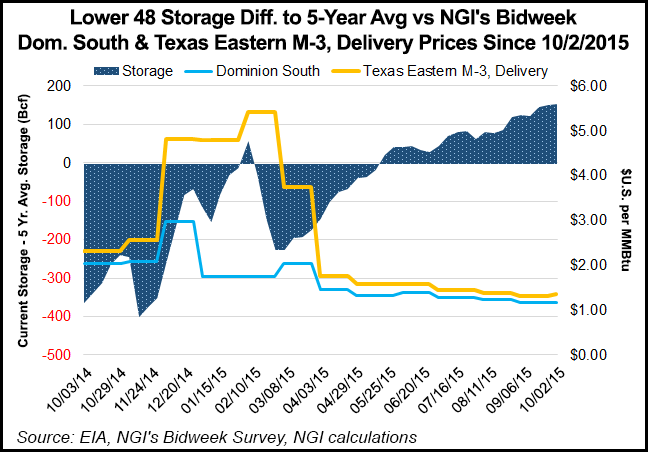

Prompt-month and balance-of-winter (December-March) prices at a couple of Northeast natural gas market hubs were pressured during the week as ample production and stout inventories have left the region awash in supplies given the absence of cold weather.

Both Dominion South point and Tetco M3 saw November fall by more than five cents between Oct. 2 and Oct. 8, whereas all other gas markets in the U.S. gained a few cents, according to NGI’s Forward Look.

At the Dominion South point, the November fixed price sat Oct. 8 at $1.29, a decline of about 8 cents from Oct. 2. The balance of winter was down a couple of cents at $1.89, Forward Look data shows.

Meanwhile, Tetco M3 November priced at $1.65, a drop of 9.5 cents on the week, while the balance of winter priced at $3.87, down 9 cents.

“Filling storage is part of the reason for that [price weakness],” said Pat Rau, NGI director of strategy and research. “It could also mean there are fears that production may not be falling as quickly in the Marcellus/Utica as the forward curves are expecting. Maybe traders are realizing that the combination of higher-than-expected production and rising storage means prices at those two points will be weaker.”

Indeed, Northeast production just last week reached an all-time high of 20.95 Bcf, according to fundamentals analyst group Bentek Energy.

Meanwhile, storage inventories across the country grew by 95 Bcf for the week ending Oct. 2. Although that build came in below analysts’ expectations, some Northeast facilities are seeing storage fill so quickly they could reach maximum capacity if Mother Nature doesn’t provide some much-needed demand.

Columbia Gas last week said its facilities are approaching maximum limits.

Genscape’s Cory Madden, research manager of natural gas, said that while storage facilities in the region are indeed filling up, it’s not the highest levels they’ve seen.

Genscape, based in Louisville, KY, provides real-time data and intelligence for commodity and energy markets.

“We estimate TCO to be at about 235 Bcf, which should put them at about 85% full,” Madden said, adding that stocks are most full in southwest Pennsylvania and northwest West Virginia.

“At this time in 2012 they were at 250 Bcf, and in 2013 were at 240 Bcf,” he said. “DTI is at about 277 Bcf, which is 8 Bcf higher than last year, but 8 Bcf lower than 2012. We think their max is at about 300 Bcf, so they’re about 92% full.”

Historically, the facility has maxed out at 293 BCf, but last November, it added the Allegheny storage project, which added 7.5 Bcf of storage, Madden said.

“Transco’s SE expansion will also give some additional export capacity when it comes fully online Dec. 1, and there’s also the Niagara Expansion and the TETCO OPEN projects, which should also help,” he said.

It’s promising that the additional infrastructure will help improve the storage picture in the Northeast, since it appears Mother Nature isn’t likely to assist in the effort.

With little certainty that significant cold weather will arrive in the next few weeks, it’s plausible injections could indeed continue beyond the traditional injection season, which ends Oct. 31.

“The weather and climate data is far from convincing due to an unusually large spread of wildly varying solutions, some of which are quite cold, and others that are relatively mild for mid-October,” said forecasters with NatGasWeather.

“As the pattern sets up, much colder Canadian air will push right up to the U.S. border with a very sharp temperature gradient over short distances,” the weather agency said. “How much success weather systems have in tapping this colder air and tracking it through the U.S. is what needs resolving.”

Meanwhile, the lack of demand also means gas in the producing region is staying put and not reaching demand centers that are now accessible via the REX East to West pipeline.

“Interestingly, shipments west on REX Zone 3 haven’t really bumped up that much since REX’s capacity moved from 1.2 Bcf to 1.8 Bcf on Aug. 1,” Rau said. “I would have thought producers would have jumped to fill that as soon as possible. But two months later, Rex flows east to west are still hovering around 1.4 Bcf/d.”

Madden said the Regency Ohio River Gathering System, which has firm capacity on REX, is about to come online and could fill up those volumes on the pipeline.

“We actually just saw a nomination point come on TETCO for a connection to Ohio River, so it could be very close,” Madden said. “Regency reported the operational capacity on their system would be 1 Bcf/d of deliveries to REX starting in October, and increasing next year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |