E&P | Infrastructure | NGI All News Access

Revamped, Profitable Pemex Goal of Mexico’s Energy Reforms

Political leaders in Mexico have been busy reforming the country’s energy markets to attract more private investment, but a revolution of sorts also has been taking place in state-owned Petroleos Mexicanos (Pemex), which is being totally reorganized, a Mexico-based energy consultant told an industry conference in Los Angeles Tuesday.

Spurring the overall market reforms followed a decade of declining oil and natural gas production in Mexico was caused by “poor management of resources,” Arturo Palacios told a session at the LDC Gas Forum Rockies & the West.

Palacios, a consultant with Mexico City-based Rodriguez Davalos Abogados (RDA), noted that hydrocarbons currently account for less than 7% of Mexico’s gross domestic product (GDP), and in the past, 60% of the revenues at Pemex were paid to federal and state governments with 40% left for operations. That is changing.

“Pemex is still a state-owned company, but it now has to be operated as a private company,” Palacios said. “In order to implement [the market reforms] it was recognized that Pemex had to change into a productive, state-owned company. Losses in the past were covered by the government, but no more. Starting in 2016, it has its own separate budget and must live within it.”

While being responsible for its own profitability, Palacios said the revamped state company has new flexibility, such as authority to:

“The main importance of the overall market reforms is that private investment now is allowed in every aspect of the energy industry,” Palacios said. “Before these reforms, only the transportation of natural gas and liquid petroleum gas [LPG] were open to private investment.”

Five pipeline projects by private companies are under construction and six more will be awarded in the near future, he said. The first five involved 2,300 kilometers (km) of pipelines and $5.2 billion in investment. Overall, the 11 projects would install more than 17,000 km and require $30 billion of investment.

In June, the Mexican government announced another 24 energy projects, including five more gas pipeline projects slated to be completed between December 2017 and June 2018, Palacios said.

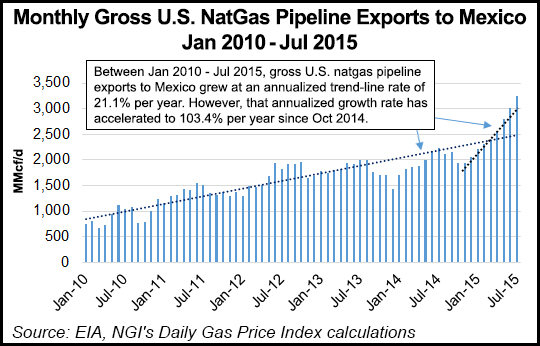

In the short term, Mexico will depend even more on increased gas exports from the United States.

“In the oil and gas sector, the most important change is that Pemex become a profitable company, so its business plan includes associations with private companies — both Mexican and foreign,” he said.

Palacios told NGI separately that Pemex has not yet made any investments in the private sector, but it is moving ahead this week with its reorganization, breaking up into seven state companies, replacing former exploration/production (E&P), petrochemical and natural gas units. The new ones include E&P, cogeneration, and logistics. “This is how far the transformation has gone,” he said.

“Pemex so far has not invested in the private sector,” Palacios said. “It has sold its participation in a couple of joint ventures in the natural gas transportation business, and for sure in 2016 we will see the first joint investments with private companies. But so far what Pemex is doing is selling its assets to put in other activities like storage or oil products.”

In August, San Diego-based Sempra Energy increased its multi-billion-dollar portfolio in Mexico after purchasing Pemex’s joint venture interests in three natural gas pipelines, an ethane pipeline, and LPG pipeline and storage facilities (see Daily GPI, Aug. 3).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |