LNG | NGI All News Access | NGI The Weekly Gas Market Report

West Coast LNG Export Projects Doubtful in Current Environment, Analysts Say

In the current oversupplied global energy market, a liquefied natural gas (LNG) export terminal on the U.S. West Coast is unlikely to become a reality anytime soon, according to several industry analysts speaking at a natural gas forum in Los Angeles.

The consensus at the LDC Gas Forum Rockies & the West conference is that the five terminals now under construction or about to start on the Gulf and East Coasts are the only ones likely to be operating by 2020. Combined, they represent incremental demand growth of 10.5 Bcf/d in the world market, which is somewhat saturated already.

That scenario leaves out the two proposed export projects in Oregon — Jordan Cove and Oregon LNG — which are in the midst of the permitting process at the Federal Energy Regulatory Commission.

“There is debate about how much U.S. LNG can make it into the global market,” said David Braziel, director of finance and fundamental analysis at RBN Energy LLC. “If all the U.S. LNG export facilities that have been proposed were built (45 Bcf/d), the capacity would dwarf the global market.” There are other significant LNG exporters worldwide, including Canada, Australia, Indonesia, East Africa and Russia, he said.

RBN thinks 33% of the global market for U.S. LNG is a reasonable assumption, Braziel said, but that leaves no room for the West Coast facilities. “Thirty percent would be about 12 Bcf, and there is already 13.2 Bcf/d of capacity being built, so that’s how we get to our [one-third] estimate and there is nothing beyond the five terminals [Sabine Pass, Freeport, Cameron, Corpus Christi and Cove Point, MD].”

Separately at the LDC Forum, a further complication was mentioned by a consultant talking about Mexico’s energy market reforms when he said that longer term, Mexico hopes to transform all three of its LNG receiving terminals into export facilities to serve Asian markets.

Rick Margolin, Genscape Inc. senior analyst, told the panel that the first exports from the United States will come from the Sabine Pass facility around the start of next year at about 150 MMcf/d. Margolin added that Genscape expects approximately 7 Bcf/d of LNG export capacity to be online by 2020.*

Bentek Energy’s Thad Walker estimates that there will be about 10 Bcf/d of export capacity built by 2020, concentrated in Maryland, Louisiana and Texas. Walker said his firm’s analysis doesn’t see much likelihood of any West Coast greenfield LNG export terminals being built.

“We currently don’t include Jordan Cove in our forecasts, although that would lead to a lot of increased demand in the U.S. West,” Walker said.* Rockies producers would love to see the terminal in Oregon built, he said. “Jordan Cove has yet to receive any contracts with Asian buyers at all at this point, and we’re certainly not going to put it in our forecast until they have a serious deal, and that is looking increasingly unlikely given what is happening in the global market.

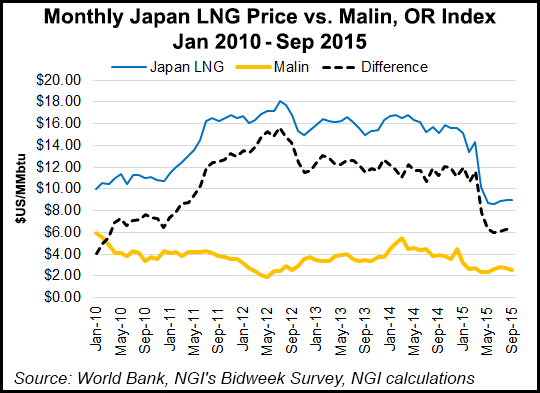

“I think it is going to take more time to see where the global LNG market is going. Certainly with depressed oil prices all the projects indexed to crude oil improve and we’re going to see a flood of Australian LNG on the Asian market, so we have a pretty depressed outlook for Jordan Cove, although it is well positioned on the West Coast to serve Asian markets, relative to the other U.S. projects.”

In response to an inquiry from NGI, Oregon LNG Project Manager Peter Hansen acknowledged the global market is “a bit oversupplied” but cautioned that it must be remembered that LNG is a global commodity, “and accordingly, there will always be a market for low-cost LNG.” Hansen said his project “will be among the lowest-cost suppliers to Asia and should have no difficulty finding a market.” However, he did not respond to questions about his prospects for contracts with Asian buyers.

Steve Piper, research director at SNL Energy, said the crash in global crude oil prices last year and the linking of many contracts outside the United State to crude oil has “hurt the competitiveness” of U.S. LNG projects. But to a large extent, U.S. LNG seems to remain competitive on a global basis, he said. Piper thinks an initial 4 Bcf/d of U.S. exports in 2017 will be “enough to influence global markets.”

He thinks West Coast projects “could be demand drivers going forward,” but not until 2020 at the earliest. Collectively, LNG exports from the projects now under construction will have “a noticeable impact” on Gulf Coast gas prices — “not a huge impact, but in the 7- to 10-cent[/Mcf] range. So it won’t be trivial.”

*Correction: Quotes originally attributed to Genscape Inc. Senior Analyst Rick Margolin on the estimated 10 Bcf/d of total U.S. gas exports by 2020, and on the viability of Jordan Cove LNG, should have been attributed to Thad Walker, a Bentek Energy analyst, instead. Genscape’s estimates for LNG exports are more in the 7 Bcf/d area. NGI regrets this error in attribution. Margolin and Walker were panelists at the LDC Forum.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |